Market making involves providing liquidity by continuously quoting buy and sell prices, capturing spreads in highly liquid markets. Statistical arbitrage relies on quantitative models to exploit pricing inefficiencies among correlated assets through automated trading strategies. Explore deeper insights into market making and statistical arbitrage to enhance your trading expertise.

Why it is important

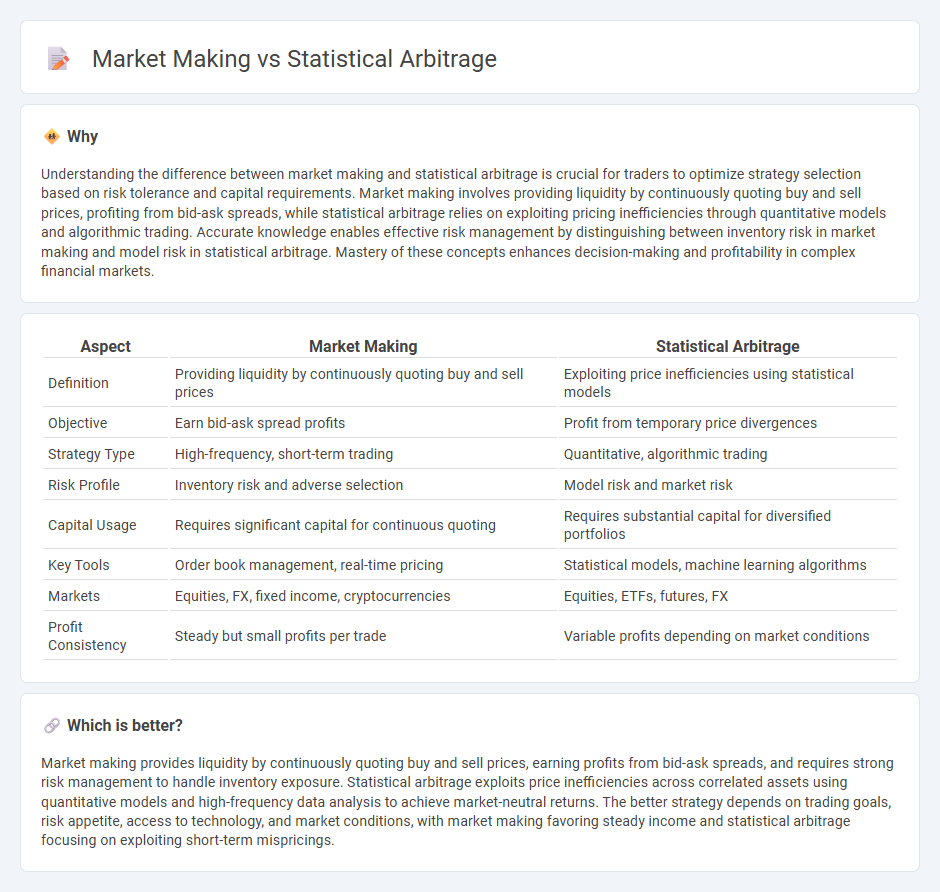

Understanding the difference between market making and statistical arbitrage is crucial for traders to optimize strategy selection based on risk tolerance and capital requirements. Market making involves providing liquidity by continuously quoting buy and sell prices, profiting from bid-ask spreads, while statistical arbitrage relies on exploiting pricing inefficiencies through quantitative models and algorithmic trading. Accurate knowledge enables effective risk management by distinguishing between inventory risk in market making and model risk in statistical arbitrage. Mastery of these concepts enhances decision-making and profitability in complex financial markets.

Comparison Table

| Aspect | Market Making | Statistical Arbitrage |

|---|---|---|

| Definition | Providing liquidity by continuously quoting buy and sell prices | Exploiting price inefficiencies using statistical models |

| Objective | Earn bid-ask spread profits | Profit from temporary price divergences |

| Strategy Type | High-frequency, short-term trading | Quantitative, algorithmic trading |

| Risk Profile | Inventory risk and adverse selection | Model risk and market risk |

| Capital Usage | Requires significant capital for continuous quoting | Requires substantial capital for diversified portfolios |

| Key Tools | Order book management, real-time pricing | Statistical models, machine learning algorithms |

| Markets | Equities, FX, fixed income, cryptocurrencies | Equities, ETFs, futures, FX |

| Profit Consistency | Steady but small profits per trade | Variable profits depending on market conditions |

Which is better?

Market making provides liquidity by continuously quoting buy and sell prices, earning profits from bid-ask spreads, and requires strong risk management to handle inventory exposure. Statistical arbitrage exploits price inefficiencies across correlated assets using quantitative models and high-frequency data analysis to achieve market-neutral returns. The better strategy depends on trading goals, risk appetite, access to technology, and market conditions, with market making favoring steady income and statistical arbitrage focusing on exploiting short-term mispricings.

Connection

Market making involves providing liquidity by continuously quoting buy and sell prices, while statistical arbitrage leverages quantitative models to identify pricing inefficiencies across securities. Both strategies rely heavily on high-frequency trading algorithms and real-time data analysis to exploit small price discrepancies for profit. The integration of market making's liquidity provision with statistical arbitrage's predictive models enhances trading efficiency and risk management in financial markets.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages advanced quantitative models and historical price data to identify short-term price inefficiencies across correlated securities, enabling traders to exploit mean reversion patterns and mispricings. This strategy heavily relies on statistical techniques such as cointegration, regression analysis, and machine learning algorithms to optimize trade execution and risk management. Explore deeper insights into statistical arbitrage strategies, algorithmic implementation, and performance metrics to maximize trading profitability.

Mean Reversion

Statistical arbitrage leverages mean reversion by identifying and exploiting pricing inefficiencies between correlated assets, aiming to profit when prices revert to their historical averages. Market making involves providing liquidity by continuously quoting bid and ask prices, profiting from the bid-ask spread while managing inventory risk that often aligns with mean reversion strategies to stabilize positions. Explore more to understand their distinct mechanisms and applications in modern trading.

Pair Trading

Statistical arbitrage in pair trading exploits pricing inefficiencies between correlated asset pairs by executing simultaneous long and short positions when deviations occur, aiming for mean reversion profits. Market making involves providing liquidity to buy and sell orders, capturing the bid-ask spread as compensation while managing inventory risk, often using high-frequency strategies. Discover the detailed mechanisms and risk profiles distinguishing pair trading statistical arbitrage from market making strategies.

Source and External Links

Statistical Arbitrage: Strategies, Examples, and Risks - dYdX - Statistical arbitrage, or stat arb, is an advanced trading method using statistical and computational techniques to identify and exploit price inefficiencies, especially in the crypto market, by predicting price movements based on historical relationships between assets over time.

The Power of Statistical Arbitrage in Finance - PyQuant News - Statistical arbitrage relies on quantitative models to detect short-term price discrepancies between related financial instruments, operating under the principle of mean reversion to generate profits by trading undervalued and overvalued assets expecting prices to converge.

Statistical arbitrage - Wikipedia - Statistical arbitrage is a class of short-term, highly quantitative and automated trading strategies employing mean reversion models across broadly diversified portfolios, often beta-neutral, and used widely by hedge funds and investment banks to capture small pricing inefficiencies via high-frequency trading.

dowidth.com

dowidth.com