Triple entry bookkeeping enhances transparency by incorporating blockchain technology to create an immutable ledger, reducing errors and fraud compared to traditional double entry systems. Real-time accounting allows businesses to access up-to-date financial data instantly, improving decision-making and cash flow management. Explore how these advanced accounting methods revolutionize financial accuracy and efficiency in modern business practices.

Why it is important

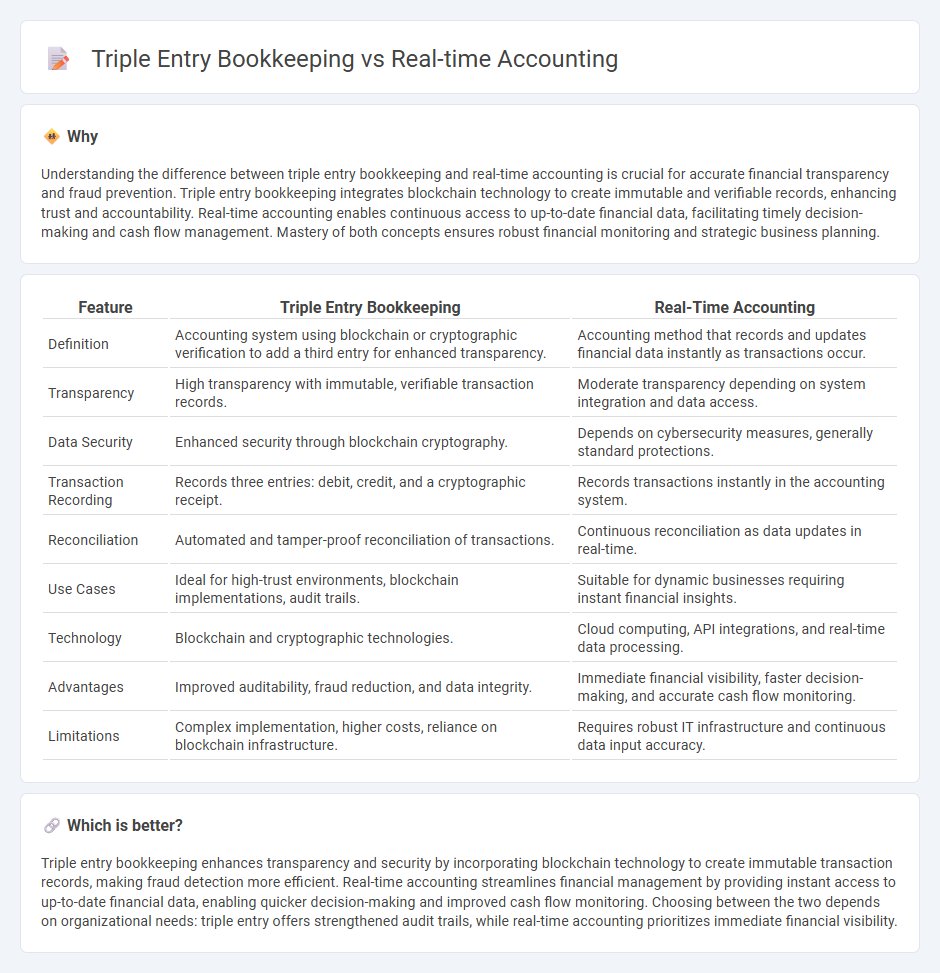

Understanding the difference between triple entry bookkeeping and real-time accounting is crucial for accurate financial transparency and fraud prevention. Triple entry bookkeeping integrates blockchain technology to create immutable and verifiable records, enhancing trust and accountability. Real-time accounting enables continuous access to up-to-date financial data, facilitating timely decision-making and cash flow management. Mastery of both concepts ensures robust financial monitoring and strategic business planning.

Comparison Table

| Feature | Triple Entry Bookkeeping | Real-Time Accounting |

|---|---|---|

| Definition | Accounting system using blockchain or cryptographic verification to add a third entry for enhanced transparency. | Accounting method that records and updates financial data instantly as transactions occur. |

| Transparency | High transparency with immutable, verifiable transaction records. | Moderate transparency depending on system integration and data access. |

| Data Security | Enhanced security through blockchain cryptography. | Depends on cybersecurity measures, generally standard protections. |

| Transaction Recording | Records three entries: debit, credit, and a cryptographic receipt. | Records transactions instantly in the accounting system. |

| Reconciliation | Automated and tamper-proof reconciliation of transactions. | Continuous reconciliation as data updates in real-time. |

| Use Cases | Ideal for high-trust environments, blockchain implementations, audit trails. | Suitable for dynamic businesses requiring instant financial insights. |

| Technology | Blockchain and cryptographic technologies. | Cloud computing, API integrations, and real-time data processing. |

| Advantages | Improved auditability, fraud reduction, and data integrity. | Immediate financial visibility, faster decision-making, and accurate cash flow monitoring. |

| Limitations | Complex implementation, higher costs, reliance on blockchain infrastructure. | Requires robust IT infrastructure and continuous data input accuracy. |

Which is better?

Triple entry bookkeeping enhances transparency and security by incorporating blockchain technology to create immutable transaction records, making fraud detection more efficient. Real-time accounting streamlines financial management by providing instant access to up-to-date financial data, enabling quicker decision-making and improved cash flow monitoring. Choosing between the two depends on organizational needs: triple entry offers strengthened audit trails, while real-time accounting prioritizes immediate financial visibility.

Connection

Triple entry bookkeeping enhances real-time accounting by recording transactions on an immutable blockchain, ensuring data accuracy and transparency. This integration allows businesses to access continuous, synchronized financial records, enabling instant reconciliation and reducing errors. Leveraging triple entry bookkeeping in real-time accounting streamlines auditing and improves trust in financial reporting.

Key Terms

Ledger Update Timing

Real-time accounting systems update the ledger instantaneously as transactions occur, ensuring continuous financial accuracy and immediate visibility into cash flow and expenses. Triple entry bookkeeping introduces a cryptographically secured third ledger entry that enhances transparency, reduces the risk of fraud, and ensures synchronized ledger updates across multiple parties in near real-time. Discover how these innovative approaches to ledger update timing can transform your financial management.

Blockchain Integration

Real-time accounting leverages continuous transaction recording, enhancing financial visibility and accuracy, while triple entry bookkeeping incorporates blockchain's immutable ledger for secure, verifiable records beyond traditional double-entry systems. Blockchain integration enables automated trust through cryptographic proofs, reducing fraud and reconciliation errors significantly. Explore how these advanced methods transform financial transparency and integrity in modern accounting frameworks.

Transaction Transparency

Real-time accounting provides immediate financial data updates, enhancing transaction visibility and reducing discrepancies. Triple entry bookkeeping incorporates a cryptographic verification layer, ensuring immutable transaction transparency across involved parties. Explore the benefits of these systems for robust financial oversight and accuracy.

Source and External Links

Real-Time Financial Control: A Complete Guide - HubiFi - Real-time accounting is a financial management method where data is continuously updated and instantly accessible, enabling businesses to make faster, well-informed decisions with up-to-date financial insights integrated from various systems through cloud-based platforms.

Real-Time Accounting: Why It's Worth the Switch - Talley LLP - Real-time accounting allows business owners and CFOs to continuously view cash flow, expenses, and revenue trends as they happen, improving decision-making agility and proactive cash flow management by eliminating delays common in traditional accounting.

What Is Real Time Accounting? | Ballards LLP - Real-time accounting means accessing and processing up-to-date financial data anytime and anywhere with automated tools that reduce paperwork and errors, offer customized reporting, and support remote collaboration without expensive hardware requirements.

dowidth.com

dowidth.com