On-demand accruals recognize expenses when incurred, aligning costs with revenues despite payment timing, while prepaid expenses record payments made in advance as assets and allocate them over time. Accurate distinction between these accounting methods ensures proper financial statement presentation and compliance with accounting standards such as GAAP or IFRS. Explore how mastering on-demand accruals and prepaid expenses enhances financial accuracy and decision-making.

Why it is important

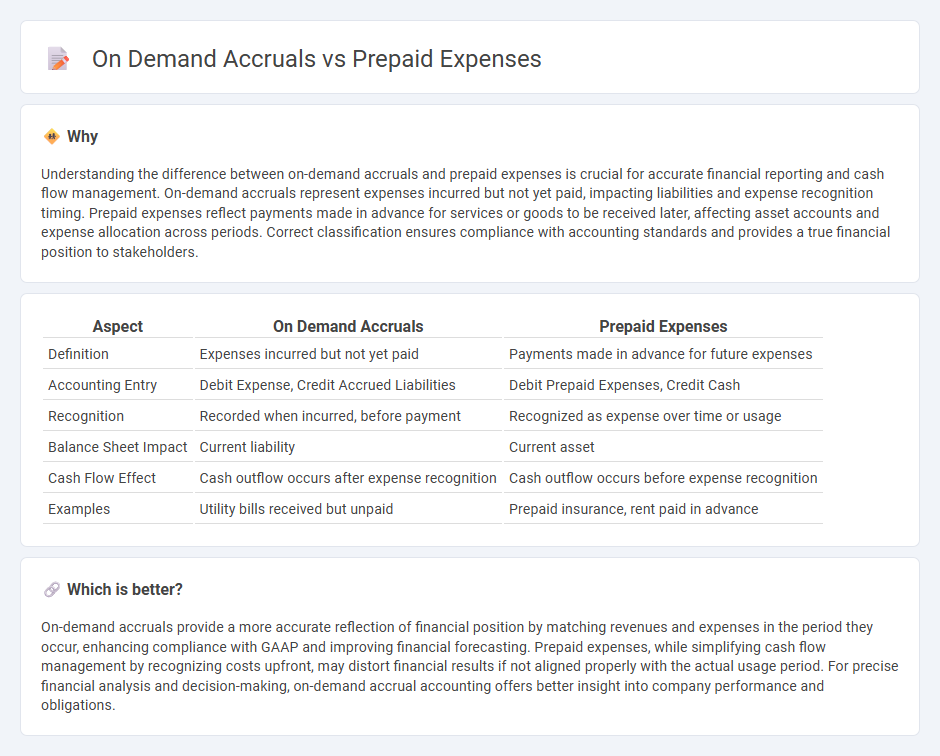

Understanding the difference between on-demand accruals and prepaid expenses is crucial for accurate financial reporting and cash flow management. On-demand accruals represent expenses incurred but not yet paid, impacting liabilities and expense recognition timing. Prepaid expenses reflect payments made in advance for services or goods to be received later, affecting asset accounts and expense allocation across periods. Correct classification ensures compliance with accounting standards and provides a true financial position to stakeholders.

Comparison Table

| Aspect | On Demand Accruals | Prepaid Expenses |

|---|---|---|

| Definition | Expenses incurred but not yet paid | Payments made in advance for future expenses |

| Accounting Entry | Debit Expense, Credit Accrued Liabilities | Debit Prepaid Expenses, Credit Cash |

| Recognition | Recorded when incurred, before payment | Recognized as expense over time or usage |

| Balance Sheet Impact | Current liability | Current asset |

| Cash Flow Effect | Cash outflow occurs after expense recognition | Cash outflow occurs before expense recognition |

| Examples | Utility bills received but unpaid | Prepaid insurance, rent paid in advance |

Which is better?

On-demand accruals provide a more accurate reflection of financial position by matching revenues and expenses in the period they occur, enhancing compliance with GAAP and improving financial forecasting. Prepaid expenses, while simplifying cash flow management by recognizing costs upfront, may distort financial results if not aligned properly with the actual usage period. For precise financial analysis and decision-making, on-demand accrual accounting offers better insight into company performance and obligations.

Connection

On-demand accruals and prepaid expenses both represent timing differences in recognizing expenses within accounting periods. Accruals record expenses incurred but not yet paid, while prepaid expenses reflect payments made for services or goods to be received in the future. Their connection lies in ensuring accurate matching of expenses to the correct accounting periods, enhancing financial statement reliability.

Key Terms

Asset Recognition

Prepaid expenses are recorded as assets when payments are made in advance for goods or services to be received in the future, ensuring that the expense recognition aligns with the period benefited. On-demand accruals recognize liabilities for expenses incurred but not yet paid, focusing on matching expenses to the period in which they are earned rather than cash flow timing. Explore further to understand their impact on financial statement accuracy and asset management.

Expense Matching

Prepaid expenses represent payments made in advance for goods or services, recorded as assets until the related expense is incurred, ensuring alignment with the accounting period benefiting from the expenditure. On-demand accruals, by contrast, recognize expenses when incurred regardless of payment timing, enhancing the accuracy of financial statements through immediate expense matching. Explore detailed examples and accounting standards to deepen your understanding of effective expense matching between prepaid expenses and on-demand accruals.

Liability Recording

Prepaid expenses represent payments made in advance for goods or services, recorded as assets initially and expensed over time, whereas on-demand accruals involve recognizing liabilities for expenses incurred but not yet paid. In liability recording, prepaid expenses reduce future liabilities by converting payments into assets, while on-demand accruals increase liabilities by acknowledging pending obligations. Explore detailed accounting practices to master liability management in both prepaid and accrued scenarios.

Source and External Links

What Are Prepaid Expenses? (Plus How To Record Them) - A prepaid expense is when a company pays in advance for goods or services it has not yet received or used, and these are recorded as assets on the balance sheet until they are consumed.

What are Prepaid Expenses? | F&A Glossary - Prepaid expenses are costs paid ahead of time for items like rent or insurance, considered current assets because they provide future economic value and are gradually expensed as they are used up.

Prepaid expenses: Definition, examples, and basics - Prepaid expenses are advance payments for goods or services to be received in the future, initially recorded as assets and then recognized as expenses over the relevant accounting periods as the benefits are consumed.

dowidth.com

dowidth.com