Embedded finance compliance ensures integrated financial services adhere to legal regulations, maintaining transparency and security throughout transactions. Know Your Customer (KYC) protocols verify client identities, effectively preventing fraud and money laundering within accounting processes. Explore how these critical frameworks shape modern financial accountability and risk management.

Why it is important

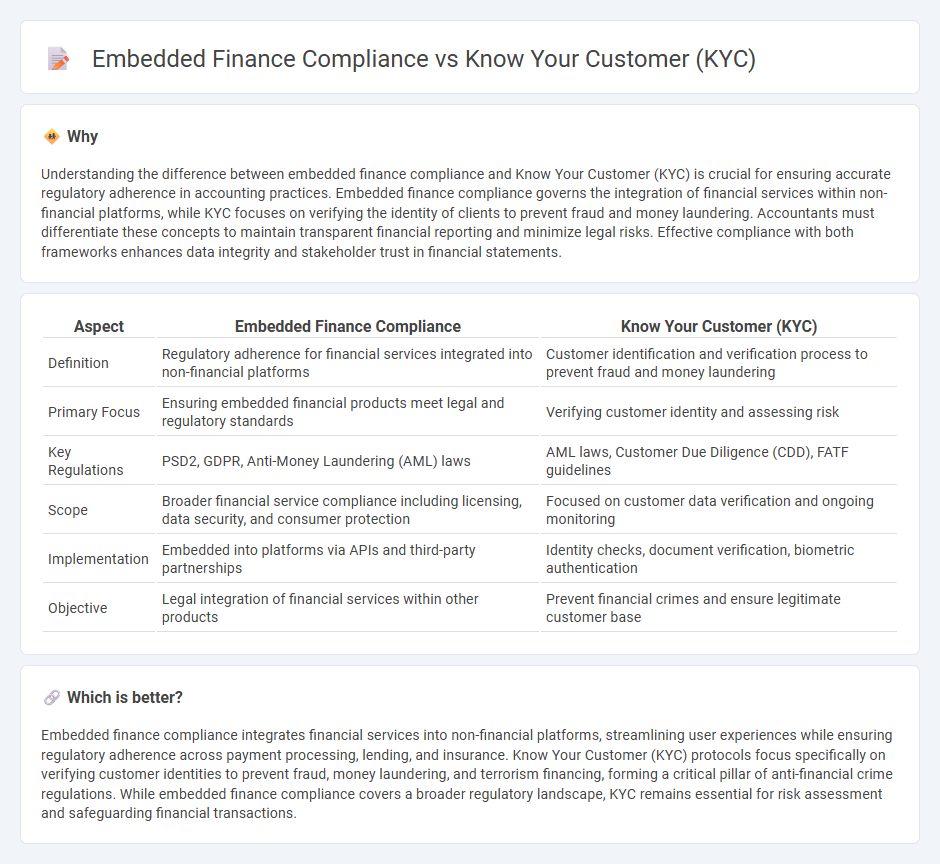

Understanding the difference between embedded finance compliance and Know Your Customer (KYC) is crucial for ensuring accurate regulatory adherence in accounting practices. Embedded finance compliance governs the integration of financial services within non-financial platforms, while KYC focuses on verifying the identity of clients to prevent fraud and money laundering. Accountants must differentiate these concepts to maintain transparent financial reporting and minimize legal risks. Effective compliance with both frameworks enhances data integrity and stakeholder trust in financial statements.

Comparison Table

| Aspect | Embedded Finance Compliance | Know Your Customer (KYC) |

|---|---|---|

| Definition | Regulatory adherence for financial services integrated into non-financial platforms | Customer identification and verification process to prevent fraud and money laundering |

| Primary Focus | Ensuring embedded financial products meet legal and regulatory standards | Verifying customer identity and assessing risk |

| Key Regulations | PSD2, GDPR, Anti-Money Laundering (AML) laws | AML laws, Customer Due Diligence (CDD), FATF guidelines |

| Scope | Broader financial service compliance including licensing, data security, and consumer protection | Focused on customer data verification and ongoing monitoring |

| Implementation | Embedded into platforms via APIs and third-party partnerships | Identity checks, document verification, biometric authentication |

| Objective | Legal integration of financial services within other products | Prevent financial crimes and ensure legitimate customer base |

Which is better?

Embedded finance compliance integrates financial services into non-financial platforms, streamlining user experiences while ensuring regulatory adherence across payment processing, lending, and insurance. Know Your Customer (KYC) protocols focus specifically on verifying customer identities to prevent fraud, money laundering, and terrorism financing, forming a critical pillar of anti-financial crime regulations. While embedded finance compliance covers a broader regulatory landscape, KYC remains essential for risk assessment and safeguarding financial transactions.

Connection

Embedded finance compliance directly relies on Know Your Customer (KYC) processes to prevent fraud and ensure regulatory adherence within financial services integrated into non-financial platforms. Accurate KYC verification helps embedded finance providers meet Anti-Money Laundering (AML) regulations and reduce the risk of illicit activities. Seamless integration of KYC protocols enhances trust, customer onboarding efficiency, and overall compliance in embedded accounting and payment solutions.

Key Terms

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) is a critical component of both Know Your Customer (KYC) and embedded finance compliance frameworks, ensuring the identification and verification of customer identities to prevent fraud and financial crimes. Embedded finance integrates financial services into non-financial platforms, requiring tailored CDD measures to address unique risk profiles and regulatory requirements. Explore the nuances of KYC versus embedded finance compliance to enhance your understanding of effective CDD strategies.

Anti-Money Laundering (AML)

Know Your Customer (KYC) procedures are essential for verifying customer identities and preventing fraud, forming a critical layer of Anti-Money Laundering (AML) compliance. Embedded finance compliance integrates AML regulations directly into financial services within non-financial platforms, requiring seamless identity verification and transaction monitoring. Explore detailed guidelines on how KYC and AML standards intersect with embedded finance to ensure regulatory adherence.

Transaction Monitoring

Transaction monitoring in Know Your Customer (KYC) processes involves verifying customer identities and detecting suspicious activities to prevent fraud and money laundering. Embedded finance compliance requires real-time transaction monitoring integrated within non-financial platforms, ensuring seamless regulatory adherence while providing financial services. Explore how transaction monitoring techniques evolve to meet the unique demands of KYC and embedded finance compliance.

Source and External Links

What is KYC - This webpage describes Know Your Customer (KYC) as a due diligence process used by financial institutions to verify identity and assess customer risk, primarily to prevent money laundering and terrorist financing.

What is KYC - This article explains KYC as a process to verify customer identities to prevent illegal activities like money laundering and fraud, emphasizing its importance in online financial transactions.

Know Your Customer - This Wikipedia page outlines the KYC guidelines and regulations in financial services, focusing on verifying identity, suitability, and risks involved for both customers and businesses.

dowidth.com

dowidth.com