Digital twin accounting leverages advanced simulation technologies to create real-time, dynamic models of financial processes, enhancing accuracy and predictive analysis compared to traditional accounting methods that rely heavily on static, historical data. This innovative approach improves decision-making by providing continuous insights into financial performance and risk management. Explore the transformative potential of digital twin accounting to revolutionize your financial strategies.

Why it is important

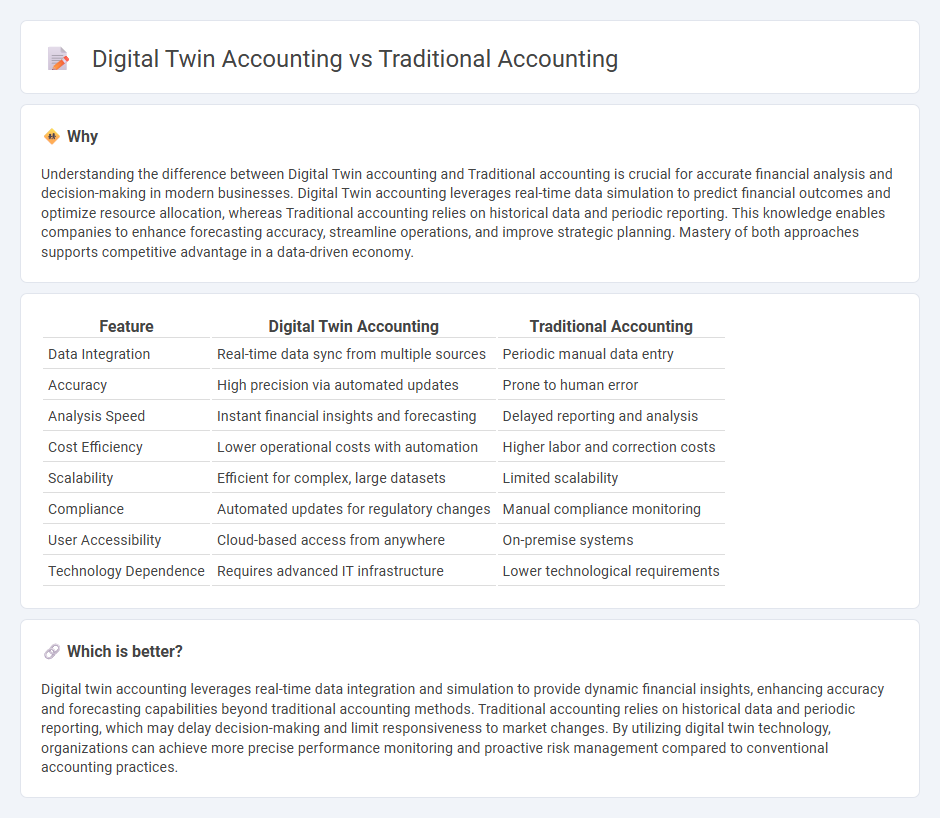

Understanding the difference between Digital Twin accounting and Traditional accounting is crucial for accurate financial analysis and decision-making in modern businesses. Digital Twin accounting leverages real-time data simulation to predict financial outcomes and optimize resource allocation, whereas Traditional accounting relies on historical data and periodic reporting. This knowledge enables companies to enhance forecasting accuracy, streamline operations, and improve strategic planning. Mastery of both approaches supports competitive advantage in a data-driven economy.

Comparison Table

| Feature | Digital Twin Accounting | Traditional Accounting |

|---|---|---|

| Data Integration | Real-time data sync from multiple sources | Periodic manual data entry |

| Accuracy | High precision via automated updates | Prone to human error |

| Analysis Speed | Instant financial insights and forecasting | Delayed reporting and analysis |

| Cost Efficiency | Lower operational costs with automation | Higher labor and correction costs |

| Scalability | Efficient for complex, large datasets | Limited scalability |

| Compliance | Automated updates for regulatory changes | Manual compliance monitoring |

| User Accessibility | Cloud-based access from anywhere | On-premise systems |

| Technology Dependence | Requires advanced IT infrastructure | Lower technological requirements |

Which is better?

Digital twin accounting leverages real-time data integration and simulation to provide dynamic financial insights, enhancing accuracy and forecasting capabilities beyond traditional accounting methods. Traditional accounting relies on historical data and periodic reporting, which may delay decision-making and limit responsiveness to market changes. By utilizing digital twin technology, organizations can achieve more precise performance monitoring and proactive risk management compared to conventional accounting practices.

Connection

Digital twin accounting leverages real-time data and simulations to mirror traditional accounting processes, enhancing accuracy in financial analysis and forecasting. By integrating digital twin technologies, traditional accounting benefits from dynamic, data-driven insights that improve decision-making and risk management. This connection fosters a hybrid approach, combining historical financial records with predictive modeling for comprehensive financial oversight.

Key Terms

Ledger (Traditional)

Traditional accounting relies on ledger-based record-keeping, capturing financial transactions in a structured format to ensure accuracy and compliance. Each entry in the ledger serves as a historical record, facilitating audits, financial reporting, and bookkeeping processes. Explore how digital twin accounting transforms these ledgers with real-time data integration for enhanced decision-making.

Real-time Data Integration (Digital Twin)

Traditional accounting relies on periodic data entry and batch processing, often resulting in time lags and limited visibility into real-time financial performance. Digital twin accounting integrates real-time data streams directly from operational systems, enabling continuous monitoring and instant financial analysis that enhances decision-making accuracy. Explore the transformative impact of digital twin accounting on financial management and operational efficiency for deeper insights.

Automation (Digital Twin)

Digital twin accounting revolutionizes automation by creating real-time, virtual replicas of financial processes that enable continuous monitoring and predictive analytics, unlike traditional accounting which relies on periodic manual data entry and static reporting. Integration of IoT sensors and AI algorithms in digital twins automates transaction tracking and anomaly detection, significantly reducing human errors and enhancing decision-making speed. Explore how digital twin accounting drives efficiency and accuracy in finance through cutting-edge automation technologies.

Source and External Links

Cash Basis vs Traditional Accounting for Inventory - Traditional accounting, also called accrual accounting, records income when earned and expenses when incurred, providing a more accurate financial picture but is more complex and costly to implement than cash basis accounting.

The Pros and Cons of Traditional vs. Digital Accounting for Event Companies - Traditional accounting involves manual recording and bookkeeping using physical ledgers and double-entry bookkeeping, in contrast to digital accounting which uses automated and computerized systems.

What is Traditional Accounting? And Why It's Failing You - Outmin - Traditional accounting refers to an outdated, fragmented system using manual processes and multiple disconnected tools, leading to inefficiencies and high costs for businesses.

dowidth.com

dowidth.com