Volume profile reading maps the distribution of traded volume at specific price levels, revealing key support and resistance zones crucial for trading decisions. VWAP (Volume Weighted Average Price) calculates the average price weighted by volume over a trading session, providing a benchmark for market trends and identifying optimal entry and exit points. Explore detailed strategies to effectively incorporate volume profile and VWAP in your trading approach.

Why it is important

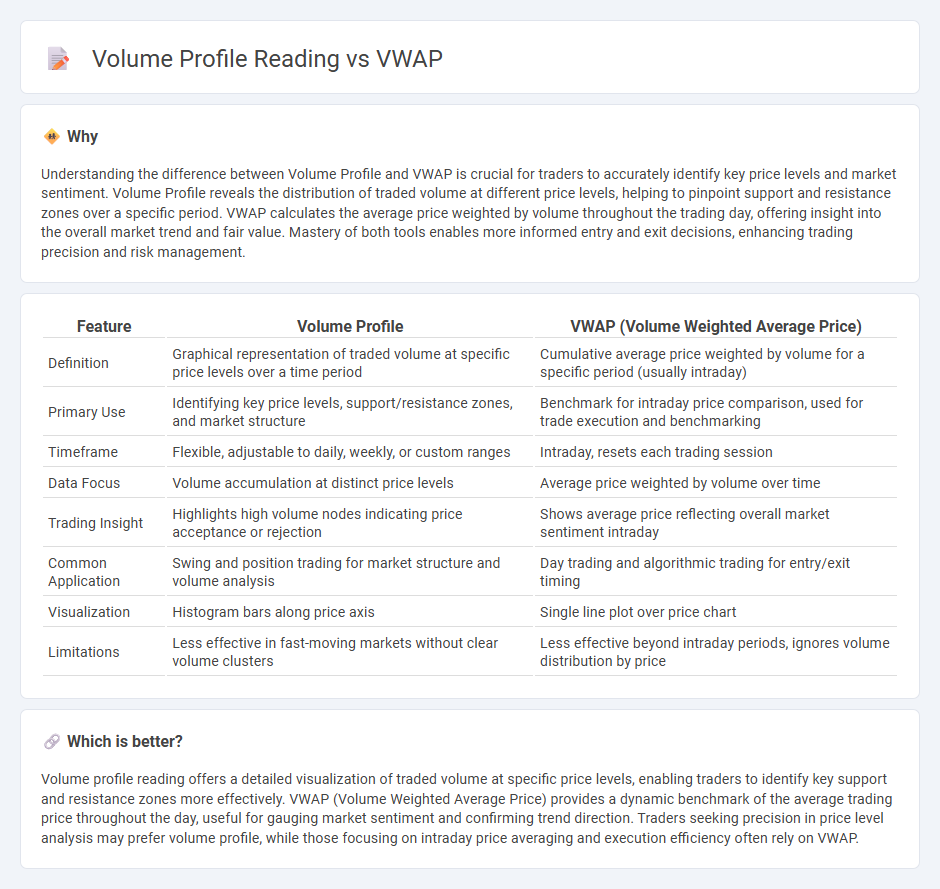

Understanding the difference between Volume Profile and VWAP is crucial for traders to accurately identify key price levels and market sentiment. Volume Profile reveals the distribution of traded volume at different price levels, helping to pinpoint support and resistance zones over a specific period. VWAP calculates the average price weighted by volume throughout the trading day, offering insight into the overall market trend and fair value. Mastery of both tools enables more informed entry and exit decisions, enhancing trading precision and risk management.

Comparison Table

| Feature | Volume Profile | VWAP (Volume Weighted Average Price) |

|---|---|---|

| Definition | Graphical representation of traded volume at specific price levels over a time period | Cumulative average price weighted by volume for a specific period (usually intraday) |

| Primary Use | Identifying key price levels, support/resistance zones, and market structure | Benchmark for intraday price comparison, used for trade execution and benchmarking |

| Timeframe | Flexible, adjustable to daily, weekly, or custom ranges | Intraday, resets each trading session |

| Data Focus | Volume accumulation at distinct price levels | Average price weighted by volume over time |

| Trading Insight | Highlights high volume nodes indicating price acceptance or rejection | Shows average price reflecting overall market sentiment intraday |

| Common Application | Swing and position trading for market structure and volume analysis | Day trading and algorithmic trading for entry/exit timing |

| Visualization | Histogram bars along price axis | Single line plot over price chart |

| Limitations | Less effective in fast-moving markets without clear volume clusters | Less effective beyond intraday periods, ignores volume distribution by price |

Which is better?

Volume profile reading offers a detailed visualization of traded volume at specific price levels, enabling traders to identify key support and resistance zones more effectively. VWAP (Volume Weighted Average Price) provides a dynamic benchmark of the average trading price throughout the day, useful for gauging market sentiment and confirming trend direction. Traders seeking precision in price level analysis may prefer volume profile, while those focusing on intraday price averaging and execution efficiency often rely on VWAP.

Connection

Volume profile reading and VWAP (Volume Weighted Average Price) are interconnected through their reliance on trading volume to provide insights into market behavior and price levels. Volume profile visualizes traded volume at specific price levels over a period, highlighting areas of high activity, while VWAP calculates the average price weighted by volume, serving as a benchmark for trade execution. Together, they enable traders to identify support and resistance zones, assess market sentiment, and optimize entry and exit points based on volume-driven price dynamics.

Key Terms

Price-Volume Distribution

VWAP (Volume Weighted Average Price) provides a single average price weighted by volume over a specific period, serving as a benchmark for price execution, while volume profile offers a detailed graphical distribution of traded volume at various price levels, highlighting key support and resistance zones. Volume profile reveals price-volume clusters that indicate market acceptance or rejection zones, whereas VWAP smooths out these variations for trend confirmation and intraday trading decisions. Explore deeper insights into how combining VWAP and volume profile enhances trading strategies and market analysis.

Intraday Benchmark

VWAP (Volume Weighted Average Price) serves as a pivotal intraday benchmark by indicating the average trading price weighted by volume, reflecting true market sentiment throughout the session. Volume Profile, on the other hand, maps the distribution of traded volumes at specific price levels, revealing significant support and resistance zones across the trading day. Explore further to understand how integrating VWAP and Volume Profile can enhance precision in intraday trading strategies.

Value Area

VWAP (Volume Weighted Average Price) provides an average trading price weighted by volume, ideal for intraday trend analysis, while the volume profile focuses on the distribution of volume across price levels over a specified period, highlighting areas of significant trading activity. The Value Area in volume profile represents the price range where 70% of the volume occurred, serving as a key support and resistance zone for traders. Explore further to understand how combining VWAP and Value Area analysis can enhance your market strategy.

Source and External Links

Volume-weighted average price - Wikipedia - VWAP is the ratio of the total value of trades to the total volume over a period, used to measure average trading price weighted by volume, with prices above VWAP indicating bullish sentiment and below indicating bearish sentiment; it is widely used by institutions to execute large orders without impacting the price significantly.

VWAP Indicator - What it Is and How to Trade With It - VWAP is a moving average indicator weighted by volume, calculated throughout the trading day, used by traders and institutions to identify trends and benchmark execution quality.

VWAP: Technical Indicator - FTMO Academy - VWAP combines price and volume to define market trends, support and resistance levels, and helps traders time entries and exits with price movements relative to the VWAP line signaling bullish or bearish conditions.

dowidth.com

dowidth.com