Delta neutral strategy manages risk by balancing long and short positions to maintain a portfolio insensitive to small price movements, often using options and hedging techniques. Trend following focuses on identifying and capitalizing on sustained market momentum, aiming to profit from prolonged price directions. Explore how these distinct approaches can enhance your trading performance and risk management.

Why it is important

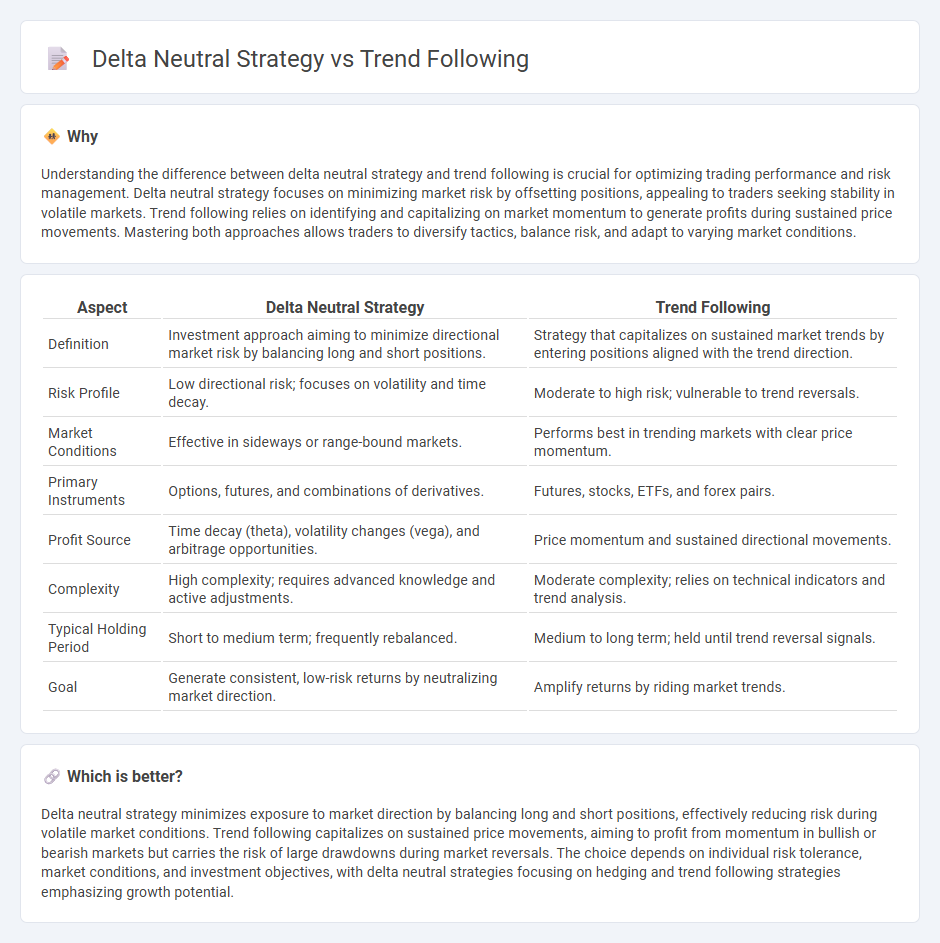

Understanding the difference between delta neutral strategy and trend following is crucial for optimizing trading performance and risk management. Delta neutral strategy focuses on minimizing market risk by offsetting positions, appealing to traders seeking stability in volatile markets. Trend following relies on identifying and capitalizing on market momentum to generate profits during sustained price movements. Mastering both approaches allows traders to diversify tactics, balance risk, and adapt to varying market conditions.

Comparison Table

| Aspect | Delta Neutral Strategy | Trend Following |

|---|---|---|

| Definition | Investment approach aiming to minimize directional market risk by balancing long and short positions. | Strategy that capitalizes on sustained market trends by entering positions aligned with the trend direction. |

| Risk Profile | Low directional risk; focuses on volatility and time decay. | Moderate to high risk; vulnerable to trend reversals. |

| Market Conditions | Effective in sideways or range-bound markets. | Performs best in trending markets with clear price momentum. |

| Primary Instruments | Options, futures, and combinations of derivatives. | Futures, stocks, ETFs, and forex pairs. |

| Profit Source | Time decay (theta), volatility changes (vega), and arbitrage opportunities. | Price momentum and sustained directional movements. |

| Complexity | High complexity; requires advanced knowledge and active adjustments. | Moderate complexity; relies on technical indicators and trend analysis. |

| Typical Holding Period | Short to medium term; frequently rebalanced. | Medium to long term; held until trend reversal signals. |

| Goal | Generate consistent, low-risk returns by neutralizing market direction. | Amplify returns by riding market trends. |

Which is better?

Delta neutral strategy minimizes exposure to market direction by balancing long and short positions, effectively reducing risk during volatile market conditions. Trend following capitalizes on sustained price movements, aiming to profit from momentum in bullish or bearish markets but carries the risk of large drawdowns during market reversals. The choice depends on individual risk tolerance, market conditions, and investment objectives, with delta neutral strategies focusing on hedging and trend following strategies emphasizing growth potential.

Connection

Delta neutral strategy and trend following intersect through their complementary approaches to risk management and market direction. While delta neutral strategies focus on maintaining a balanced portfolio to minimize exposure to price movements, trend following seeks to capitalize on sustained directional trends in the market. Combining these methods allows traders to hedge against volatility while systematically capturing profit opportunities from prevailing market trends.

Key Terms

**Trend Following:**

Trend following strategy capitalizes on persistent market momentum by entering positions aligned with prevailing price trends, typically using moving averages and breakout signals as key indicators. This approach thrives in trending markets, aiming to maximize gains during extended upward or downward price movements while minimizing exposure to sideways markets. Explore more to understand how trend following can enhance your trading performance and risk management.

Moving Average

Trend following strategies utilize moving averages to identify market direction by smoothing price data, enabling traders to capture sustained trends with signals generated when short-term averages cross above or below long-term averages. Delta neutral strategies, conversely, use moving averages primarily to manage hedge adjustments by tracking underlying asset price movements to maintain a balanced position that minimizes directional risk. Explore these approaches in depth to understand how moving averages optimize both trend capturing and risk-neutral trading techniques.

Breakout

Trend following strategies capitalize on price momentum, entering trades when assets break out beyond established support or resistance levels, aiming to ride sustained directional moves. Delta neutral strategies focus on maintaining balanced exposure by offsetting directional risk, often utilizing options to profit from volatility around breakout events without directional bias. Explore how these approaches differ in risk management and profit potential in breakout scenarios to enhance your trading strategy.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where investors buy assets when prices are rising and sell when prices are falling, aiming to profit from the continuation of existing market trends rather than predicting future price movements.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies use technical analysis tools to identify and trade in the direction of market trends, exiting when signs of reversal appear, and rely on systematic rules, risk management, and diversification across assets.

Trend-Following Primer - Graham Capital Management - Trend-following involves algorithmic models that systematically identify and trade price trends in various markets, taking long positions in uptrends and short positions in downtrends, with a focus on portfolio diversification and volatility targeting.

dowidth.com

dowidth.com