Quantitative momentum trading relies on statistical models and price trends to identify stocks with strong upward or downward momentum, focusing on market data and algorithms. Fundamental analysis evaluates a company's financial health, earnings, and economic factors to determine its intrinsic value and long-term potential. Explore the differences between these approaches to enhance your trading strategy.

Why it is important

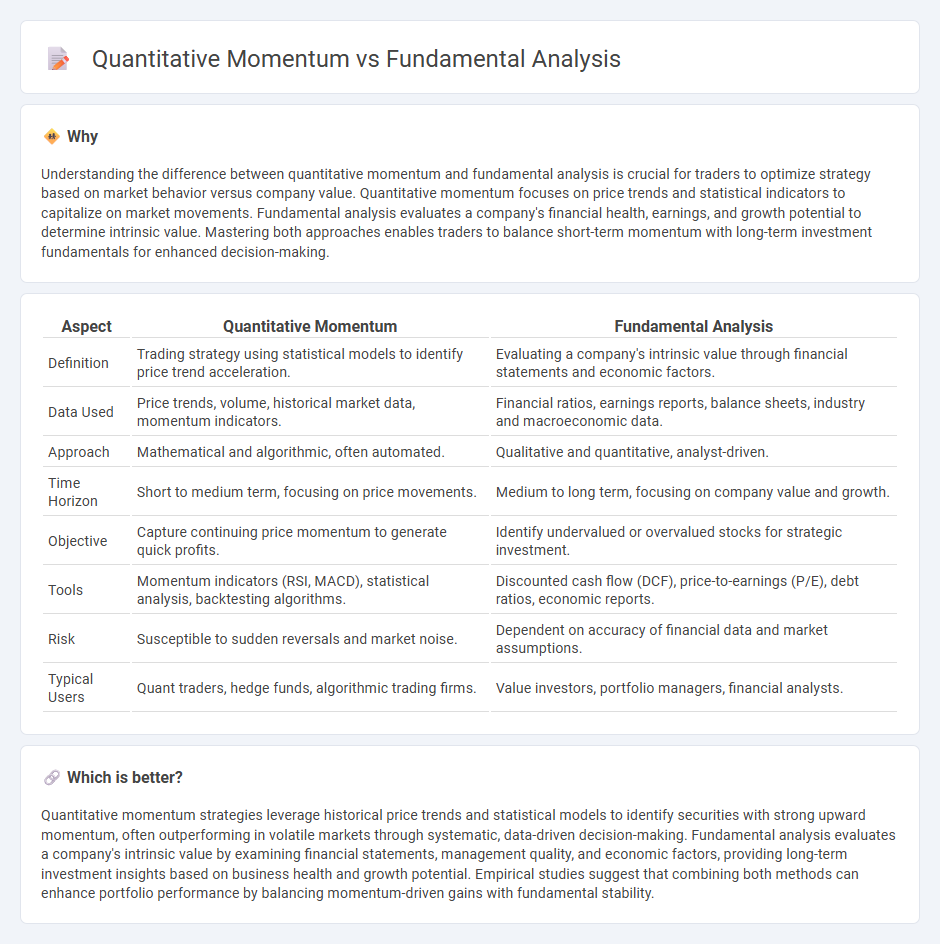

Understanding the difference between quantitative momentum and fundamental analysis is crucial for traders to optimize strategy based on market behavior versus company value. Quantitative momentum focuses on price trends and statistical indicators to capitalize on market movements. Fundamental analysis evaluates a company's financial health, earnings, and growth potential to determine intrinsic value. Mastering both approaches enables traders to balance short-term momentum with long-term investment fundamentals for enhanced decision-making.

Comparison Table

| Aspect | Quantitative Momentum | Fundamental Analysis |

|---|---|---|

| Definition | Trading strategy using statistical models to identify price trend acceleration. | Evaluating a company's intrinsic value through financial statements and economic factors. |

| Data Used | Price trends, volume, historical market data, momentum indicators. | Financial ratios, earnings reports, balance sheets, industry and macroeconomic data. |

| Approach | Mathematical and algorithmic, often automated. | Qualitative and quantitative, analyst-driven. |

| Time Horizon | Short to medium term, focusing on price movements. | Medium to long term, focusing on company value and growth. |

| Objective | Capture continuing price momentum to generate quick profits. | Identify undervalued or overvalued stocks for strategic investment. |

| Tools | Momentum indicators (RSI, MACD), statistical analysis, backtesting algorithms. | Discounted cash flow (DCF), price-to-earnings (P/E), debt ratios, economic reports. |

| Risk | Susceptible to sudden reversals and market noise. | Dependent on accuracy of financial data and market assumptions. |

| Typical Users | Quant traders, hedge funds, algorithmic trading firms. | Value investors, portfolio managers, financial analysts. |

Which is better?

Quantitative momentum strategies leverage historical price trends and statistical models to identify securities with strong upward momentum, often outperforming in volatile markets through systematic, data-driven decision-making. Fundamental analysis evaluates a company's intrinsic value by examining financial statements, management quality, and economic factors, providing long-term investment insights based on business health and growth potential. Empirical studies suggest that combining both methods can enhance portfolio performance by balancing momentum-driven gains with fundamental stability.

Connection

Quantitative momentum uses statistical models to identify stocks with accelerating price trends, while fundamental analysis evaluates a company's intrinsic value through financial metrics. The connection lies in combining momentum indicators with fundamental data to enhance trade decision-making, capturing both price action and underlying economic strength. This integrated approach improves predictive accuracy and risk management in trading strategies.

Key Terms

**Fundamental Analysis:**

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, management quality, industry conditions, and economic factors, providing a comprehensive view of its long-term growth potential. This approach emphasizes metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio to identify undervalued stocks with strong fundamentals. Explore more about how fundamental analysis can enhance investment decisions and portfolio performance.

Earnings

Earnings serve as a pivotal metric in fundamental analysis, where investors scrutinize financial statements to assess a company's profitability, growth potential, and intrinsic value. In quantitative momentum strategies, earnings growth rates are often used alongside price trends and volume to identify stocks with accelerating performance. Explore how integrating earnings data enhances investment decisions by learning more about these analytical approaches.

Valuation

Fundamental analysis emphasizes valuation metrics such as price-to-earnings ratios, book value, and cash flow to assess a company's intrinsic worth and potential for long-term growth. Quantitative momentum strategies prioritize price trends and momentum indicators, often disregarding traditional valuation measures to capitalize on market momentum. Explore more about how these distinct approaches impact investment decisions and asset allocation strategies.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method of assessing the intrinsic value of a security by analyzing various macroeconomic and microeconomic factors to determine if it is overvalued or undervalued, helping investors make informed decisions.

What is fundamental analysis? How to assess value in trading - Saxo - Fundamental analysis focuses on assessing an asset's intrinsic value by examining core aspects and industry factors, independent of market sentiment or price movements, to decide if the asset is over or undervalued.

Fundamental analysis - Wikipedia - Fundamental analysis involves economic, industry, and company analysis to determine a stock's intrinsic value, guiding investors on whether to buy, hold, or sell based on whether the intrinsic value is above, equal to, or below the market price.

dowidth.com

dowidth.com