Alternative data signals leverage non-traditional sources such as social media trends, satellite imagery, and web traffic to provide unique insights into market movements. Order flow signals, on the other hand, analyze real-time transaction data and liquidity patterns to predict price changes based on supply and demand dynamics. Explore the differences between these powerful trading signals to enhance your market strategies.

Why it is important

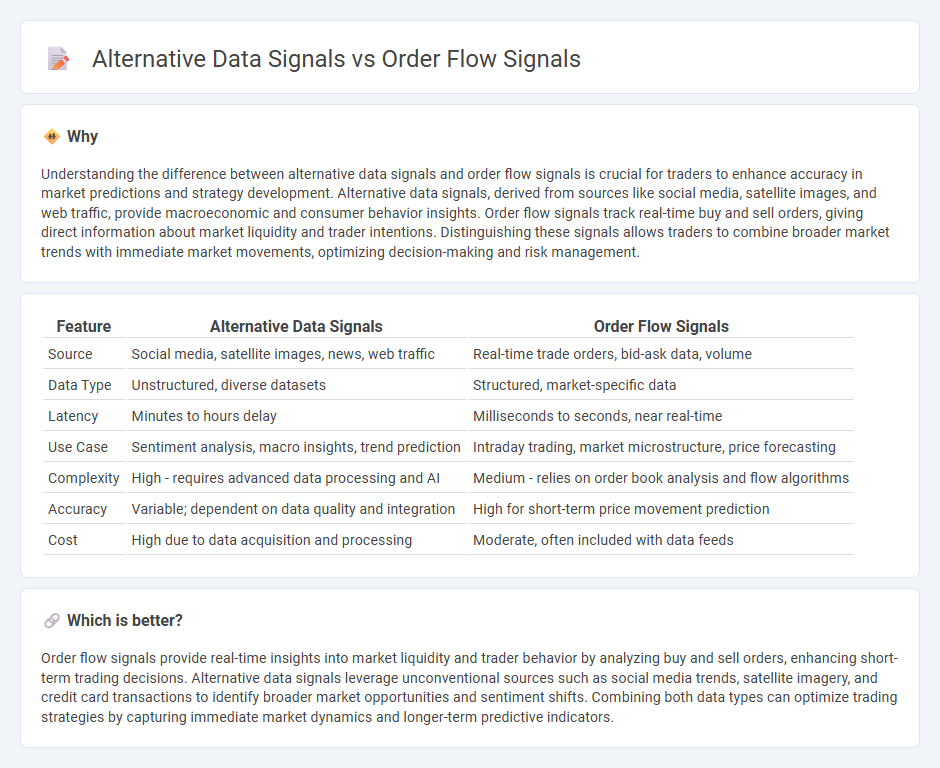

Understanding the difference between alternative data signals and order flow signals is crucial for traders to enhance accuracy in market predictions and strategy development. Alternative data signals, derived from sources like social media, satellite images, and web traffic, provide macroeconomic and consumer behavior insights. Order flow signals track real-time buy and sell orders, giving direct information about market liquidity and trader intentions. Distinguishing these signals allows traders to combine broader market trends with immediate market movements, optimizing decision-making and risk management.

Comparison Table

| Feature | Alternative Data Signals | Order Flow Signals |

|---|---|---|

| Source | Social media, satellite images, news, web traffic | Real-time trade orders, bid-ask data, volume |

| Data Type | Unstructured, diverse datasets | Structured, market-specific data |

| Latency | Minutes to hours delay | Milliseconds to seconds, near real-time |

| Use Case | Sentiment analysis, macro insights, trend prediction | Intraday trading, market microstructure, price forecasting |

| Complexity | High - requires advanced data processing and AI | Medium - relies on order book analysis and flow algorithms |

| Accuracy | Variable; dependent on data quality and integration | High for short-term price movement prediction |

| Cost | High due to data acquisition and processing | Moderate, often included with data feeds |

Which is better?

Order flow signals provide real-time insights into market liquidity and trader behavior by analyzing buy and sell orders, enhancing short-term trading decisions. Alternative data signals leverage unconventional sources such as social media trends, satellite imagery, and credit card transactions to identify broader market opportunities and sentiment shifts. Combining both data types can optimize trading strategies by capturing immediate market dynamics and longer-term predictive indicators.

Connection

Alternative data signals, such as social media sentiment, news analytics, and satellite imagery, complement order flow signals by providing broader market context beyond traditional price and volume metrics. Order flow signals track real-time buying and selling activity on exchanges, revealing immediate supply and demand dynamics that, when combined with alternative data, enhance predictive accuracy in trading strategies. Integrating these data sources allows traders to identify market inefficiencies and anticipate price movements with higher confidence.

Key Terms

Liquidity Imbalance

Liquidity imbalance in order flow signals highlights disparities between buy and sell orders, revealing potential price movements and market sentiment shifts. Unlike alternative data signals derived from non-traditional sources such as social media or satellite imagery, liquidity imbalance provides direct insights into market depth and trading pressure. Explore how mastering liquidity imbalance can enhance your trading strategy and market timing precision.

Transaction Volume

Order flow signals provide real-time insights into market transactions by analyzing the volume and frequency of buy and sell orders, revealing immediate market sentiment and potential price trends. Alternative data signals encompass a broader spectrum, including social media trends, economic indicators, and consumer behavior, which offer contextual understanding beyond transaction volume alone. Discover how combining transaction volume insights with alternative data can enhance predictive accuracy in market analysis.

Sentiment Analysis

Order flow signals provide real-time insights into market participant behavior by analyzing transaction data and trade volumes, revealing buying or selling pressure trends. Alternative data signals, particularly sentiment analysis, extract investor emotions and market sentiment from social media, news, and other unstructured text sources to predict potential market movements. Explore the differences and advantages of these data signals to enhance your trading strategies.

Source and External Links

Best Order Flow Indicators: A Comprehensive Guide to Improve ... - Order flow signals analyze the interaction of buy and sell orders in real time, revealing supply and demand imbalances and enabling traders to anticipate price movements using tools like footprint charts, VWAP, volume delta, depth of market, and time and sales data.

Key Order Flow Strategies: Breakouts, Trends, Trapped Traders, and ... - Order flow signals include identifying price structure patterns, differentiating aggressive (market) versus passive (limit) orders, as well as recognizing exhaustion signals and stop runs to time entries and exits more effectively.

Order Flow Analysis: A Complete Guide to Reading Market ... - Key order flow signals derive from components such as volume delta (net buying vs selling pressure), order book imbalances, bid-ask spreads, time and sales, and market depth, which together provide a live view of the supply and demand dynamics driving price changes.

dowidth.com

dowidth.com