Order flow analysis provides real-time insight into market liquidity by examining the actual buy and sell orders, enabling traders to anticipate price movements with precision. Price action trading focuses on interpreting historical price patterns and candlestick formations to predict future market trends without relying on indicators. Explore deeper comparisons and strategies to enhance your trading effectiveness.

Why it is important

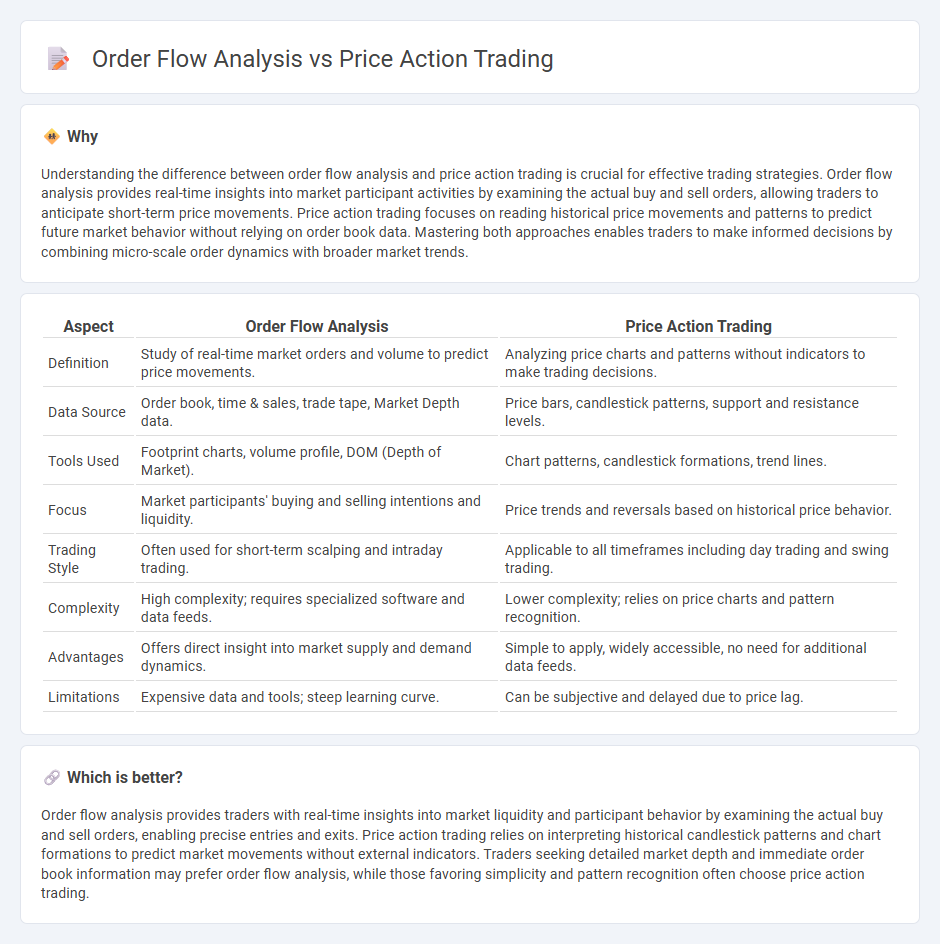

Understanding the difference between order flow analysis and price action trading is crucial for effective trading strategies. Order flow analysis provides real-time insights into market participant activities by examining the actual buy and sell orders, allowing traders to anticipate short-term price movements. Price action trading focuses on reading historical price movements and patterns to predict future market behavior without relying on order book data. Mastering both approaches enables traders to make informed decisions by combining micro-scale order dynamics with broader market trends.

Comparison Table

| Aspect | Order Flow Analysis | Price Action Trading |

|---|---|---|

| Definition | Study of real-time market orders and volume to predict price movements. | Analyzing price charts and patterns without indicators to make trading decisions. |

| Data Source | Order book, time & sales, trade tape, Market Depth data. | Price bars, candlestick patterns, support and resistance levels. |

| Tools Used | Footprint charts, volume profile, DOM (Depth of Market). | Chart patterns, candlestick formations, trend lines. |

| Focus | Market participants' buying and selling intentions and liquidity. | Price trends and reversals based on historical price behavior. |

| Trading Style | Often used for short-term scalping and intraday trading. | Applicable to all timeframes including day trading and swing trading. |

| Complexity | High complexity; requires specialized software and data feeds. | Lower complexity; relies on price charts and pattern recognition. |

| Advantages | Offers direct insight into market supply and demand dynamics. | Simple to apply, widely accessible, no need for additional data feeds. |

| Limitations | Expensive data and tools; steep learning curve. | Can be subjective and delayed due to price lag. |

Which is better?

Order flow analysis provides traders with real-time insights into market liquidity and participant behavior by examining the actual buy and sell orders, enabling precise entries and exits. Price action trading relies on interpreting historical candlestick patterns and chart formations to predict market movements without external indicators. Traders seeking detailed market depth and immediate order book information may prefer order flow analysis, while those favoring simplicity and pattern recognition often choose price action trading.

Connection

Order flow analysis provides real-time insight into market participant behavior by examining the actual buy and sell orders, which directly influences price action patterns seen on charts. Price action trading interprets these patterns to make informed decisions, relying on the supply and demand dynamics revealed through order flow data. Together, they enable traders to anticipate market movements with greater precision by combining quantitative order information and qualitative price behavior.

Key Terms

**Price Action Trading:**

Price action trading relies on interpreting historical price movements and patterns on candlestick charts to forecast future market behavior without depending on indicators or external data. Traders analyze support and resistance levels, chart patterns, and price momentum to make informed decisions based on market psychology and supply-demand dynamics. Explore more about the techniques and advantages of price action trading to enhance your market strategy.

Candlestick Patterns

Candlestick patterns in price action trading offer visual cues through formations like doji, engulfing, and hammer to anticipate market reversals or continuations without relying on volume data. Order flow analysis enhances this by examining real-time transaction data and market depth, allowing traders to confirm or challenge candlestick signals with precise buy and sell pressure insights. Explore further to understand how integrating these methods can refine your trading strategy.

Support and Resistance

Price action trading emphasizes interpreting historical price movements and candlestick patterns around Support and Resistance levels to predict market behavior. Order flow analysis examines real-time buy and sell order data, providing deeper insight into the strength and sustainability of these key levels by revealing underlying trader intentions. Discover how combining both techniques can enhance your strategy in mastering Support and Resistance dynamics.

Source and External Links

Price Action Trading: Meaning, Benefits and Strategies - Price action trading involves making trading decisions based on the price movements of stocks and includes strategies like support and resistance trading, breakout trading, trendline trading, and candlestick pattern recognition for entry and exit points.

What Is Price Action? - Price Action Trading Introduction - Price action trading is a method focused on analyzing raw price movement over time without relying on indicators, emphasizing the relationship of current prices to past prices to predict future market direction.

Price Action Trading Explained - Price action trading means using clean, indicator-free charts (often candlestick charts) to identify repeating price patterns and market sentiment clues, enabling traders to anticipate price moves by focusing strictly on the market's raw price data.

dowidth.com

dowidth.com