Tape reading focuses on analyzing real-time order flow and price action to gauge market liquidity and trader intentions, while sentiment analysis interprets broader market emotions by evaluating news, social media, and other textual data. Tape reading provides granular insights into immediate supply and demand dynamics, whereas sentiment analysis offers a macro perspective on investor mood and potential market trends. Explore the nuances of tape reading and sentiment analysis to enhance your trading strategy.

Why it is important

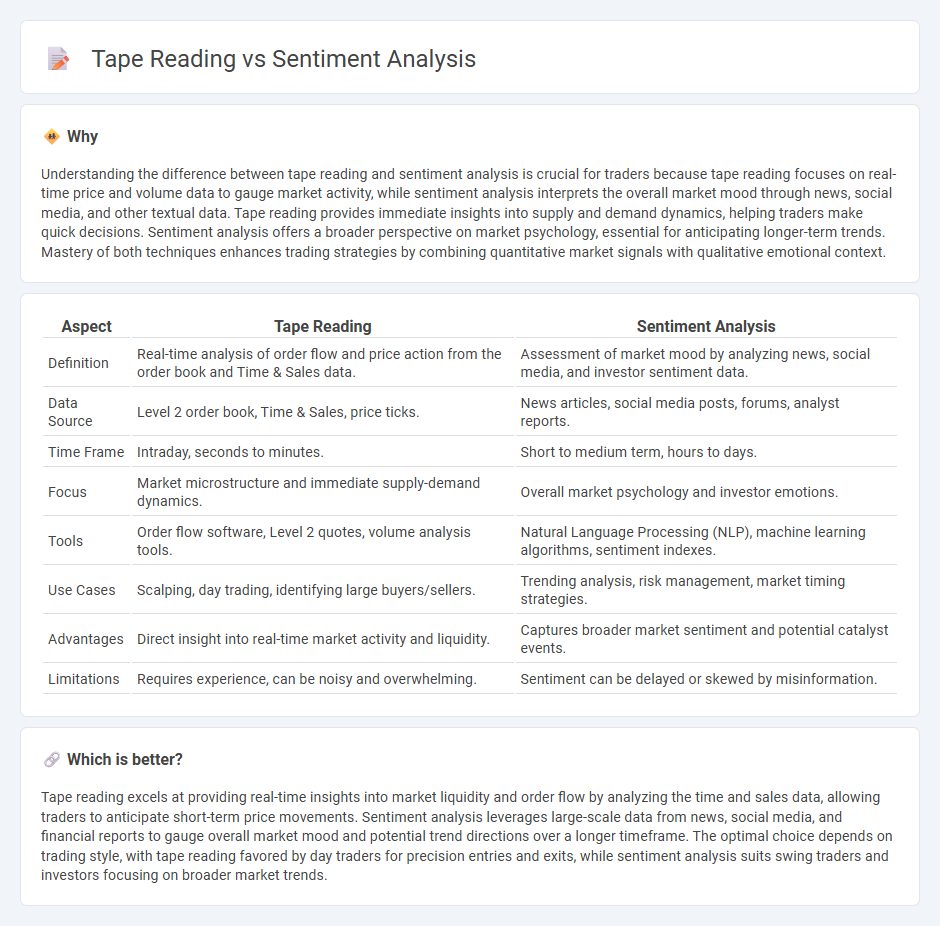

Understanding the difference between tape reading and sentiment analysis is crucial for traders because tape reading focuses on real-time price and volume data to gauge market activity, while sentiment analysis interprets the overall market mood through news, social media, and other textual data. Tape reading provides immediate insights into supply and demand dynamics, helping traders make quick decisions. Sentiment analysis offers a broader perspective on market psychology, essential for anticipating longer-term trends. Mastery of both techniques enhances trading strategies by combining quantitative market signals with qualitative emotional context.

Comparison Table

| Aspect | Tape Reading | Sentiment Analysis |

|---|---|---|

| Definition | Real-time analysis of order flow and price action from the order book and Time & Sales data. | Assessment of market mood by analyzing news, social media, and investor sentiment data. |

| Data Source | Level 2 order book, Time & Sales, price ticks. | News articles, social media posts, forums, analyst reports. |

| Time Frame | Intraday, seconds to minutes. | Short to medium term, hours to days. |

| Focus | Market microstructure and immediate supply-demand dynamics. | Overall market psychology and investor emotions. |

| Tools | Order flow software, Level 2 quotes, volume analysis tools. | Natural Language Processing (NLP), machine learning algorithms, sentiment indexes. |

| Use Cases | Scalping, day trading, identifying large buyers/sellers. | Trending analysis, risk management, market timing strategies. |

| Advantages | Direct insight into real-time market activity and liquidity. | Captures broader market sentiment and potential catalyst events. |

| Limitations | Requires experience, can be noisy and overwhelming. | Sentiment can be delayed or skewed by misinformation. |

Which is better?

Tape reading excels at providing real-time insights into market liquidity and order flow by analyzing the time and sales data, allowing traders to anticipate short-term price movements. Sentiment analysis leverages large-scale data from news, social media, and financial reports to gauge overall market mood and potential trend directions over a longer timeframe. The optimal choice depends on trading style, with tape reading favored by day traders for precision entries and exits, while sentiment analysis suits swing traders and investors focusing on broader market trends.

Connection

Tape reading monitors real-time price and volume data to identify market momentum and order flow, providing insights into trader behavior. Sentiment analysis evaluates public opinions and emotional trends from social media, news, and forums to gauge market psychology. The integration of tape reading and sentiment analysis enhances trading decisions by combining quantitative order data with qualitative market sentiment for a comprehensive view.

Key Terms

**Sentiment Analysis:**

Sentiment analysis leverages natural language processing and machine learning algorithms to interpret and quantify emotions expressed in text data from social media, reviews, and news feeds. This technique enables traders and analysts to gauge market mood and predict price movements by analyzing vast amounts of unstructured data in real time. Explore how sentiment analysis can enhance your trading strategies by understanding market psychology more deeply.

Market Sentiment

Market sentiment reflects the overall attitude of investors toward a particular security or financial market, often assessed through sentiment analysis using natural language processing tools on news, social media, and financial reports. Tape reading, on the other hand, focuses on real-time price and volume data to gauge market movements and trader behavior, providing immediate insight into short-term market sentiment. Explore deeper strategies to leverage both sentiment analysis and tape reading for more informed trading decisions.

News Analytics

Sentiment analysis leverages natural language processing to quantify public emotions and opinions from news articles and social media, providing valuable data for financial forecasting. Tape reading, rooted in interpreting real-time trade orders and price movements, offers granular market insights but lacks the broad contextual understanding that news analytics provide. Explore how combining these techniques can enhance trading strategies by gaining deeper insights into market sentiment and behavior.

Source and External Links

Sentiment Analysis and How to Leverage It - Qualtrics - Sentiment analysis identifies and interprets qualitative data to understand feelings about topics or products, and includes types like fine-grained, aspect-based, and intent-based sentiment analysis, each useful for different insights such as emotion intensity, feature-specific feedback, and motivations behind text.

What Is Sentiment Analysis? - IBM - Sentiment analysis or opinion mining processes large volumes of text to classify sentiment as positive, negative, or neutral, helping businesses gain insights from customer data to improve customer experience and brand reputation.

What is Sentiment Analysis? - AWS - Sentiment analysis analyzes digital text to determine emotional tone and includes methods like fine-grained scoring, aspect-based, intent-based, and emotional detection to capture nuanced customer feelings across interactions and products.

dowidth.com

dowidth.com