Execution algorithms optimize trade orders by breaking them into smaller parts to minimize market impact and improve price efficiency. Dark pool trading involves private exchanges where large-volume trades occur anonymously, reducing the risk of price slippage. Discover how these strategies can enhance trading performance and reduce costs.

Why it is important

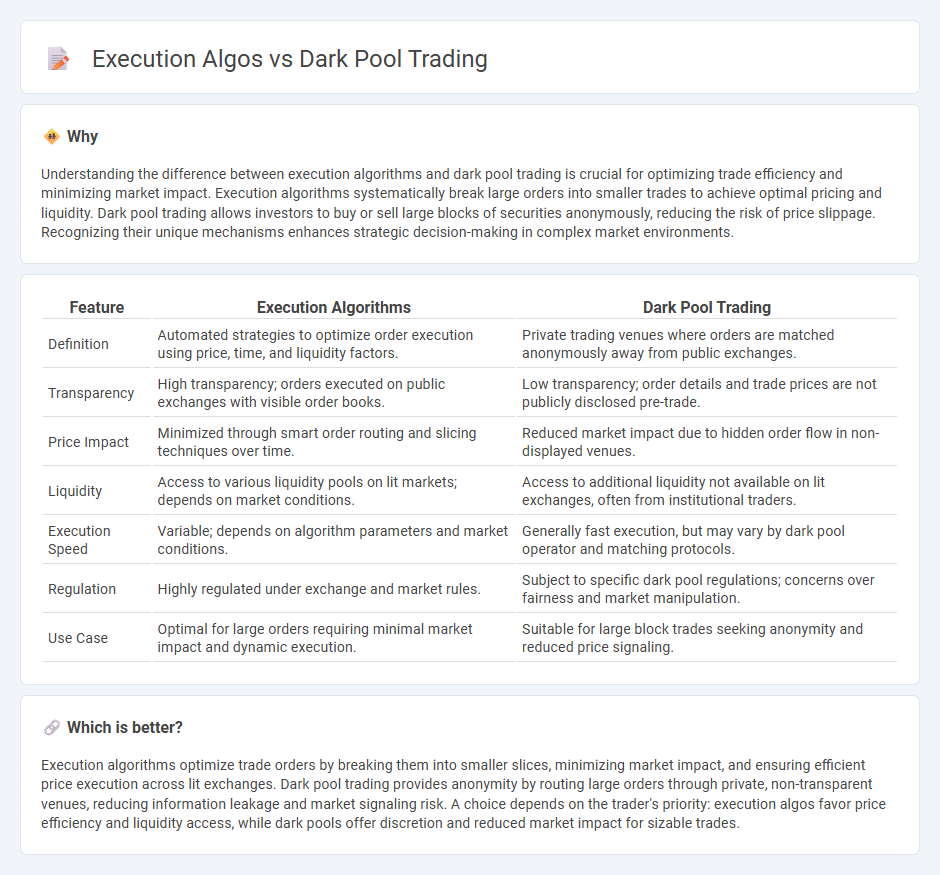

Understanding the difference between execution algorithms and dark pool trading is crucial for optimizing trade efficiency and minimizing market impact. Execution algorithms systematically break large orders into smaller trades to achieve optimal pricing and liquidity. Dark pool trading allows investors to buy or sell large blocks of securities anonymously, reducing the risk of price slippage. Recognizing their unique mechanisms enhances strategic decision-making in complex market environments.

Comparison Table

| Feature | Execution Algorithms | Dark Pool Trading |

|---|---|---|

| Definition | Automated strategies to optimize order execution using price, time, and liquidity factors. | Private trading venues where orders are matched anonymously away from public exchanges. |

| Transparency | High transparency; orders executed on public exchanges with visible order books. | Low transparency; order details and trade prices are not publicly disclosed pre-trade. |

| Price Impact | Minimized through smart order routing and slicing techniques over time. | Reduced market impact due to hidden order flow in non-displayed venues. |

| Liquidity | Access to various liquidity pools on lit markets; depends on market conditions. | Access to additional liquidity not available on lit exchanges, often from institutional traders. |

| Execution Speed | Variable; depends on algorithm parameters and market conditions. | Generally fast execution, but may vary by dark pool operator and matching protocols. |

| Regulation | Highly regulated under exchange and market rules. | Subject to specific dark pool regulations; concerns over fairness and market manipulation. |

| Use Case | Optimal for large orders requiring minimal market impact and dynamic execution. | Suitable for large block trades seeking anonymity and reduced price signaling. |

Which is better?

Execution algorithms optimize trade orders by breaking them into smaller slices, minimizing market impact, and ensuring efficient price execution across lit exchanges. Dark pool trading provides anonymity by routing large orders through private, non-transparent venues, reducing information leakage and market signaling risk. A choice depends on the trader's priority: execution algos favor price efficiency and liquidity access, while dark pools offer discretion and reduced market impact for sizable trades.

Connection

Execution algorithms enhance trading efficiency by strategically routing orders to dark pools, minimizing market impact and reducing information leakage. Dark pool trading offers liquidity through private exchanges, enabling large trades to execute anonymously, which improves price stability. Integrating execution algos with dark pools optimizes order matching and price discovery, benefiting institutional investors.

Key Terms

Liquidity

Dark pool trading offers access to non-public liquidity, enabling large orders to be executed with minimal market impact compared to traditional exchanges. Execution algorithms optimize order placement across various venues, including dark pools, to balance price improvement and execution speed while minimizing market impact. Discover how combining dark pools and sophisticated execution algos can enhance liquidity strategies.

Order Routing

Dark pool trading leverages non-public exchanges to execute large block trades with reduced market impact, enhancing price discovery for institutional investors. Execution algorithms optimize order routing across multiple venues, balancing factors like liquidity, latency, and fees to minimize transaction costs and market impact. Explore detailed strategies comparing dark pool execution and algorithmic routing to elevate your trading efficiency.

Price Impact

Dark pool trading minimizes price impact by executing large orders anonymously away from public exchanges, reducing market signaling and adverse price movements. Execution algorithms strategically slice orders over time to balance speed and price stability, aiming to limit market impact through adaptive trading tactics and liquidity detection. Discover how these methods compare in preserving trade value under varying market conditions.

Source and External Links

Dark pool - Wikipedia - Dark pools are private trading venues where institutional investors trade large blocks of securities anonymously, avoiding market impact by not revealing trade size or trader identity until after execution, but they reduce market transparency and can harm market efficiency.

Dark Pool - Overview, How It Works, Pros and Cons - Corporate Finance Institute - Dark pools allow large trades to be executed away from public markets to reduce price impact and front running, but face criticism for lack of regulation, potential conflicts of interest, and giving some traders unfair advantages.

Can You Swim in a Dark Pool? - FINRA - Dark pools are designed for institutional investors to execute large trades anonymously without moving stock prices, though their lack of public order books can hinder price discovery and market transparency.

dowidth.com

dowidth.com