Order book imbalance occurs when buy and sell orders are unevenly distributed, signaling potential shifts in market momentum and price direction. Liquidity sweeps target large hidden orders by rapidly executing trades across multiple price levels, often triggering significant volatility. Explore these concepts to enhance your trading strategy and market analysis.

Why it is important

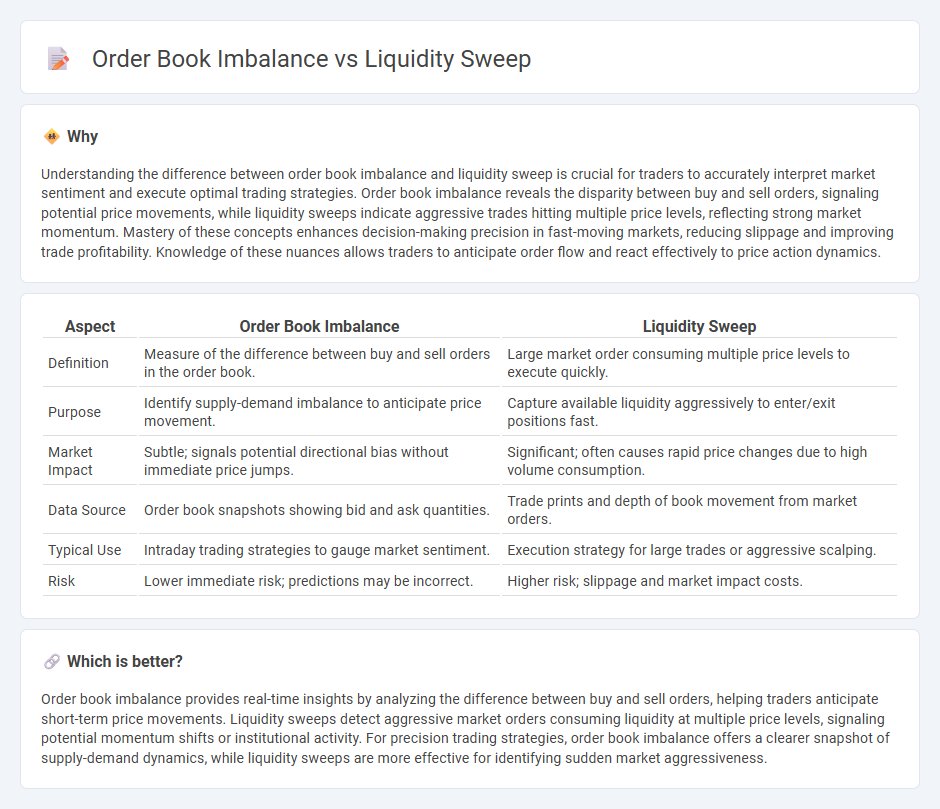

Understanding the difference between order book imbalance and liquidity sweep is crucial for traders to accurately interpret market sentiment and execute optimal trading strategies. Order book imbalance reveals the disparity between buy and sell orders, signaling potential price movements, while liquidity sweeps indicate aggressive trades hitting multiple price levels, reflecting strong market momentum. Mastery of these concepts enhances decision-making precision in fast-moving markets, reducing slippage and improving trade profitability. Knowledge of these nuances allows traders to anticipate order flow and react effectively to price action dynamics.

Comparison Table

| Aspect | Order Book Imbalance | Liquidity Sweep |

|---|---|---|

| Definition | Measure of the difference between buy and sell orders in the order book. | Large market order consuming multiple price levels to execute quickly. |

| Purpose | Identify supply-demand imbalance to anticipate price movement. | Capture available liquidity aggressively to enter/exit positions fast. |

| Market Impact | Subtle; signals potential directional bias without immediate price jumps. | Significant; often causes rapid price changes due to high volume consumption. |

| Data Source | Order book snapshots showing bid and ask quantities. | Trade prints and depth of book movement from market orders. |

| Typical Use | Intraday trading strategies to gauge market sentiment. | Execution strategy for large trades or aggressive scalping. |

| Risk | Lower immediate risk; predictions may be incorrect. | Higher risk; slippage and market impact costs. |

Which is better?

Order book imbalance provides real-time insights by analyzing the difference between buy and sell orders, helping traders anticipate short-term price movements. Liquidity sweeps detect aggressive market orders consuming liquidity at multiple price levels, signaling potential momentum shifts or institutional activity. For precision trading strategies, order book imbalance offers a clearer snapshot of supply-demand dynamics, while liquidity sweeps are more effective for identifying sudden market aggressiveness.

Connection

Order book imbalance reflects the disparity between buy and sell orders at various price levels, influencing market liquidity dynamics. Liquidity sweeps occur when large orders consume multiple price levels in the order book, exploiting these imbalances to trigger rapid price movements. Understanding the connection between order book imbalance and liquidity sweeps is crucial for traders aiming to anticipate short-term market volatility and optimize trade execution strategies.

Key Terms

Bid-Ask Spread

Liquidity sweep involves aggressive market orders executed to capture available liquidity across multiple price levels, often narrowing the bid-ask spread temporarily. Order book imbalance reflects the disparity between bid and ask volumes, indicating potential directional pressure on price and influencing the spread's width dynamically. Explore how these mechanisms impact real-time market efficiency and trading strategies for deeper insights.

Market Depth

Liquidity sweep involves large market orders rapidly consuming available liquidity, causing swift price movements and revealing hidden market depth beyond the visible order book. Order book imbalance measures the disparity between buy and sell orders at various price levels, providing insight into potential directional pressure and liquidity concentration. Explore deeper market depth dynamics by understanding how liquidity sweeps and order book imbalances interact in price discovery.

Aggressive Orders

Aggressive orders play a crucial role in liquidity sweeps by rapidly consuming available liquidity at multiple price levels, causing swift price movements in the market. In contrast, order book imbalance measures the disparity between buy and sell orders, indicating potential directional pressure but not necessarily immediate execution like aggressive orders do. Explore how aggressive order analysis can enhance market timing and execution strategies for better trading outcomes.

Source and External Links

What is Liquidity Sweep: Everything You Need to Know - A liquidity sweep is a market move where large players trigger many pending orders across price zones to enter or exit positions with minimal slippage, causing rapid price changes often seen within liquidity zones populated by stop-losses and pending orders.

Liquidity Sweeps: A Complete Guide to Smart Money Manipulation! - It is a tactic where price temporarily breaches key levels like previous highs or lows to trigger stop-losses and lure traders into traps before reversing, enabling institutions to gather liquidity efficiently for their large trades.

What is a Liquidity Sweep and How to Trade It? - Liquidity sweeps involve institutional players hunting stop-loss orders in supply or demand zones, sweeping through these levels to fill large orders before price reversal, differing from liquidity runs which are directional continuations instead of reversals.

dowidth.com

dowidth.com