Intercompany automation streamlines financial transactions between subsidiaries by automating reconciliations, reducing errors, and accelerating closing processes. Enterprise Resource Planning (ERP) integrates core business functions, including accounting, but often requires customization to handle complex intercompany processes effectively. Discover more about optimizing intercompany workflows with tailored automation solutions.

Why it is important

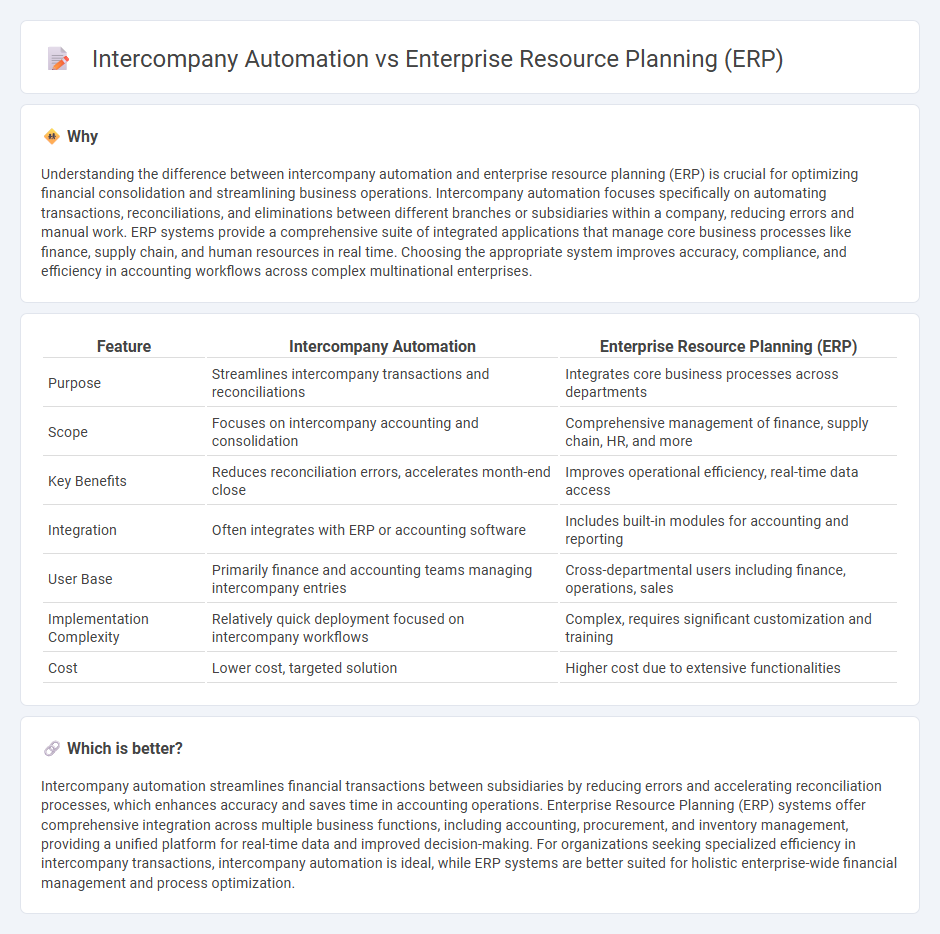

Understanding the difference between intercompany automation and enterprise resource planning (ERP) is crucial for optimizing financial consolidation and streamlining business operations. Intercompany automation focuses specifically on automating transactions, reconciliations, and eliminations between different branches or subsidiaries within a company, reducing errors and manual work. ERP systems provide a comprehensive suite of integrated applications that manage core business processes like finance, supply chain, and human resources in real time. Choosing the appropriate system improves accuracy, compliance, and efficiency in accounting workflows across complex multinational enterprises.

Comparison Table

| Feature | Intercompany Automation | Enterprise Resource Planning (ERP) |

|---|---|---|

| Purpose | Streamlines intercompany transactions and reconciliations | Integrates core business processes across departments |

| Scope | Focuses on intercompany accounting and consolidation | Comprehensive management of finance, supply chain, HR, and more |

| Key Benefits | Reduces reconciliation errors, accelerates month-end close | Improves operational efficiency, real-time data access |

| Integration | Often integrates with ERP or accounting software | Includes built-in modules for accounting and reporting |

| User Base | Primarily finance and accounting teams managing intercompany entries | Cross-departmental users including finance, operations, sales |

| Implementation Complexity | Relatively quick deployment focused on intercompany workflows | Complex, requires significant customization and training |

| Cost | Lower cost, targeted solution | Higher cost due to extensive functionalities |

Which is better?

Intercompany automation streamlines financial transactions between subsidiaries by reducing errors and accelerating reconciliation processes, which enhances accuracy and saves time in accounting operations. Enterprise Resource Planning (ERP) systems offer comprehensive integration across multiple business functions, including accounting, procurement, and inventory management, providing a unified platform for real-time data and improved decision-making. For organizations seeking specialized efficiency in intercompany transactions, intercompany automation is ideal, while ERP systems are better suited for holistic enterprise-wide financial management and process optimization.

Connection

Intercompany automation streamlines financial transactions and reconciliations between subsidiaries, enhancing the accuracy of enterprise resource planning (ERP) systems by ensuring real-time data consistency across entities. ERP platforms integrate intercompany processes within their modules, facilitating automated eliminations, reporting, and compliance management. This connection reduces manual errors, accelerates closing cycles, and improves overall financial visibility in multinational corporations.

Key Terms

Consolidation

Enterprise Resource Planning (ERP) systems integrate core business processes across departments, providing unified financial consolidation by aggregating data from multiple subsidiaries into a single system. Intercompany automation specializes in streamlining and reconciling transactions between affiliated entities, accelerating consolidation cycles through automated elimination of intercompany balances and discrepancies. Explore deeper insights on how ERP and intercompany automation complement each other to optimize financial consolidation efficiency.

Reconciliation

Enterprise resource planning (ERP) systems integrate financial data across business units, but often require manual intervention for intercompany reconciliation, leading to errors and delays. Intercompany automation streamlines reconciliation by automatically matching transactions and resolving discrepancies in real-time, enhancing accuracy and reducing closing cycles. Explore how intercompany automation complements ERP solutions to optimize reconciliation processes and improve financial transparency.

Workflow Integration

Enterprise Resource Planning (ERP) systems centralize business processes and data, enabling seamless workflow integration across departments by standardizing and automating tasks such as finance, procurement, and inventory management. Intercompany automation specifically targets transaction processing and data exchange between related business entities, reducing manual errors and accelerating cross-entity workflows. Explore how integrating ERP with intercompany automation optimizes operational efficiency and data accuracy across your enterprise.

Source and External Links

Enterprise Resource Planning - This is a category of business management software that integrates and manages various business processes, often in real time, using shared databases and technology.

What is Enterprise Resource Planning (ERP)? - ERP is a software system designed to automate and integrate an organization's functions, processes, and workflows across different departments like finance and manufacturing.

What is ERP? - ERP is a comprehensive business software that automates processes, provides insights, and controls by centralizing data from departments like accounting, sales, and manufacturing.

dowidth.com

dowidth.com