Forensic accounting software specializes in detecting fraud, conducting investigations, and analyzing financial discrepancies through detailed audit trails and data analytics. Accounts payable software streamlines invoice processing, payment scheduling, and vendor management to improve accuracy and efficiency in managing outgoing payments. Explore the features and benefits of each solution to determine which best fits your financial management needs.

Why it is important

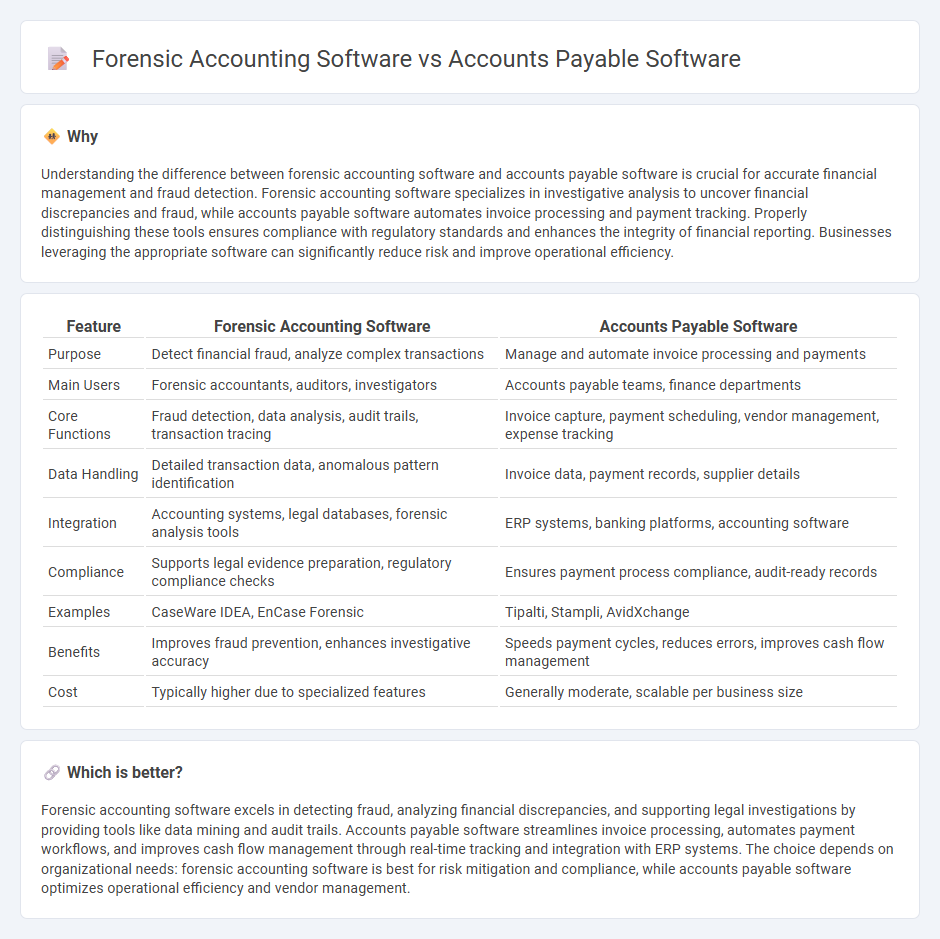

Understanding the difference between forensic accounting software and accounts payable software is crucial for accurate financial management and fraud detection. Forensic accounting software specializes in investigative analysis to uncover financial discrepancies and fraud, while accounts payable software automates invoice processing and payment tracking. Properly distinguishing these tools ensures compliance with regulatory standards and enhances the integrity of financial reporting. Businesses leveraging the appropriate software can significantly reduce risk and improve operational efficiency.

Comparison Table

| Feature | Forensic Accounting Software | Accounts Payable Software |

|---|---|---|

| Purpose | Detect financial fraud, analyze complex transactions | Manage and automate invoice processing and payments |

| Main Users | Forensic accountants, auditors, investigators | Accounts payable teams, finance departments |

| Core Functions | Fraud detection, data analysis, audit trails, transaction tracing | Invoice capture, payment scheduling, vendor management, expense tracking |

| Data Handling | Detailed transaction data, anomalous pattern identification | Invoice data, payment records, supplier details |

| Integration | Accounting systems, legal databases, forensic analysis tools | ERP systems, banking platforms, accounting software |

| Compliance | Supports legal evidence preparation, regulatory compliance checks | Ensures payment process compliance, audit-ready records |

| Examples | CaseWare IDEA, EnCase Forensic | Tipalti, Stampli, AvidXchange |

| Benefits | Improves fraud prevention, enhances investigative accuracy | Speeds payment cycles, reduces errors, improves cash flow management |

| Cost | Typically higher due to specialized features | Generally moderate, scalable per business size |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing tools like data mining and audit trails. Accounts payable software streamlines invoice processing, automates payment workflows, and improves cash flow management through real-time tracking and integration with ERP systems. The choice depends on organizational needs: forensic accounting software is best for risk mitigation and compliance, while accounts payable software optimizes operational efficiency and vendor management.

Connection

Forensic accounting software and accounts payable software intersect through their shared focus on financial accuracy and fraud detection. Forensic accounting tools analyze transactional data from accounts payable systems to identify irregularities, such as duplicate payments or vendor fraud. Integrating these software solutions enhances audit capabilities, improves compliance, and strengthens internal controls within the accounting process.

Key Terms

Invoice Processing

Accounts payable software streamlines invoice processing by automating data capture, approval workflows, and payment scheduling, reducing errors and improving efficiency for invoice management. Forensic accounting software, on the other hand, is designed to detect and analyze fraudulent activities within invoice transactions, utilizing advanced algorithms and audit trails for deeper financial investigation. Explore the distinct features and benefits of each software type to optimize your invoice processing strategies.

Fraud Detection

Accounts payable software streamlines invoice processing and payment management but has limited capabilities in detecting complex fraud patterns compared to forensic accounting software, which employs advanced analytics and data mining techniques to uncover financial discrepancies and suspicious activities. Forensic accounting software integrates machine learning algorithms and anomaly detection to identify potential fraud in large datasets, making it essential for in-depth financial investigations. Explore our detailed comparison to understand which software best suits your fraud detection needs.

Audit Trail

Accounts payable software streamlines invoice processing and payment workflows, maintaining detailed audit trails that track transaction history, user actions, and approval processes to ensure compliance and reduce errors. Forensic accounting software specializes in analyzing complex financial data and audit trails to detect fraud, discrepancies, and unauthorized changes within financial records for legal or investigative purposes. Explore key differences in audit trail capabilities and security features to choose the right solution for your business needs.

Source and External Links

The 9 Best Accounts Payable Software Solutions - May 2025 - Sage offers robust, compliance-focused accounts payable automation for mid-sized to large enterprises, with features like multi-company support, three-way matching, and detailed audit trails.

9 Best Accounts Payable Software Solutions in 2025 - Tipalti provides a scalable, AI-driven cloud platform that streamlines invoice management, global payments, supplier onboarding, and integrates tightly with ERPs for businesses of all sizes.

AP Automation Software - Plooto delivers flexible, customizable AP automation that eliminates manual data entry, supports custom approval workflows, and integrates seamlessly with accounting software for improved cash flow management.

dowidth.com

dowidth.com