Environmental Social Governance (ESG) accounting focuses on measuring a company's sustainability and ethical impact by tracking social responsibility, environmental performance, and corporate governance metrics. Cost accounting analyzes production costs to improve efficiency and profitability by evaluating direct and indirect expenses associated with manufacturing or services. Explore how integrating ESG accounting with traditional cost accounting can drive both financial success and sustainable business practices.

Why it is important

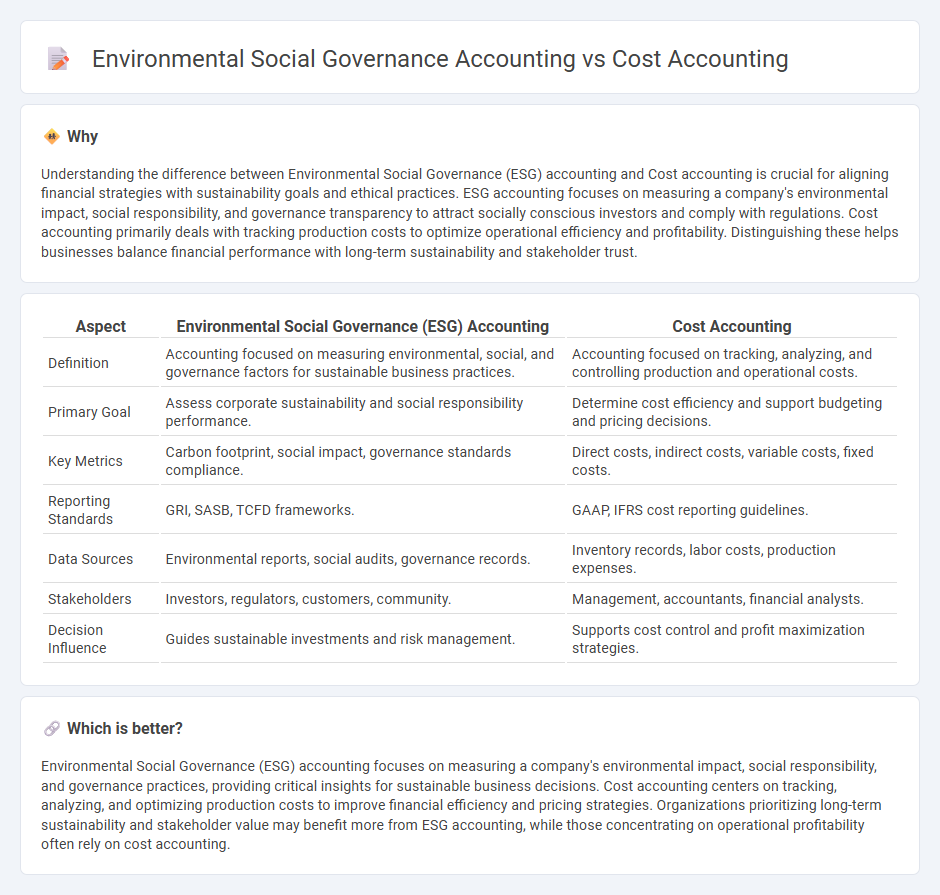

Understanding the difference between Environmental Social Governance (ESG) accounting and Cost accounting is crucial for aligning financial strategies with sustainability goals and ethical practices. ESG accounting focuses on measuring a company's environmental impact, social responsibility, and governance transparency to attract socially conscious investors and comply with regulations. Cost accounting primarily deals with tracking production costs to optimize operational efficiency and profitability. Distinguishing these helps businesses balance financial performance with long-term sustainability and stakeholder trust.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Cost Accounting |

|---|---|---|

| Definition | Accounting focused on measuring environmental, social, and governance factors for sustainable business practices. | Accounting focused on tracking, analyzing, and controlling production and operational costs. |

| Primary Goal | Assess corporate sustainability and social responsibility performance. | Determine cost efficiency and support budgeting and pricing decisions. |

| Key Metrics | Carbon footprint, social impact, governance standards compliance. | Direct costs, indirect costs, variable costs, fixed costs. |

| Reporting Standards | GRI, SASB, TCFD frameworks. | GAAP, IFRS cost reporting guidelines. |

| Data Sources | Environmental reports, social audits, governance records. | Inventory records, labor costs, production expenses. |

| Stakeholders | Investors, regulators, customers, community. | Management, accountants, financial analysts. |

| Decision Influence | Guides sustainable investments and risk management. | Supports cost control and profit maximization strategies. |

Which is better?

Environmental Social Governance (ESG) accounting focuses on measuring a company's environmental impact, social responsibility, and governance practices, providing critical insights for sustainable business decisions. Cost accounting centers on tracking, analyzing, and optimizing production costs to improve financial efficiency and pricing strategies. Organizations prioritizing long-term sustainability and stakeholder value may benefit more from ESG accounting, while those concentrating on operational profitability often rely on cost accounting.

Connection

Environmental Social Governance (ESG) accounting integrates sustainability metrics into traditional financial reporting, enabling organizations to track and disclose environmental and social impacts alongside economic costs. Cost accounting supports ESG by quantifying the expenses related to sustainable practices, such as waste reduction, energy efficiency, and corporate social responsibility initiatives. This connection enhances decision-making by aligning financial performance with long-term environmental and social objectives, promoting transparency and accountability.

Key Terms

**Cost Accounting:**

Cost accounting systematically tracks, records, and analyzes production expenses to optimize budgeting and control financial performance within organizations. It provides detailed insights into direct and indirect costs, enabling precise product costing and profitability analysis. Explore deeper to understand how cost accounting drives efficiency and strategic decision-making in business operations.

Variable Costs

Cost accounting emphasizes the tracking and analysis of variable costs such as direct materials, labor, and variable overhead to optimize operational efficiency and profitability. Environmental Social Governance (ESG) accounting integrates variable environmental and social costs, including waste management expenses, emissions control, and community impact investments, reflecting sustainability considerations in financial decisions. Explore how integrating variable costs in both frameworks enhances comprehensive business performance and responsible corporate governance.

Overhead Allocation

Cost accounting emphasizes precise overhead allocation by assigning indirect costs to products or services to determine accurate product costs and improve pricing strategies. Environmental Social Governance (ESG) accounting integrates overhead allocation with sustainability metrics, allocating costs related to environmental impact and social initiatives to promote transparency and compliance with regulatory frameworks. Explore further to understand how overhead allocation differences impact financial and sustainability reporting.

Source and External Links

What Is Cost Accounting | A Guide for Businesses - BPM - Cost accounting is a specialized field that analyzes, standardizes, forecasts, and compares cost data to determine the true cost of products or services to improve pricing, reduce waste, and enhance profitability and operational performance for internal decision-making.

Cost Accounting Defined: What It Is & Why It Matters - NetSuite - Cost accounting tracks, analyzes, and summarizes all fixed and variable input costs related to production or service delivery, helping management control costs and make informed pricing decisions, distinct from financial accounting which serves external reporting requirements.

What Does a Cost Accountant Do? - A cost accountant manages and analyzes organizational expenses, develops budgets and growth projections, and uses various cost accounting methods to improve operational efficiency and support informed financial decisions within the company.

dowidth.com

dowidth.com