Paper trading competitions simulate real market conditions without financial risk, allowing traders to test strategies and improve skills using virtual funds. Options trading challenges present complex scenarios that require advanced understanding of derivatives, volatility, and risk management to succeed in competitive environments. Explore these dynamic platforms to enhance trading expertise and navigate market complexities effectively.

Why it is important

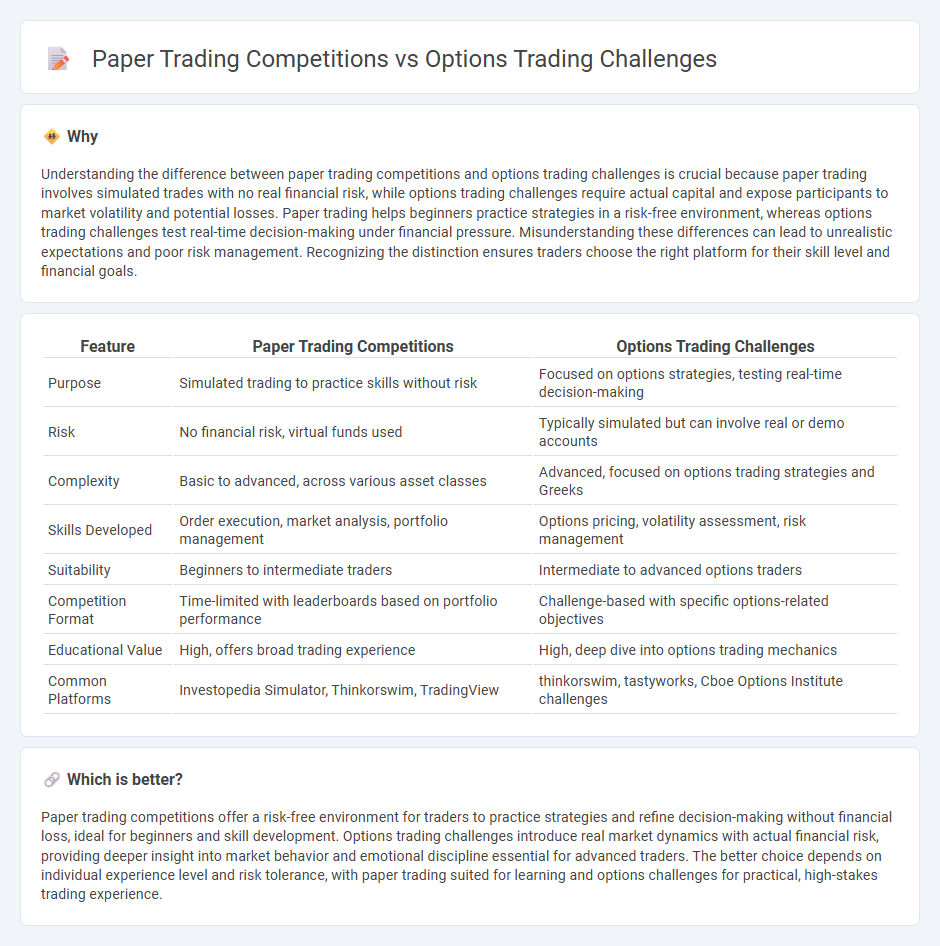

Understanding the difference between paper trading competitions and options trading challenges is crucial because paper trading involves simulated trades with no real financial risk, while options trading challenges require actual capital and expose participants to market volatility and potential losses. Paper trading helps beginners practice strategies in a risk-free environment, whereas options trading challenges test real-time decision-making under financial pressure. Misunderstanding these differences can lead to unrealistic expectations and poor risk management. Recognizing the distinction ensures traders choose the right platform for their skill level and financial goals.

Comparison Table

| Feature | Paper Trading Competitions | Options Trading Challenges |

|---|---|---|

| Purpose | Simulated trading to practice skills without risk | Focused on options strategies, testing real-time decision-making |

| Risk | No financial risk, virtual funds used | Typically simulated but can involve real or demo accounts |

| Complexity | Basic to advanced, across various asset classes | Advanced, focused on options trading strategies and Greeks |

| Skills Developed | Order execution, market analysis, portfolio management | Options pricing, volatility assessment, risk management |

| Suitability | Beginners to intermediate traders | Intermediate to advanced options traders |

| Competition Format | Time-limited with leaderboards based on portfolio performance | Challenge-based with specific options-related objectives |

| Educational Value | High, offers broad trading experience | High, deep dive into options trading mechanics |

| Common Platforms | Investopedia Simulator, Thinkorswim, TradingView | thinkorswim, tastyworks, Cboe Options Institute challenges |

Which is better?

Paper trading competitions offer a risk-free environment for traders to practice strategies and refine decision-making without financial loss, ideal for beginners and skill development. Options trading challenges introduce real market dynamics with actual financial risk, providing deeper insight into market behavior and emotional discipline essential for advanced traders. The better choice depends on individual experience level and risk tolerance, with paper trading suited for learning and options challenges for practical, high-stakes trading experience.

Connection

Paper trading competitions and options trading challenges are interconnected by providing traders with risk-free environments to practice and refine strategies before engaging in live markets. Both formats emphasize skill development in market analysis, order execution, and risk management, using simulated capital to mirror real trading scenarios. These competitive platforms help participants build confidence and improve decision-making abilities specific to options trading complexities.

Key Terms

Liquidity

Options trading challenges often experience real-time liquidity constraints, affecting order execution and pricing accuracy, while paper trading competitions simulate ideal market conditions with unlimited liquidity and no slippage. Liquidity in live markets influences bid-ask spreads and the ability to enter or exit positions swiftly, which is absent in paper trading environments. Explore deeper insights on how liquidity impacts options trading strategies and competition performance.

Slippage

Slippage represents the difference between the expected price of a trade and the actual execution price, posing significant challenges in live options trading due to market volatility and order execution delays. Paper trading competitions often fail to capture this critical factor, providing an unrealistic simulation of trade outcomes. Explore how understanding and managing slippage can enhance your options trading strategies and performance.

Execution risk

Execution risk significantly impacts real options trading, where factors like slippage, latency, and order fill uncertainty affect actual profit outcomes. Paper trading competitions eliminate execution risk by simulating trades with perfect fills and no delay, providing an idealized trading environment. Explore detailed insights on how execution risk alters trading strategies and performance in live markets.

Source and External Links

7 common options trading mistakes to avoid - Challenges in options trading include mismatching strategy with market outlook, choosing wrong expiration dates, wrong position size, and ignoring important factors such as technical and fundamental analysis for developing a proper outlook.

STOP Making these TOP 10 Options Trading Mistakes - Major challenges involve trying to consistently profit with out-of-the-money options due to rapid time decay, the difficulty of predicting both timing and direction, and misunderstanding probability in option pricing.

10 Common Mistakes of Options Trading - Other challenges to avoid include misallocation of capital, overemphasizing high win-rate without profit, lack of portfolio diversification, and lack of trading discipline.

dowidth.com

dowidth.com