Blockchain-based accounting utilizes distributed ledger technology to enhance transparency, security, and accuracy in financial record-keeping by creating immutable transaction records. Decentralized finance (DeFi) accounting extends this concept by integrating automated smart contracts and decentralized applications to facilitate trustless, peer-to-peer financial operations without intermediaries. Explore how these innovative accounting systems transform financial management and reporting in modern finance.

Why it is important

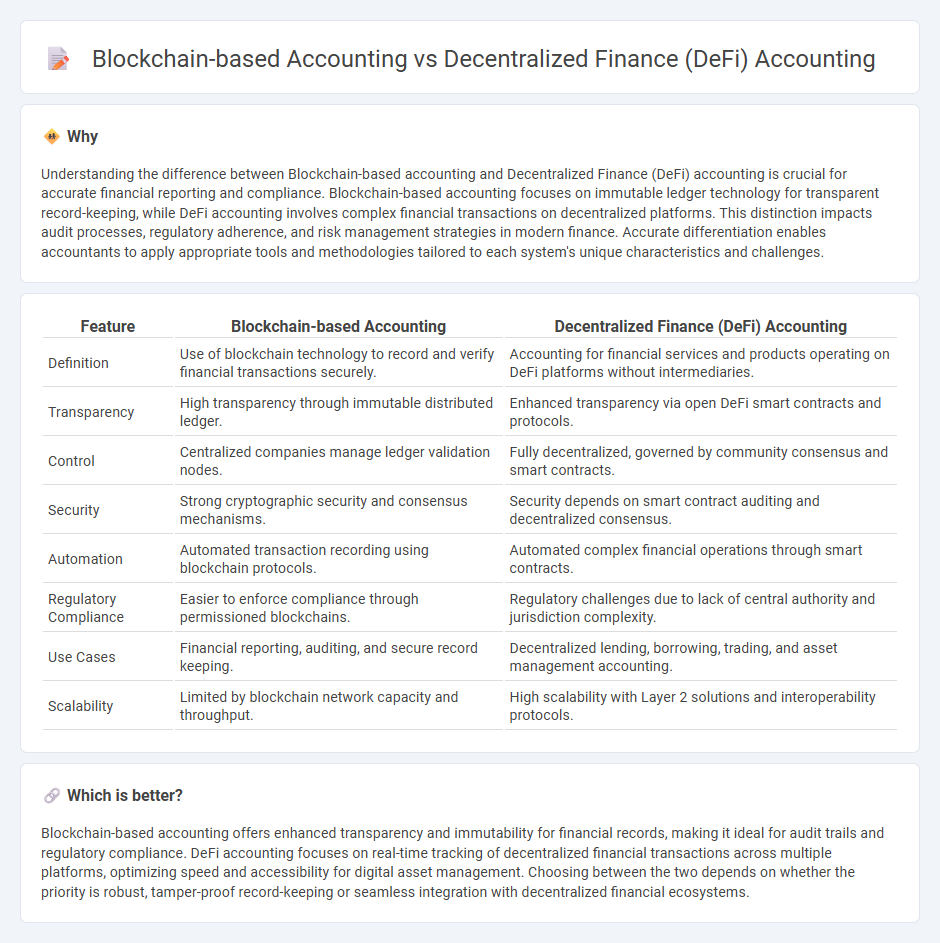

Understanding the difference between Blockchain-based accounting and Decentralized Finance (DeFi) accounting is crucial for accurate financial reporting and compliance. Blockchain-based accounting focuses on immutable ledger technology for transparent record-keeping, while DeFi accounting involves complex financial transactions on decentralized platforms. This distinction impacts audit processes, regulatory adherence, and risk management strategies in modern finance. Accurate differentiation enables accountants to apply appropriate tools and methodologies tailored to each system's unique characteristics and challenges.

Comparison Table

| Feature | Blockchain-based Accounting | Decentralized Finance (DeFi) Accounting |

|---|---|---|

| Definition | Use of blockchain technology to record and verify financial transactions securely. | Accounting for financial services and products operating on DeFi platforms without intermediaries. |

| Transparency | High transparency through immutable distributed ledger. | Enhanced transparency via open DeFi smart contracts and protocols. |

| Control | Centralized companies manage ledger validation nodes. | Fully decentralized, governed by community consensus and smart contracts. |

| Security | Strong cryptographic security and consensus mechanisms. | Security depends on smart contract auditing and decentralized consensus. |

| Automation | Automated transaction recording using blockchain protocols. | Automated complex financial operations through smart contracts. |

| Regulatory Compliance | Easier to enforce compliance through permissioned blockchains. | Regulatory challenges due to lack of central authority and jurisdiction complexity. |

| Use Cases | Financial reporting, auditing, and secure record keeping. | Decentralized lending, borrowing, trading, and asset management accounting. |

| Scalability | Limited by blockchain network capacity and throughput. | High scalability with Layer 2 solutions and interoperability protocols. |

Which is better?

Blockchain-based accounting offers enhanced transparency and immutability for financial records, making it ideal for audit trails and regulatory compliance. DeFi accounting focuses on real-time tracking of decentralized financial transactions across multiple platforms, optimizing speed and accessibility for digital asset management. Choosing between the two depends on whether the priority is robust, tamper-proof record-keeping or seamless integration with decentralized financial ecosystems.

Connection

Blockchain-based accounting ensures transparent, immutable recording of financial transactions, providing a reliable foundation for Decentralized Finance (DeFi) accounting systems. DeFi accounting leverages blockchain technology to automate and verify transactions across decentralized platforms without intermediaries, enhancing accuracy and efficiency. The integration of blockchain in accounting enables real-time auditing and reduces risks of fraud within DeFi ecosystems.

Key Terms

Smart Contracts

Decentralized finance (DeFi) accounting leverages smart contracts to automate transparent, immutable transaction records, reducing reliance on intermediaries compared to traditional blockchain-based accounting systems. Smart contracts enable real-time auditing and enforce predefined rules for asset management, enhancing accuracy and efficiency in financial reporting within DeFi ecosystems. Explore the distinct benefits and operational mechanisms of smart contracts in DeFi accounting to optimize your understanding of next-generation financial technology.

Tokenization

Decentralized finance (DeFi) accounting emphasizes trustless, transparent transaction records using smart contracts, while blockchain-based accounting centers on immutable ledgers for provenance and audit trails. Tokenization in DeFi enables fractional ownership and real-time asset liquidity, transforming traditional accounting by embedding financial instruments directly on the blockchain. Explore how integrating tokenized assets revolutionizes accounting frameworks and enhances financial ecosystem efficiency.

Immutable Ledger

Decentralized finance (DeFi) accounting leverages smart contracts on blockchain networks to enable transparent, trustless financial transactions with real-time verification, ensuring an immutable ledger that cannot be altered retroactively. Blockchain-based accounting extends this by providing time-stamped, distributed records that enhance auditability and reduce reconciliation errors, offering a tamper-resistant financial data trail. Explore how these technologies transform traditional accounting practices through enhanced security and operational efficiency.

dowidth.com

dowidth.com