Quantitative momentum strategies leverage statistical models to identify assets exhibiting strong recent performance, capitalizing on persistent price trends driven by investor behavior and market psychology. Trend-following approaches, on the other hand, systematically track market direction using moving averages or breakout signals to capture sustained upward or downward movements regardless of asset type. Explore how these powerful quantitative methodologies can enhance your trading performance.

Why it is important

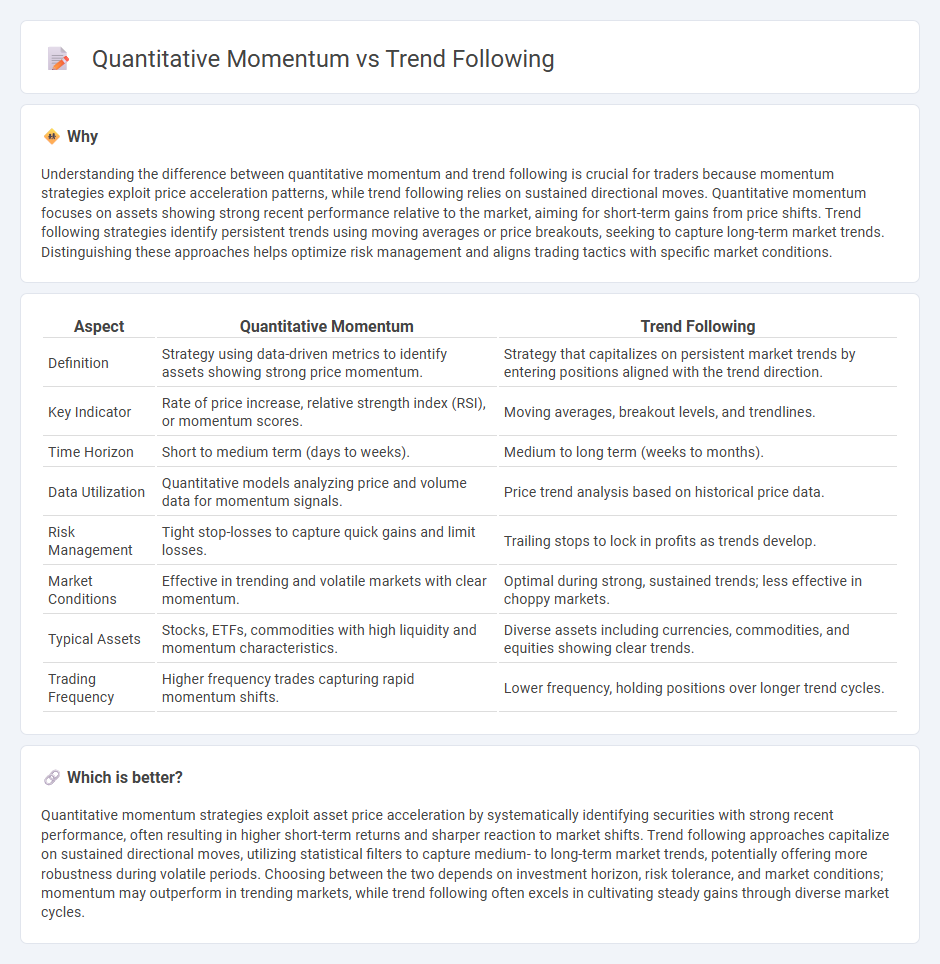

Understanding the difference between quantitative momentum and trend following is crucial for traders because momentum strategies exploit price acceleration patterns, while trend following relies on sustained directional moves. Quantitative momentum focuses on assets showing strong recent performance relative to the market, aiming for short-term gains from price shifts. Trend following strategies identify persistent trends using moving averages or price breakouts, seeking to capture long-term market trends. Distinguishing these approaches helps optimize risk management and aligns trading tactics with specific market conditions.

Comparison Table

| Aspect | Quantitative Momentum | Trend Following |

|---|---|---|

| Definition | Strategy using data-driven metrics to identify assets showing strong price momentum. | Strategy that capitalizes on persistent market trends by entering positions aligned with the trend direction. |

| Key Indicator | Rate of price increase, relative strength index (RSI), or momentum scores. | Moving averages, breakout levels, and trendlines. |

| Time Horizon | Short to medium term (days to weeks). | Medium to long term (weeks to months). |

| Data Utilization | Quantitative models analyzing price and volume data for momentum signals. | Price trend analysis based on historical price data. |

| Risk Management | Tight stop-losses to capture quick gains and limit losses. | Trailing stops to lock in profits as trends develop. |

| Market Conditions | Effective in trending and volatile markets with clear momentum. | Optimal during strong, sustained trends; less effective in choppy markets. |

| Typical Assets | Stocks, ETFs, commodities with high liquidity and momentum characteristics. | Diverse assets including currencies, commodities, and equities showing clear trends. |

| Trading Frequency | Higher frequency trades capturing rapid momentum shifts. | Lower frequency, holding positions over longer trend cycles. |

Which is better?

Quantitative momentum strategies exploit asset price acceleration by systematically identifying securities with strong recent performance, often resulting in higher short-term returns and sharper reaction to market shifts. Trend following approaches capitalize on sustained directional moves, utilizing statistical filters to capture medium- to long-term market trends, potentially offering more robustness during volatile periods. Choosing between the two depends on investment horizon, risk tolerance, and market conditions; momentum may outperform in trending markets, while trend following often excels in cultivating steady gains through diverse market cycles.

Connection

Quantitative momentum and trend following both rely on price momentum as a core signal to identify profitable trading opportunities in financial markets. Quantitative momentum strategies use statistical algorithms to measure the speed and strength of asset price changes, while trend following systematically captures sustained price movements by entering trades aligned with prevailing trends. Their connection lies in leveraging historical price data to exploit persistent directional shifts, enhancing portfolio returns through disciplined, data-driven decision-making.

Key Terms

**Trend Following:**

Trend following is a trading strategy that capitalizes on the persistence of market trends by systematically entering positions aligned with the direction of price movements, often using moving averages, breakouts, or channel-based signals. It avoids predicting market reversals and relies on technical indicators to identify sustained trends across various asset classes, enhancing diversification and risk management. Discover more about how trend following can improve portfolio performance and reduce drawdowns.

Moving Averages

Trend following strategies utilizing moving averages identify market direction by analyzing price trends over set periods, often employing simple or exponential moving averages to generate buy or sell signals. Quantitative momentum, while also leveraging moving averages, incorporates statistical measures such as rate of change or relative strength indices to quantify momentum strength beyond simple trend identification. Explore deeper insights into how moving averages empower these strategies and optimize trading performance.

Breakouts

Trend following relies on identifying sustained price movements beyond key support or resistance levels, particularly focusing on breakouts that signal the start of new market trends. Quantitative momentum strategies use statistical models to measure the strength and velocity of price changes, emphasizing momentum indicators to validate breakout signals. Explore how these methodologies differ in breakout identification and risk management for enhanced trading performance.

Source and External Links

Trend following - Trend following or trend trading is a trading strategy where one buys an asset when its price trend is rising and sells when the trend is falling, aiming to ride and profit from ongoing price movements rather than predicting future price levels.

Trend Following Trading Strategies and Systems (Backtest ... - Trend following strategies use technical analysis tools to identify and capitalize on existing market trends by entering trades in the trend's direction and exiting upon signs of reversal, focusing on momentum and systematic risk management.

Trend-Following Primer - Trend-following is a large-scale alternative investment strategy that systematically identifies price trends across multiple markets, taking long positions in uptrends and short positions in downtrends, and is valued for its low correlation to traditional assets and potential to perform in both rising and falling markets.

dowidth.com

dowidth.com