Transfer pricing analytics involves evaluating intercompany transactions to ensure compliance with regulatory requirements and accurate profit allocation among multinational entities. Tax optimization focuses on structuring business operations and financial arrangements to minimize tax liabilities within legal frameworks. Explore how integrating transfer pricing analytics enhances effective tax optimization strategies.

Why it is important

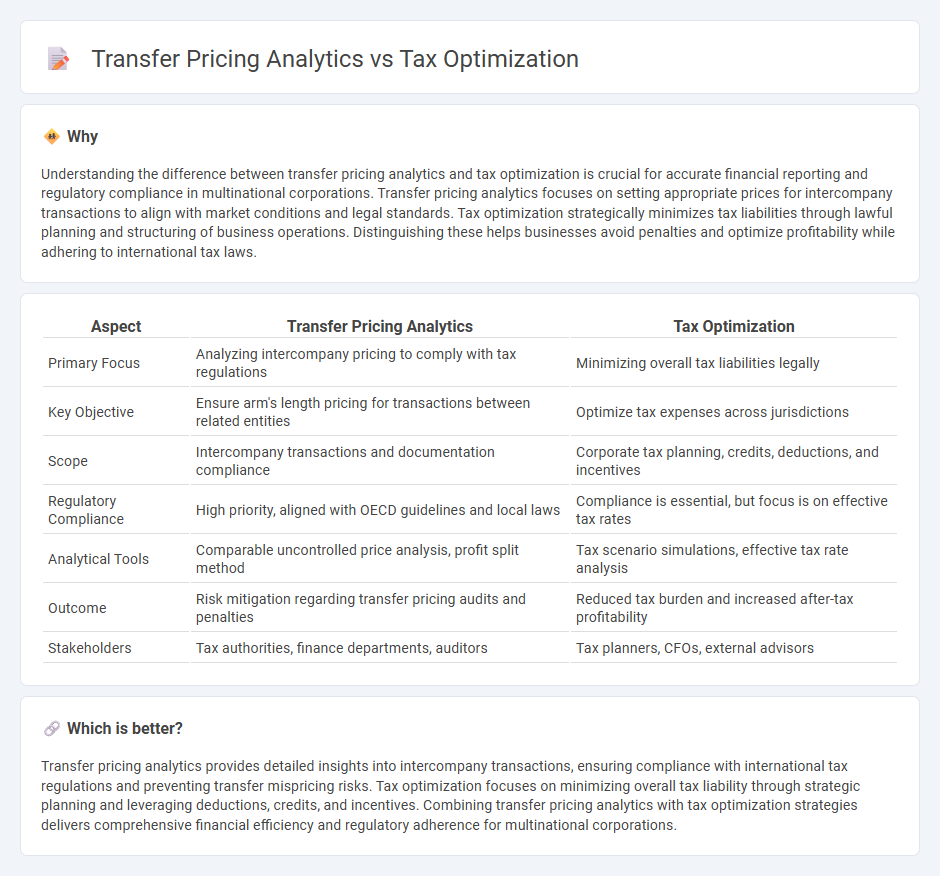

Understanding the difference between transfer pricing analytics and tax optimization is crucial for accurate financial reporting and regulatory compliance in multinational corporations. Transfer pricing analytics focuses on setting appropriate prices for intercompany transactions to align with market conditions and legal standards. Tax optimization strategically minimizes tax liabilities through lawful planning and structuring of business operations. Distinguishing these helps businesses avoid penalties and optimize profitability while adhering to international tax laws.

Comparison Table

| Aspect | Transfer Pricing Analytics | Tax Optimization |

|---|---|---|

| Primary Focus | Analyzing intercompany pricing to comply with tax regulations | Minimizing overall tax liabilities legally |

| Key Objective | Ensure arm's length pricing for transactions between related entities | Optimize tax expenses across jurisdictions |

| Scope | Intercompany transactions and documentation compliance | Corporate tax planning, credits, deductions, and incentives |

| Regulatory Compliance | High priority, aligned with OECD guidelines and local laws | Compliance is essential, but focus is on effective tax rates |

| Analytical Tools | Comparable uncontrolled price analysis, profit split method | Tax scenario simulations, effective tax rate analysis |

| Outcome | Risk mitigation regarding transfer pricing audits and penalties | Reduced tax burden and increased after-tax profitability |

| Stakeholders | Tax authorities, finance departments, auditors | Tax planners, CFOs, external advisors |

Which is better?

Transfer pricing analytics provides detailed insights into intercompany transactions, ensuring compliance with international tax regulations and preventing transfer mispricing risks. Tax optimization focuses on minimizing overall tax liability through strategic planning and leveraging deductions, credits, and incentives. Combining transfer pricing analytics with tax optimization strategies delivers comprehensive financial efficiency and regulatory adherence for multinational corporations.

Connection

Transfer pricing analytics provides detailed insights into intercompany transaction prices, ensuring compliance with international tax regulations and minimizing risks of transfer pricing adjustments. Accurate data analysis supports tax optimization strategies by identifying opportunities to allocate profits strategically across jurisdictions with favorable tax rates. Integrating transfer pricing analytics with tax planning enhances multinational corporations' ability to reduce effective tax rates while avoiding penalties and audits.

Key Terms

**Tax Optimization:**

Tax optimization involves strategically managing financial activities to minimize tax liabilities while complying with regulations, leveraging deductions, credits, and exemptions effectively. It focuses on designing corporate structures and transactions to achieve the lowest possible tax burden through legal methods and thorough tax planning. Explore more about effective tax optimization strategies to enhance your financial performance.

Tax Efficiency

Tax optimization enhances overall tax efficiency by strategically managing deductions, credits, and entity structures to minimize tax liability within legal frameworks. Transfer pricing analytics specifically examines intercompany pricing policies to ensure compliance with arm's length standards, reducing risks of tax penalties and double taxation. Explore how integrating these approaches can maximize your organization's tax efficiency and compliance.

Deductions

Tax optimization strategies often emphasize maximizing deductions to reduce overall taxable income, while transfer pricing analytics focus on establishing arm's length pricing to comply with international tax regulations. Effective management of deductions in transfer pricing involves detailed documentation and alignment with country-specific tax laws to avoid disputes and penalties. Discover more about integrating tax optimization with transfer pricing analytics to enhance deduction strategies.

Source and External Links

Tax Optimization 101: How to Maximize Your Savings - Tax optimization involves smart tax reduction strategies like maximizing retirement contributions and harvesting tax losses to lower tax liability and keep more money.

Smart List of 12 Tax Reduction Strategies - Global Wealth Advisors - Effective tax optimization includes minimizing taxable income through retirement savings, maximizing deductions, and regular review of financials to employ tax reduction strategies year-round.

Tax Optimization at Different Stages of the Business Lifecycle - Business tax optimization strategies vary by lifecycle stage and include choosing the right business structure and leveraging deductions to sustainably lower tax liabilities.

dowidth.com

dowidth.com