Cryptofinance reconciliation involves verifying digital asset transactions and blockchain records to ensure accuracy and prevent fraud, while payroll reconciliation focuses on matching employee payment records with tax filings and benefits. Both processes require precise data validation to maintain financial integrity and regulatory compliance. Explore deeper insights into how these reconciliations impact modern accounting practices.

Why it is important

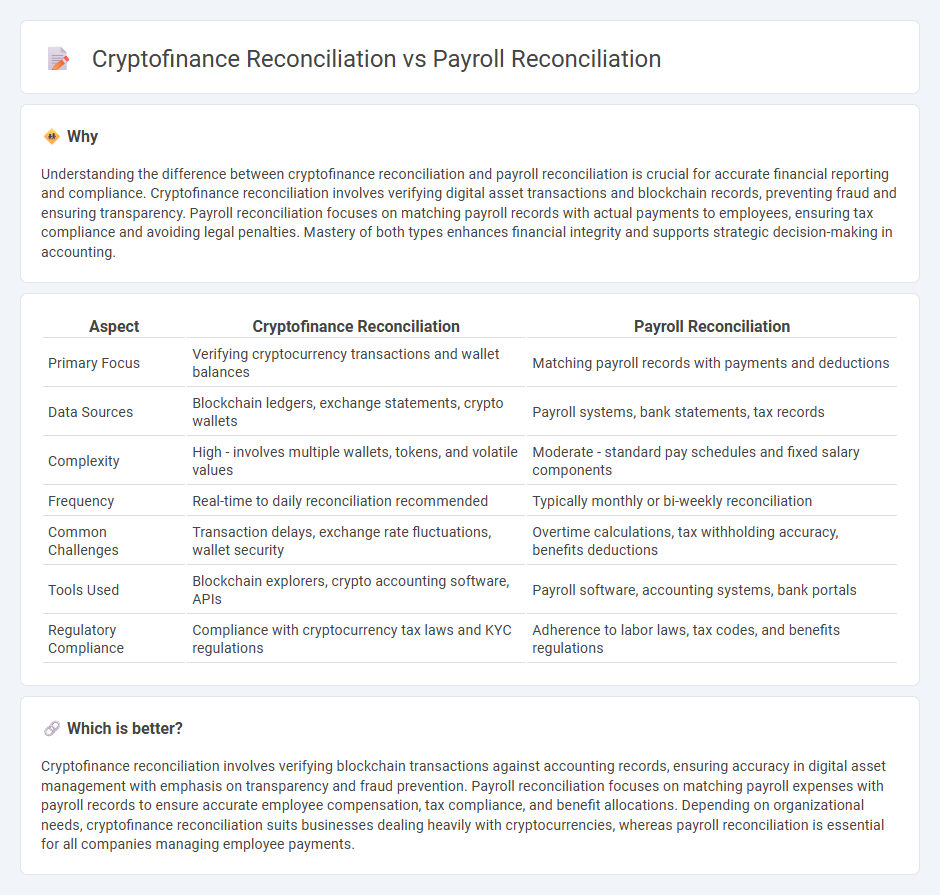

Understanding the difference between cryptofinance reconciliation and payroll reconciliation is crucial for accurate financial reporting and compliance. Cryptofinance reconciliation involves verifying digital asset transactions and blockchain records, preventing fraud and ensuring transparency. Payroll reconciliation focuses on matching payroll records with actual payments to employees, ensuring tax compliance and avoiding legal penalties. Mastery of both types enhances financial integrity and supports strategic decision-making in accounting.

Comparison Table

| Aspect | Cryptofinance Reconciliation | Payroll Reconciliation |

|---|---|---|

| Primary Focus | Verifying cryptocurrency transactions and wallet balances | Matching payroll records with payments and deductions |

| Data Sources | Blockchain ledgers, exchange statements, crypto wallets | Payroll systems, bank statements, tax records |

| Complexity | High - involves multiple wallets, tokens, and volatile values | Moderate - standard pay schedules and fixed salary components |

| Frequency | Real-time to daily reconciliation recommended | Typically monthly or bi-weekly reconciliation |

| Common Challenges | Transaction delays, exchange rate fluctuations, wallet security | Overtime calculations, tax withholding accuracy, benefits deductions |

| Tools Used | Blockchain explorers, crypto accounting software, APIs | Payroll software, accounting systems, bank portals |

| Regulatory Compliance | Compliance with cryptocurrency tax laws and KYC regulations | Adherence to labor laws, tax codes, and benefits regulations |

Which is better?

Cryptofinance reconciliation involves verifying blockchain transactions against accounting records, ensuring accuracy in digital asset management with emphasis on transparency and fraud prevention. Payroll reconciliation focuses on matching payroll expenses with payroll records to ensure accurate employee compensation, tax compliance, and benefit allocations. Depending on organizational needs, cryptofinance reconciliation suits businesses dealing heavily with cryptocurrencies, whereas payroll reconciliation is essential for all companies managing employee payments.

Connection

Cryptofinance reconciliation and payroll reconciliation intersect through the accurate tracking of cryptocurrency-based salary payments, ensuring all crypto transactions are correctly recorded and verified against payroll records. Integrating blockchain data with payroll systems enhances transparency and minimizes discrepancies in digital asset compensation. This alignment supports compliance with financial regulations and streamlines auditing processes involving both traditional payroll and digital currency payouts.

Key Terms

**Payroll reconciliation:**

Payroll reconciliation involves verifying employee salary payments, ensuring deductions, taxes, and benefits align with payroll records and legal compliance. It detects discrepancies between payroll data and bank statements to prevent errors and fraud. Discover more about effective payroll reconciliation techniques and tools to enhance financial accuracy.

Gross Pay

Payroll reconciliation involves verifying Gross Pay by comparing employee earnings records with payroll registers, tax filings, and benefit deductions to ensure accurate compensation and compliance with labor laws. Cryptofinance reconciliation focuses on matching Gross Pay figures within blockchain transactions, smart contracts, and digital wallet distributions to confirm the integrity and transparency of decentralized payroll disbursements. Explore the detailed methodologies and tools used in both payroll and cryptofinance reconciliation to enhance financial accuracy and security.

Deductions

Payroll reconciliation involves verifying deductions such as taxes, benefits, and garnishments against payroll records to ensure accuracy and compliance with financial regulations. Cryptofinance reconciliation focuses on tracking cryptocurrency transaction fees, smart contract gas costs, and decentralized finance deductions to maintain transparent ledger entries. Explore how precise deduction management varies between traditional payroll and cryptofinance systems for deeper financial insights.

Source and External Links

What is Payroll Reconciliation? | How it Works - Trintech - This webpage provides an overview of payroll reconciliation, including steps such as checking the payroll register, approving timesheets, and verifying pay rates.

What is Payroll Reconciliation | F&A Glossary - BlackLine - This resource defines payroll reconciliation as the process of verifying that records of employee compensation are accurate, involving checks on payroll registers and time sheet data.

What Is Payroll Reconciliation? A How-To Guide - NetSuite - This guide outlines payroll reconciliation as a process to ensure accuracy in payroll records, including verifying payments and deductions against financial documents like bank statements.

dowidth.com

dowidth.com