Tokenized assets represent real-world items like real estate or stocks on a blockchain, providing direct ownership and increased liquidity. Synthetic assets, on the other hand, are derivatives that replicate the value of underlying assets without requiring actual ownership. Explore the nuances of tokenized and synthetic assets to understand their impact on modern trading strategies.

Why it is important

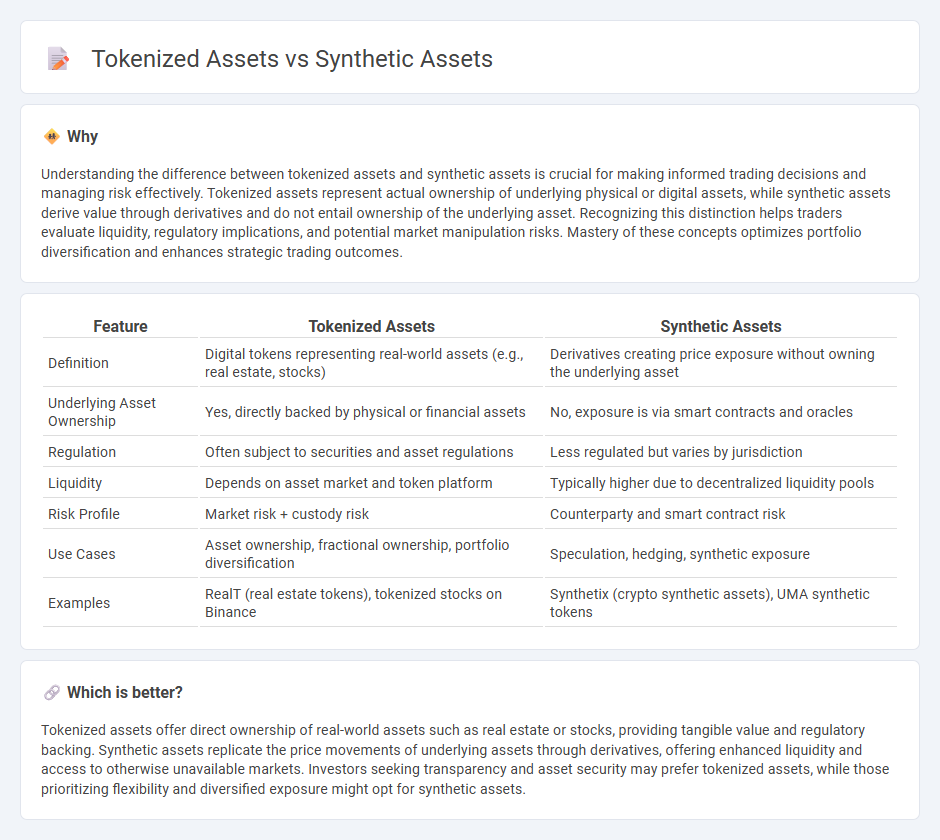

Understanding the difference between tokenized assets and synthetic assets is crucial for making informed trading decisions and managing risk effectively. Tokenized assets represent actual ownership of underlying physical or digital assets, while synthetic assets derive value through derivatives and do not entail ownership of the underlying asset. Recognizing this distinction helps traders evaluate liquidity, regulatory implications, and potential market manipulation risks. Mastery of these concepts optimizes portfolio diversification and enhances strategic trading outcomes.

Comparison Table

| Feature | Tokenized Assets | Synthetic Assets |

|---|---|---|

| Definition | Digital tokens representing real-world assets (e.g., real estate, stocks) | Derivatives creating price exposure without owning the underlying asset |

| Underlying Asset Ownership | Yes, directly backed by physical or financial assets | No, exposure is via smart contracts and oracles |

| Regulation | Often subject to securities and asset regulations | Less regulated but varies by jurisdiction |

| Liquidity | Depends on asset market and token platform | Typically higher due to decentralized liquidity pools |

| Risk Profile | Market risk + custody risk | Counterparty and smart contract risk |

| Use Cases | Asset ownership, fractional ownership, portfolio diversification | Speculation, hedging, synthetic exposure |

| Examples | RealT (real estate tokens), tokenized stocks on Binance | Synthetix (crypto synthetic assets), UMA synthetic tokens |

Which is better?

Tokenized assets offer direct ownership of real-world assets such as real estate or stocks, providing tangible value and regulatory backing. Synthetic assets replicate the price movements of underlying assets through derivatives, offering enhanced liquidity and access to otherwise unavailable markets. Investors seeking transparency and asset security may prefer tokenized assets, while those prioritizing flexibility and diversified exposure might opt for synthetic assets.

Connection

Tokenized assets represent real-world securities on a blockchain, enabling fractional ownership and increased liquidity in trading markets. Synthetic assets replicate the price movements of underlying assets using derivatives, allowing traders to gain exposure without owning the actual asset. Both tokenized and synthetic assets leverage blockchain technology to enhance accessibility, reduce settlement times, and create new opportunities for diversified trading strategies.

Key Terms

Underlying Asset

Synthetic assets replicate the value of underlying assets through smart contracts without owning the actual asset, enabling exposure to diverse markets such as stocks, commodities, or indices. Tokenized assets represent ownership of real-world underlying assets like real estate, art, or securities by converting them into blockchain-based tokens, providing direct claims to the asset. Explore the nuances of underlying asset representation to understand which approach best suits your investment strategy.

Derivative Structure

Synthetic assets replicate the value of underlying assets through derivative contracts without owning the asset directly, enabling exposure to stocks, commodities, or indexes on blockchain platforms. Tokenized assets represent ownership of real-world assets, such as real estate or art, through digital tokens on a blockchain, ensuring transparency and liquidity while adhering to regulatory frameworks. Explore the intricacies of derivative structures in synthetic and tokenized assets for a deeper understanding of their financial mechanics.

Blockchain Representation

Synthetic assets are blockchain-based derivatives that replicate the value of real-world assets without requiring ownership, enabling exposure to stocks, commodities, or indices through smart contracts. Tokenized assets involve converting actual physical or financial assets into digital tokens on a blockchain, providing ownership rights and facilitating instant, fractional trading. Explore how these blockchain representations reshape asset management and investment opportunities.

Source and External Links

Crypto synthetic assets, explained - Cointelegraph - Synthetic assets in crypto are blockchain-based financial instruments designed to replicate the value and performance of real-world assets like stocks, commodities, or currencies without owning the underlying asset, created using derivatives and smart contracts mainly in DeFi ecosystems.

Synthetic Asset Definition - CoinMarketCap - Synthetic assets, or synths, are tokenized derivatives tracked on blockchain, allowing investors to trade with exposure to assets they do not own, offering security and traceability through decentralized ledger technology.

What are synthetic crypto assets? - Kraken - Synthetic crypto assets are blockchain-based tokens that provide indirect exposure to traditional real-world assets via decentralized finance platforms, enabling anyone to create and trade derivatives of various asset classes without geographic or censorship restrictions.

dowidth.com

dowidth.com