Modular blockchains trading enhances scalability and flexibility by separating consensus, data availability, and execution layers, enabling faster and more secure transactions compared to traditional monolithic chains. Synthetic assets trading involves creating on-chain representations of real-world assets, allowing traders to gain exposure without owning the underlying asset, often increasing liquidity and market access. Explore the differences and benefits of these innovative trading approaches to optimize your investment strategy.

Why it is important

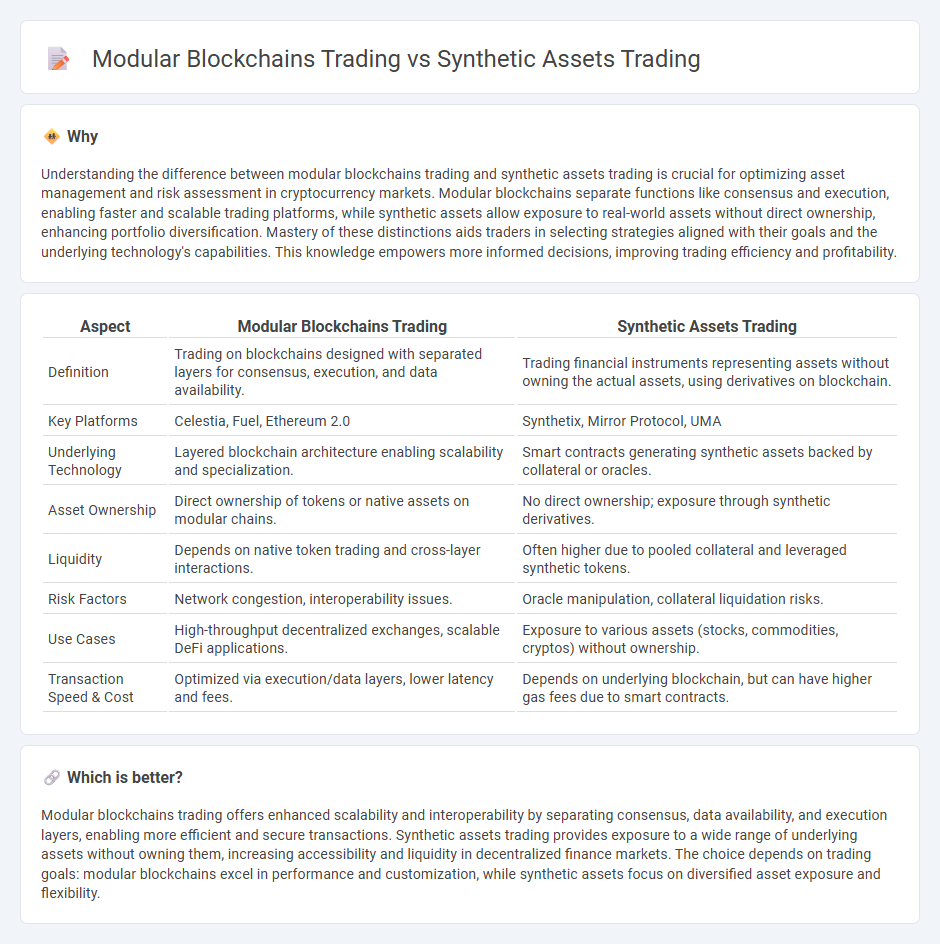

Understanding the difference between modular blockchains trading and synthetic assets trading is crucial for optimizing asset management and risk assessment in cryptocurrency markets. Modular blockchains separate functions like consensus and execution, enabling faster and scalable trading platforms, while synthetic assets allow exposure to real-world assets without direct ownership, enhancing portfolio diversification. Mastery of these distinctions aids traders in selecting strategies aligned with their goals and the underlying technology's capabilities. This knowledge empowers more informed decisions, improving trading efficiency and profitability.

Comparison Table

| Aspect | Modular Blockchains Trading | Synthetic Assets Trading |

|---|---|---|

| Definition | Trading on blockchains designed with separated layers for consensus, execution, and data availability. | Trading financial instruments representing assets without owning the actual assets, using derivatives on blockchain. |

| Key Platforms | Celestia, Fuel, Ethereum 2.0 | Synthetix, Mirror Protocol, UMA |

| Underlying Technology | Layered blockchain architecture enabling scalability and specialization. | Smart contracts generating synthetic assets backed by collateral or oracles. |

| Asset Ownership | Direct ownership of tokens or native assets on modular chains. | No direct ownership; exposure through synthetic derivatives. |

| Liquidity | Depends on native token trading and cross-layer interactions. | Often higher due to pooled collateral and leveraged synthetic tokens. |

| Risk Factors | Network congestion, interoperability issues. | Oracle manipulation, collateral liquidation risks. |

| Use Cases | High-throughput decentralized exchanges, scalable DeFi applications. | Exposure to various assets (stocks, commodities, cryptos) without ownership. |

| Transaction Speed & Cost | Optimized via execution/data layers, lower latency and fees. | Depends on underlying blockchain, but can have higher gas fees due to smart contracts. |

Which is better?

Modular blockchains trading offers enhanced scalability and interoperability by separating consensus, data availability, and execution layers, enabling more efficient and secure transactions. Synthetic assets trading provides exposure to a wide range of underlying assets without owning them, increasing accessibility and liquidity in decentralized finance markets. The choice depends on trading goals: modular blockchains excel in performance and customization, while synthetic assets focus on diversified asset exposure and flexibility.

Connection

Modular blockchains enhance trading efficiency by separating consensus, execution, and data availability layers, enabling faster and more scalable transactions for synthetic assets. Synthetic assets trading relies on these blockchains to securely issue, trade, and settle derivatives representing real-world assets without direct ownership. This integration allows seamless access to diverse financial instruments with reduced counterparty risk and increased liquidity in decentralized markets.

Key Terms

**Synthetic assets trading:**

Synthetic assets trading enables users to gain exposure to a wide range of real-world assets such as commodities, stocks, and indices without owning the underlying asset, leveraging decentralized finance (DeFi) protocols on platforms like Synthetix. This approach offers enhanced liquidity, lower entry barriers, and 24/7 global access compared to traditional markets, making synthetic asset trading efficient for hedging and speculative purposes. Explore how synthetic assets reshape trading opportunities and risk management strategies in DeFi ecosystems.

Derivatives

Synthetic assets trading enables the creation of tokenized derivatives that replicate real-world asset performance without owning the underlying assets, offering high liquidity and broad market exposure on blockchain platforms. Modular blockchains trading focuses on scalability and customization by separating consensus, execution, and data layers, allowing for optimized derivative contracts with reduced latency and enhanced security. Explore further to understand the impact of these innovations on decentralized derivatives markets and trading efficiency.

Collateralization

Synthetic assets trading relies heavily on over-collateralization to maintain stability and reduce counterparty risk, often requiring users to lock up assets worth more than the synthetic position to ensure solvency. Modular blockchains trading, on the other hand, leverages specialized layers for execution, settlement, and consensus, optimizing collateral efficiency by isolating risk and improving transaction finality. Explore the deeper mechanics of collateralization in both systems to enhance your trading strategy knowledge.

Source and External Links

Synthetic Asset Definition - CoinMarketCap - Synthetic assets are tokenized derivatives on blockchain that allow investors to trade with exposure to any asset securely and anonymously, by creating a token linked to an underlying asset's value through derivatives.

Your guide to synthetics in trading - StoneX - Synthetics in trading are financial instruments made by combining derivatives like options to replicate the performance and risk profile of other assets, enabling customized investment strategies without owning the underlying asset.

Synthetic Assets: The Versatile Solution for DeFi Traders - Webisoft - Synthetic assets enable decentralized trading of any real-world assets like stocks or commodities on the blockchain without needing a counterparty, providing high liquidity, low fees, and no middleman.

dowidth.com

dowidth.com