Altcoin sniping involves quickly buying newly listed cryptocurrencies to capitalize on early price surges, leveraging real-time data and automated trading bots for rapid execution. Market making, on the other hand, focuses on providing liquidity by placing simultaneous buy and sell orders to profit from bid-ask spreads while stabilizing market prices. Explore the strategies and tools involved in altcoin sniping versus market making to enhance your trading performance.

Why it is important

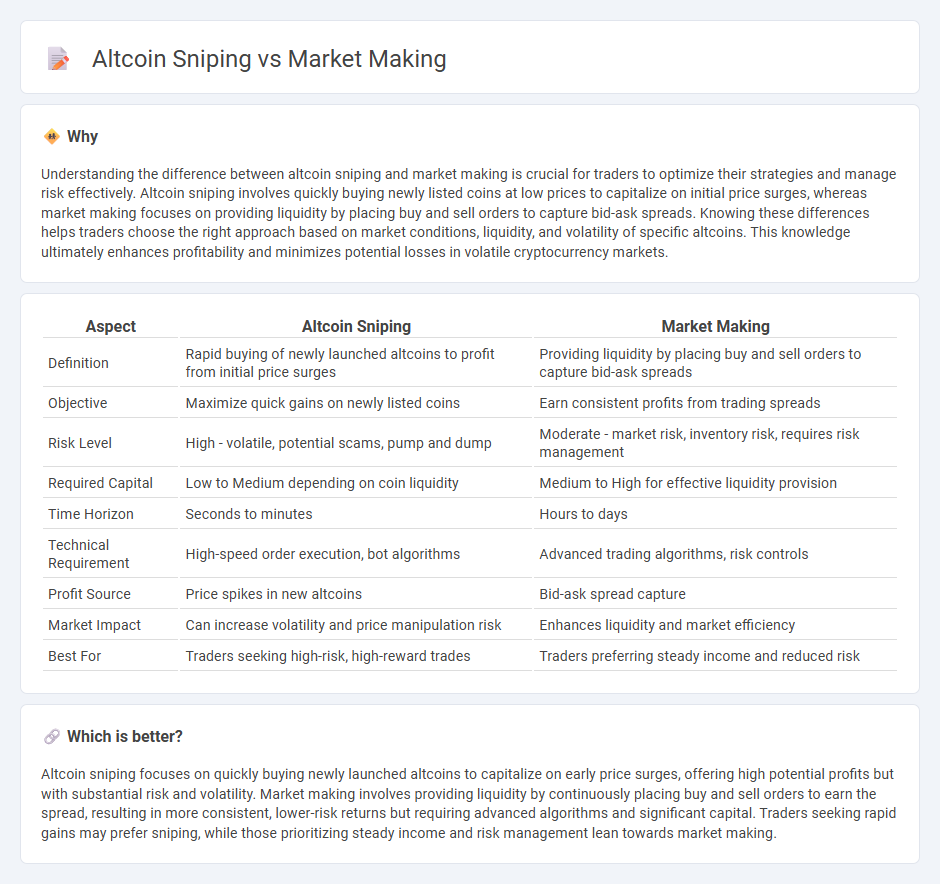

Understanding the difference between altcoin sniping and market making is crucial for traders to optimize their strategies and manage risk effectively. Altcoin sniping involves quickly buying newly listed coins at low prices to capitalize on initial price surges, whereas market making focuses on providing liquidity by placing buy and sell orders to capture bid-ask spreads. Knowing these differences helps traders choose the right approach based on market conditions, liquidity, and volatility of specific altcoins. This knowledge ultimately enhances profitability and minimizes potential losses in volatile cryptocurrency markets.

Comparison Table

| Aspect | Altcoin Sniping | Market Making |

|---|---|---|

| Definition | Rapid buying of newly launched altcoins to profit from initial price surges | Providing liquidity by placing buy and sell orders to capture bid-ask spreads |

| Objective | Maximize quick gains on newly listed coins | Earn consistent profits from trading spreads |

| Risk Level | High - volatile, potential scams, pump and dump | Moderate - market risk, inventory risk, requires risk management |

| Required Capital | Low to Medium depending on coin liquidity | Medium to High for effective liquidity provision |

| Time Horizon | Seconds to minutes | Hours to days |

| Technical Requirement | High-speed order execution, bot algorithms | Advanced trading algorithms, risk controls |

| Profit Source | Price spikes in new altcoins | Bid-ask spread capture |

| Market Impact | Can increase volatility and price manipulation risk | Enhances liquidity and market efficiency |

| Best For | Traders seeking high-risk, high-reward trades | Traders preferring steady income and reduced risk |

Which is better?

Altcoin sniping focuses on quickly buying newly launched altcoins to capitalize on early price surges, offering high potential profits but with substantial risk and volatility. Market making involves providing liquidity by continuously placing buy and sell orders to earn the spread, resulting in more consistent, lower-risk returns but requiring advanced algorithms and significant capital. Traders seeking rapid gains may prefer sniping, while those prioritizing steady income and risk management lean towards market making.

Connection

Altcoin sniping leverages market making dynamics by rapidly executing buy and sell orders to capitalize on price inefficiencies in newly listed tokens. Market makers provide liquidity that facilitates altcoin sniping by creating tight bid-ask spreads, enabling swift transaction opportunities. Both strategies rely on high-frequency trading algorithms and real-time data analysis to maximize profit in volatile crypto markets.

Key Terms

Market Making:

Market making involves providing liquidity by simultaneously placing buy and sell orders to profit from the bid-ask spread, stabilizing the market and reducing volatility. It requires advanced algorithms and deep knowledge of order books to maintain tight spreads and manage inventory risk effectively. Discover more about how market making strategies can enhance trading efficiency and profitability.

Bid-Ask Spread

Market making involves continuously providing buy and sell orders around the bid-ask spread to capture small profits from the difference, enhancing liquidity in altcoin markets. Altcoin sniping targets rapid identification and execution of trades on price discrepancies or newly listed coins, often exploiting volatile bid-ask spreads for quick gains. Explore detailed strategies and tools to optimize performance in market making and altcoin sniping.

Liquidity Provision

Market making involves continuously providing buy and sell orders to maintain liquidity and stabilize price fluctuations in cryptocurrency markets. Altcoin sniping focuses on quickly capitalizing on price spikes during initial coin offerings or sudden market movements, often with less emphasis on sustained liquidity. Explore the intricacies of liquidity provision and trading strategies to enhance your market engagement.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market makers earn profits primarily through the bid-ask spread by buying at the bid price and selling at the ask price, while managing inventory and analyzing order flow to anticipate market movements, all under regulatory oversight.

Market maker: What it is, importance, benefits & examples - StoneX - A market maker continuously quotes buy and sell prices providing liquidity, profiting from the bid-ask spread, while managing inventory risk through sophisticated algorithms and strategies.

Market Making and Mean Reversion - CIS UPenn - Market making refers to strategies that provide market liquidity by simultaneously quoting buy and sell prices, profiting from the spread while avoiding large net inventory positions.

dowidth.com

dowidth.com