Environmental Social Governance (ESG) accounting integrates sustainability factors into financial analysis, emphasizing a company's impact on society and the environment alongside economic performance. Non-financial reporting extends beyond ESG by encompassing broader aspects such as corporate social responsibility, ethical practices, and stakeholder engagement that are not solely captured in traditional financial statements. Discover how ESG accounting and non-financial reporting shape transparent business practices and investment decisions.

Why it is important

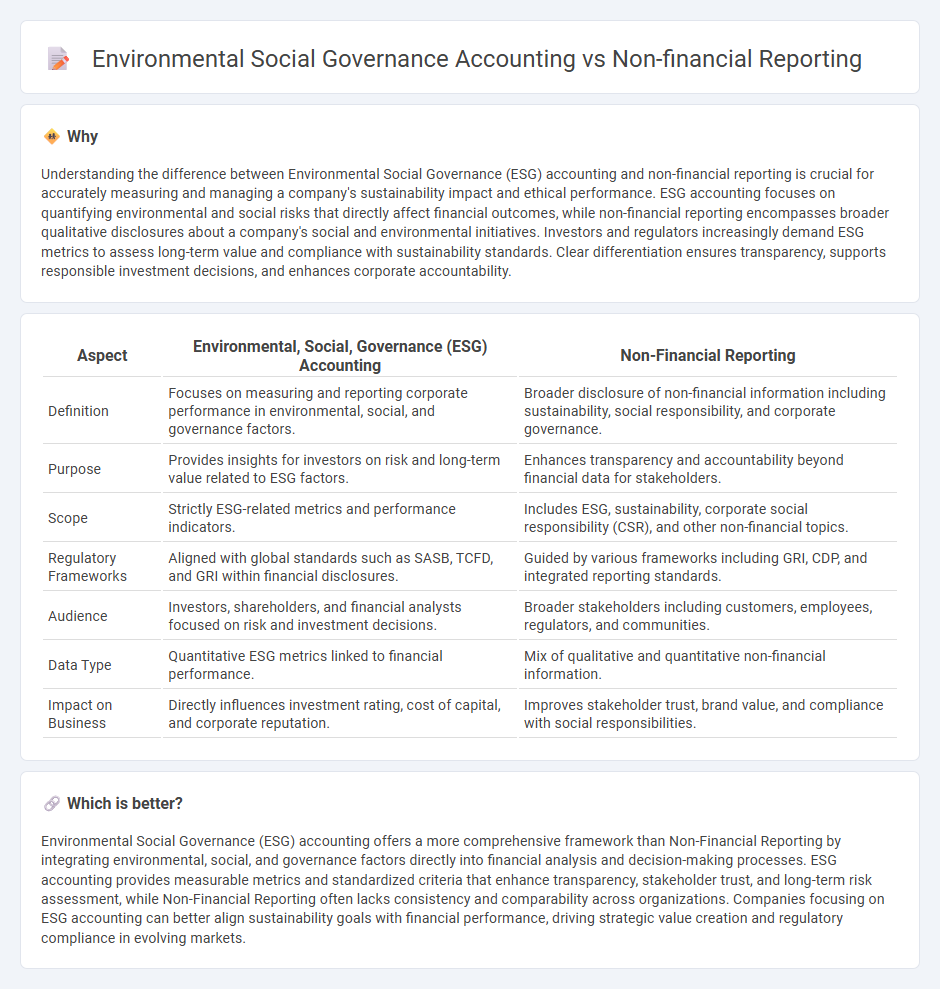

Understanding the difference between Environmental Social Governance (ESG) accounting and non-financial reporting is crucial for accurately measuring and managing a company's sustainability impact and ethical performance. ESG accounting focuses on quantifying environmental and social risks that directly affect financial outcomes, while non-financial reporting encompasses broader qualitative disclosures about a company's social and environmental initiatives. Investors and regulators increasingly demand ESG metrics to assess long-term value and compliance with sustainability standards. Clear differentiation ensures transparency, supports responsible investment decisions, and enhances corporate accountability.

Comparison Table

| Aspect | Environmental, Social, Governance (ESG) Accounting | Non-Financial Reporting |

|---|---|---|

| Definition | Focuses on measuring and reporting corporate performance in environmental, social, and governance factors. | Broader disclosure of non-financial information including sustainability, social responsibility, and corporate governance. |

| Purpose | Provides insights for investors on risk and long-term value related to ESG factors. | Enhances transparency and accountability beyond financial data for stakeholders. |

| Scope | Strictly ESG-related metrics and performance indicators. | Includes ESG, sustainability, corporate social responsibility (CSR), and other non-financial topics. |

| Regulatory Frameworks | Aligned with global standards such as SASB, TCFD, and GRI within financial disclosures. | Guided by various frameworks including GRI, CDP, and integrated reporting standards. |

| Audience | Investors, shareholders, and financial analysts focused on risk and investment decisions. | Broader stakeholders including customers, employees, regulators, and communities. |

| Data Type | Quantitative ESG metrics linked to financial performance. | Mix of qualitative and quantitative non-financial information. |

| Impact on Business | Directly influences investment rating, cost of capital, and corporate reputation. | Improves stakeholder trust, brand value, and compliance with social responsibilities. |

Which is better?

Environmental Social Governance (ESG) accounting offers a more comprehensive framework than Non-Financial Reporting by integrating environmental, social, and governance factors directly into financial analysis and decision-making processes. ESG accounting provides measurable metrics and standardized criteria that enhance transparency, stakeholder trust, and long-term risk assessment, while Non-Financial Reporting often lacks consistency and comparability across organizations. Companies focusing on ESG accounting can better align sustainability goals with financial performance, driving strategic value creation and regulatory compliance in evolving markets.

Connection

Environmental Social Governance (ESG) accounting integrates non-financial reporting to measure a company's sustainability and ethical impact alongside financial performance. Non-financial reporting provides essential data on environmental practices, social responsibility, and governance structures, enabling ESG metrics to offer a comprehensive view of corporate accountability. This connection enhances transparency for investors and stakeholders focused on long-term sustainable growth and risk management.

Key Terms

Non-financial reporting:

Non-financial reporting encompasses a broad range of disclosures beyond financial statements, including environmental impact, social responsibility, and corporate governance practices, aimed at providing stakeholders with a comprehensive view of a company's sustainability performance. It captures qualitative and quantitative data on topics such as carbon emissions, labor practices, diversity, and ethical conduct, aligning with frameworks like GRI (Global Reporting Initiative) and SASB (Sustainability Accounting Standards Board). Explore more about how non-financial reporting drives transparency and strategic decision-making in modern businesses.

Sustainability Disclosure

Non-financial reporting encompasses a broad spectrum of sustainability disclosure, including environmental, social, and governance (ESG) accounting, which focuses on measurable criteria linked to corporate sustainability and ethical impact. ESG accounting specifically provides structured frameworks for evaluating a company's environmental performance, social responsibilities, and governance practices, aiding investors and stakeholders in making informed decisions aligned with sustainability goals. Explore further to understand how ESG accounting drives transparency and accountability in sustainability disclosure initiatives.

Stakeholder Engagement

Non-financial reporting encompasses a broad range of metrics including environmental impact, social responsibility, and governance practices, while Environmental Social Governance (ESG) accounting specifically quantifies and integrates these factors into financial analysis to enhance investor decisions. Stakeholder engagement in non-financial reporting often involves comprehensive communication strategies aimed at transparency and accountability, whereas ESG accounting requires more data-driven interaction emphasizing measurable outcomes and risk management. Explore how these frameworks impact corporate transparency and stakeholder trust by learning more about their methodologies and practical applications.

Source and External Links

Non-financial reporting: responsible, far-sighted management - Non-financial reporting involves disclosing essential value-creation information beyond financial figures, focusing on social, environmental, and governance themes important for long-term corporate responsibility and particularly relevant for large multinational companies.

Non-financial Reporting Directive - European Parliament - The EU Non-financial Reporting Directive (2014/95/EU) requires large public interest companies with over 500 employees to disclose social responsibility, human rights, anti-corruption, board diversity, and environmental policies to improve transparency and sustainable business practices across member states.

Where to Start with Non-Financial Reporting - Effective non-financial reporting requires identifying relevant ESG topics, addressing data gaps through cross-functional collaboration, and selecting an appropriate reporting framework such as GRI or ISSB to meet stakeholder and regulatory expectations.

dowidth.com

dowidth.com