Zero knowledge proof trading enhances privacy by allowing transactions to be verified without revealing underlying data, leading to increased security and trust in digital asset exchanges. Off-chain trading reduces network congestion and transaction costs by executing trades outside the main blockchain while still leveraging on-chain settlement mechanisms. Explore how these innovative trading approaches transform asset exchange efficiency and confidentiality.

Why it is important

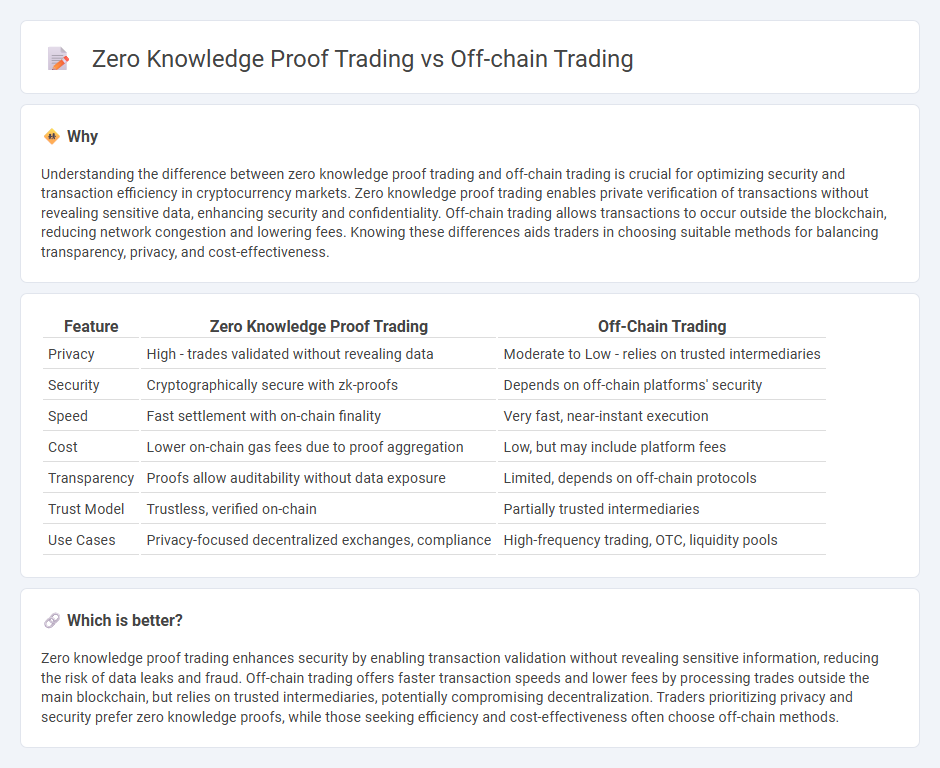

Understanding the difference between zero knowledge proof trading and off-chain trading is crucial for optimizing security and transaction efficiency in cryptocurrency markets. Zero knowledge proof trading enables private verification of transactions without revealing sensitive data, enhancing security and confidentiality. Off-chain trading allows transactions to occur outside the blockchain, reducing network congestion and lowering fees. Knowing these differences aids traders in choosing suitable methods for balancing transparency, privacy, and cost-effectiveness.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Off-Chain Trading |

|---|---|---|

| Privacy | High - trades validated without revealing data | Moderate to Low - relies on trusted intermediaries |

| Security | Cryptographically secure with zk-proofs | Depends on off-chain platforms' security |

| Speed | Fast settlement with on-chain finality | Very fast, near-instant execution |

| Cost | Lower on-chain gas fees due to proof aggregation | Low, but may include platform fees |

| Transparency | Proofs allow auditability without data exposure | Limited, depends on off-chain protocols |

| Trust Model | Trustless, verified on-chain | Partially trusted intermediaries |

| Use Cases | Privacy-focused decentralized exchanges, compliance | High-frequency trading, OTC, liquidity pools |

Which is better?

Zero knowledge proof trading enhances security by enabling transaction validation without revealing sensitive information, reducing the risk of data leaks and fraud. Off-chain trading offers faster transaction speeds and lower fees by processing trades outside the main blockchain, but relies on trusted intermediaries, potentially compromising decentralization. Traders prioritizing privacy and security prefer zero knowledge proofs, while those seeking efficiency and cost-effectiveness often choose off-chain methods.

Connection

Zero-knowledge proof trading enhances off-chain trading by enabling private and secure validation of transactions without revealing sensitive data to the blockchain. Off-chain trading platforms leverage zero-knowledge proofs to confirm trade authenticity and enforce rules while reducing on-chain congestion and costs. This integration ensures higher scalability and confidentiality in decentralized finance ecosystems.

Key Terms

Custody

Off-chain trading enhances custody solutions by enabling asset transfers outside the blockchain, reducing fees and latency while maintaining asset control through trusted intermediaries or custody providers. Zero Knowledge Proof (ZKP) trading secures custody by proving transaction validity without revealing sensitive data, ensuring privacy and compliance in decentralized finance environments. Explore the advantages and technical innovations behind custody in off-chain and ZKP trading models to optimize secure asset management.

Privacy

Off-chain trading enhances privacy by executing transactions outside the main blockchain, reducing exposure and minimizing the risk of data leaks, while zero-knowledge proof trading leverages cryptographic proofs to validate transactions without revealing sensitive information on-chain. Zero-knowledge proofs offer strong privacy guarantees by enabling transaction validation with cryptographic certainty, ensuring confidentiality and data integrity on public ledgers. Explore how these privacy-focused trading methods compare in security, scalability, and compliance to deepen your understanding.

Settlement

Off-chain trading enhances settlement speed by processing transactions outside the blockchain, reducing congestion and lowering fees while relying on periodic on-chain settlements for finality. Zero-knowledge proof trading strengthens settlement security through cryptographic verification that transactions are valid without revealing details, enabling privacy-preserving and trust-minimized settlement on-chain. Explore the nuanced benefits and technical mechanisms of both settlement methods to optimize your trading strategy.

Source and External Links

What is Off-Chain? Definition & Meaning | Crypto Wiki - BitDegree - Off-chain trading refers to transactions conducted outside the blockchain network, enabling faster processing, lower fees, and greater privacy by avoiding on-chain verification and miners.

On-Chain vs. Off-Chain Transactions - Crypto Council for Innovation - Off-chain trading happens outside the main blockchain often via secondary layers like payment channels or sidechains, offering speed and cost advantages but requiring some trust in third-party operators.

On-chain vs. off-chain cryptocurrency transactions - Coinbase - Off-chain trading uses Layer-2 solutions such as payment channels to enable instant, low-fee, and private transactions, addressing blockchain scalability but sometimes sacrificing decentralization.

dowidth.com

dowidth.com