Perpetual contracts are derivative instruments that allow traders to speculate on asset prices without an expiry date, continuously renewing positions using funding rates to anchor prices to spot markets. Options contracts grant the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified expiration, providing strategic flexibility for hedging and speculation. Explore the key differences in risk management, leverage, and trading strategies to master both contract types effectively.

Why it is important

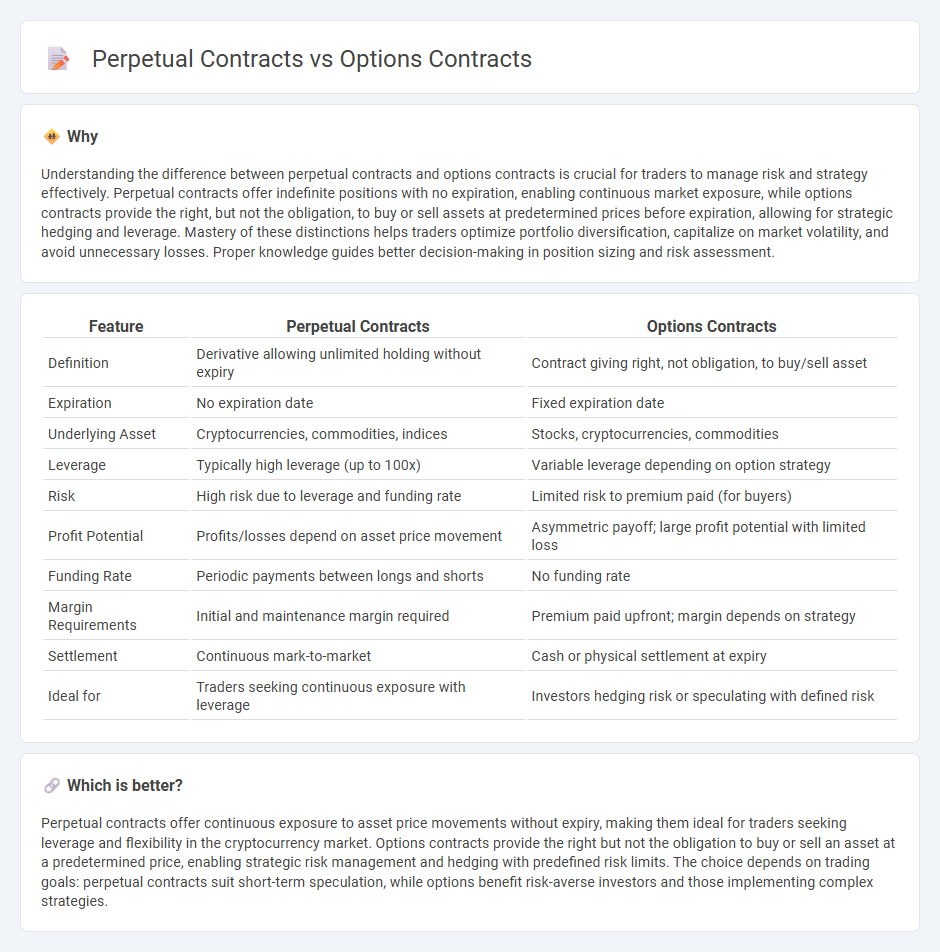

Understanding the difference between perpetual contracts and options contracts is crucial for traders to manage risk and strategy effectively. Perpetual contracts offer indefinite positions with no expiration, enabling continuous market exposure, while options contracts provide the right, but not the obligation, to buy or sell assets at predetermined prices before expiration, allowing for strategic hedging and leverage. Mastery of these distinctions helps traders optimize portfolio diversification, capitalize on market volatility, and avoid unnecessary losses. Proper knowledge guides better decision-making in position sizing and risk assessment.

Comparison Table

| Feature | Perpetual Contracts | Options Contracts |

|---|---|---|

| Definition | Derivative allowing unlimited holding without expiry | Contract giving right, not obligation, to buy/sell asset |

| Expiration | No expiration date | Fixed expiration date |

| Underlying Asset | Cryptocurrencies, commodities, indices | Stocks, cryptocurrencies, commodities |

| Leverage | Typically high leverage (up to 100x) | Variable leverage depending on option strategy |

| Risk | High risk due to leverage and funding rate | Limited risk to premium paid (for buyers) |

| Profit Potential | Profits/losses depend on asset price movement | Asymmetric payoff; large profit potential with limited loss |

| Funding Rate | Periodic payments between longs and shorts | No funding rate |

| Margin Requirements | Initial and maintenance margin required | Premium paid upfront; margin depends on strategy |

| Settlement | Continuous mark-to-market | Cash or physical settlement at expiry |

| Ideal for | Traders seeking continuous exposure with leverage | Investors hedging risk or speculating with defined risk |

Which is better?

Perpetual contracts offer continuous exposure to asset price movements without expiry, making them ideal for traders seeking leverage and flexibility in the cryptocurrency market. Options contracts provide the right but not the obligation to buy or sell an asset at a predetermined price, enabling strategic risk management and hedging with predefined risk limits. The choice depends on trading goals: perpetual contracts suit short-term speculation, while options benefit risk-averse investors and those implementing complex strategies.

Connection

Perpetual contracts and options contracts are interconnected through their roles in risk management and speculative strategies within trading markets. Both instruments allow traders to gain exposure to underlying assets without direct ownership, with perpetual contracts offering continuous, leverage-based positions and options providing the right to buy or sell at predetermined prices. The interplay between these derivatives enhances liquidity and price discovery, enabling more sophisticated hedging and arbitrage opportunities.

Key Terms

Expiry Date

Options contracts have a predetermined expiry date, which defines the last day the contract can be exercised or traded, impacting its time value and risk profile. Perpetual contracts lack an expiry date, allowing traders to hold positions indefinitely without settlement, often financed through funding rates to maintain price alignment with the underlying asset. Explore more to understand how expiry dates influence trading strategies and risk management in derivatives markets.

Leverage

Options contracts offer leverage by allowing traders to control a larger position with a smaller capital outlay, typically through the premium paid for the option. Perpetual contracts provide even higher leverage, often up to 100x, enabling traders to maximize exposure without an expiration date, but this also increases the risk of liquidation. Explore more details on how leverage dynamics differ between these contract types and optimize your trading strategy.

Settlement

Options contracts settle on a predetermined expiration date, where the holder can choose to exercise the right to buy or sell the underlying asset at a specified strike price. Perpetual contracts, commonly used in cryptocurrency derivatives, do not have an expiration date and instead use a funding rate mechanism to keep their price aligned with the underlying asset. To learn more about the differences in settlement and risk management between these contracts, explore detailed trading resources.

Source and External Links

Options | FINRA.org - Options contracts give investors the right, but not obligation, to buy (call) or sell (put) an underlying asset at a specified strike price within a limited time, with the seller taking on the obligation if assigned; they can manage risk or generate income but trading requires brokerage approval due to complexity and risk.

Option (finance) - Options are financial contracts that allow the holder to buy or sell an asset at a strike price by a set time, traded either on exchanges with standardized terms or over-the-counter with customizable contracts tailored to business needs.

What are options, and how do they work? - Options contracts come in calls (right to buy) and puts (right to sell), with buyers being "long" and sellers "short"; these contracts provide leverage and flexibility, allowing investors to speculate on or hedge price movements of underlying assets by expiration date.

dowidth.com

dowidth.com