Supply chain finance accounting focuses on optimizing cash flow by managing payables and financing solutions between buyers and suppliers, while accounts receivable accounting centers on tracking and collecting incoming payments from customers. The key difference lies in supply chain finance's role in improving working capital and liquidity across the supply chain, whereas accounts receivable accounting primarily ensures accurate recording and aging of customer debts. Explore detailed comparisons and best practices to enhance financial management strategies.

Why it is important

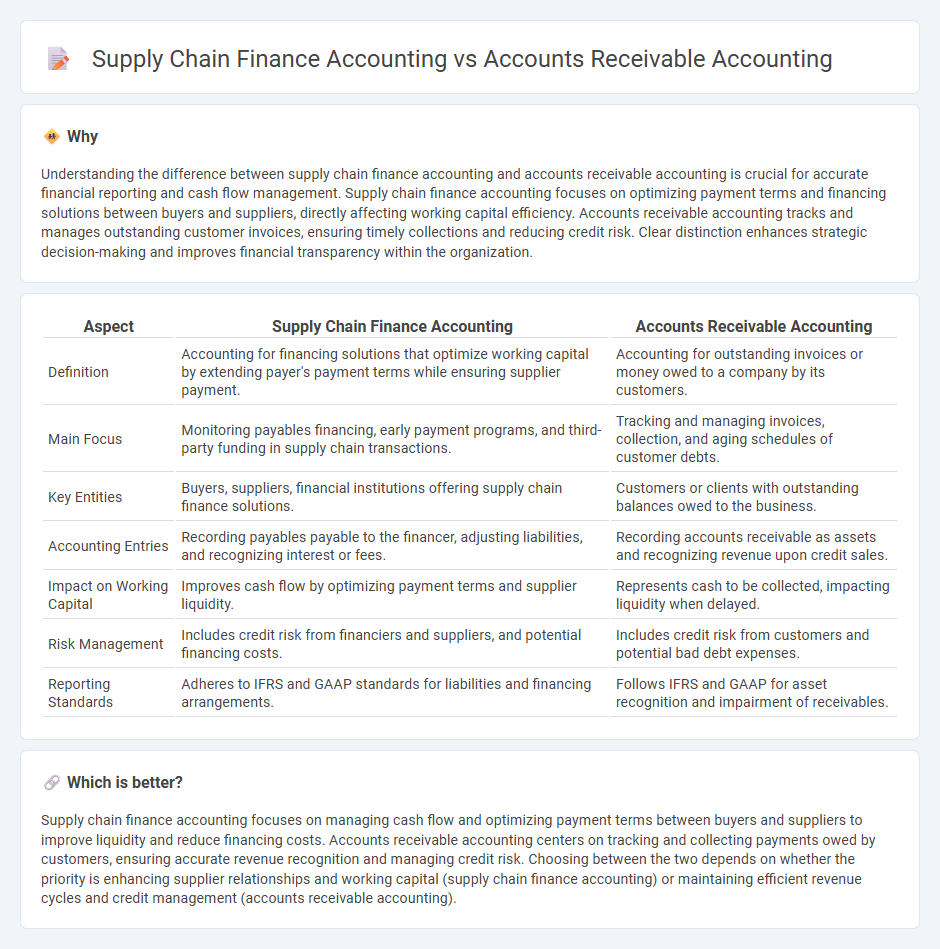

Understanding the difference between supply chain finance accounting and accounts receivable accounting is crucial for accurate financial reporting and cash flow management. Supply chain finance accounting focuses on optimizing payment terms and financing solutions between buyers and suppliers, directly affecting working capital efficiency. Accounts receivable accounting tracks and manages outstanding customer invoices, ensuring timely collections and reducing credit risk. Clear distinction enhances strategic decision-making and improves financial transparency within the organization.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Accounts Receivable Accounting |

|---|---|---|

| Definition | Accounting for financing solutions that optimize working capital by extending payer's payment terms while ensuring supplier payment. | Accounting for outstanding invoices or money owed to a company by its customers. |

| Main Focus | Monitoring payables financing, early payment programs, and third-party funding in supply chain transactions. | Tracking and managing invoices, collection, and aging schedules of customer debts. |

| Key Entities | Buyers, suppliers, financial institutions offering supply chain finance solutions. | Customers or clients with outstanding balances owed to the business. |

| Accounting Entries | Recording payables payable to the financer, adjusting liabilities, and recognizing interest or fees. | Recording accounts receivable as assets and recognizing revenue upon credit sales. |

| Impact on Working Capital | Improves cash flow by optimizing payment terms and supplier liquidity. | Represents cash to be collected, impacting liquidity when delayed. |

| Risk Management | Includes credit risk from financiers and suppliers, and potential financing costs. | Includes credit risk from customers and potential bad debt expenses. |

| Reporting Standards | Adheres to IFRS and GAAP standards for liabilities and financing arrangements. | Follows IFRS and GAAP for asset recognition and impairment of receivables. |

Which is better?

Supply chain finance accounting focuses on managing cash flow and optimizing payment terms between buyers and suppliers to improve liquidity and reduce financing costs. Accounts receivable accounting centers on tracking and collecting payments owed by customers, ensuring accurate revenue recognition and managing credit risk. Choosing between the two depends on whether the priority is enhancing supplier relationships and working capital (supply chain finance accounting) or maintaining efficient revenue cycles and credit management (accounts receivable accounting).

Connection

Supply chain finance accounting and accounts receivable accounting are interconnected through the management of cash flow and credit risk between buyers and suppliers. Supply chain finance optimizes payment terms and financing options to accelerate accounts receivable turnover, improving liquidity for suppliers. Accurate recording and monitoring of receivables ensure transparency and facilitate effective supply chain financing arrangements.

Key Terms

**Accounts Receivable Accounting:**

Accounts receivable accounting involves managing and recording amounts owed by customers for goods or services delivered, impacting cash flow and financial reporting accuracy. It tracks invoice issuance, payment collection, and aging schedules to optimize working capital and reduce credit risk. Discover more about the critical role of accounts receivable accounting in enhancing business financial health and operational efficiency.

Invoice

Accounts receivable accounting manages invoices by recording money owed by customers, tracking outstanding payments to optimize cash flow and reduce credit risk. Supply chain finance accounting involves financing invoices between buyers and suppliers, enhancing liquidity by allowing early payment discounts and improving working capital efficiency. Explore more to understand the distinct processes and benefits of invoice handling in both accounting areas.

Aging Schedule

Accounts receivable accounting centers on tracking outstanding customer invoices and managing the Aging Schedule to evaluate payment delays and credit risk, typically categorizing receivables by time intervals such as 30, 60, or 90 days. Supply chain finance accounting integrates Aging Schedule data to optimize working capital by enabling early payments to suppliers through financing programs, thereby improving cash flow and supplier relationships. Explore further to understand how these accounting practices influence liquidity management and financial strategy within organizations.

Source and External Links

What Is Accounts Receivable? AR Explained - Accounts receivable (AR) represents the amounts clients owe a company for goods or services already delivered and invoiced, recorded as a current asset under accrual accounting and reconciled regularly for accuracy.

Accounts receivable accounting - AR arises when a sale is made on credit, creating a short-term asset for the seller documented by an invoice, and is recognized under accrual accounting but not under cash basis accounting.

What is Accounts Receivable? - AR includes unpaid invoices, late payments, and sales made on credit, representing legally enforceable amounts due from customers and recorded as an asset on the balance sheet.

dowidth.com

dowidth.com