Copy trading allows investors to replicate the trades of experienced traders in real-time, providing a hands-off approach to market participation. Automated trading uses algorithms and predefined rules to execute trades instantly, increasing speed and reducing emotional bias. Discover the key differences and benefits of copy trading versus automated trading to enhance your investment strategy.

Why it is important

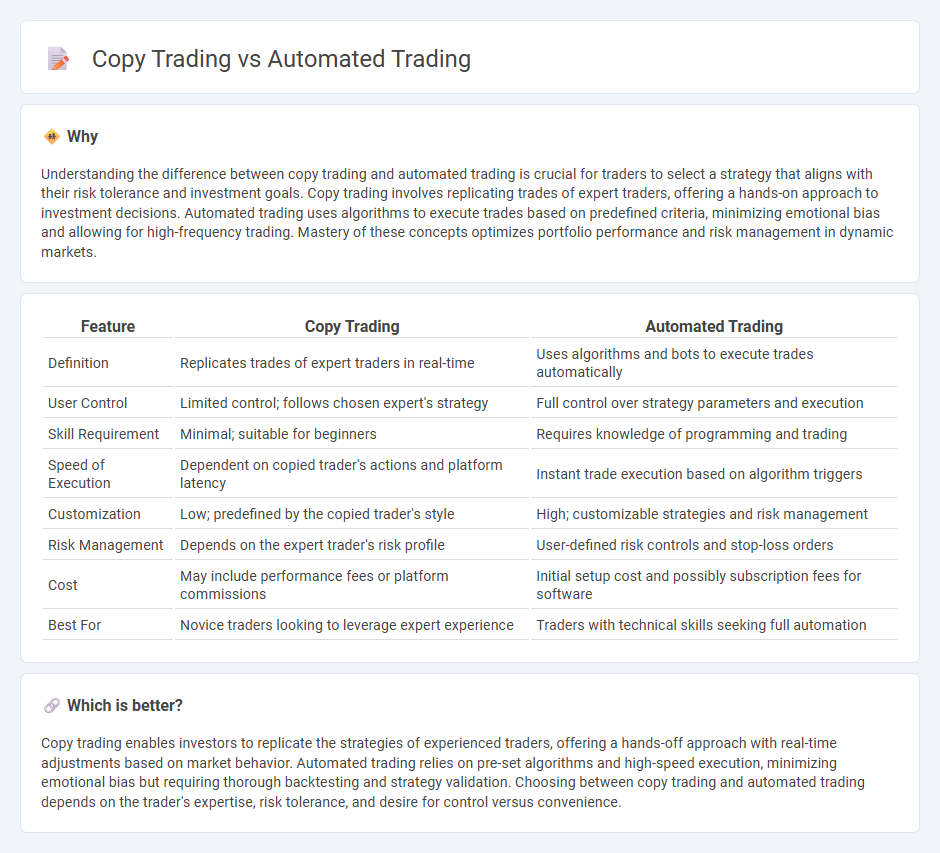

Understanding the difference between copy trading and automated trading is crucial for traders to select a strategy that aligns with their risk tolerance and investment goals. Copy trading involves replicating trades of expert traders, offering a hands-on approach to investment decisions. Automated trading uses algorithms to execute trades based on predefined criteria, minimizing emotional bias and allowing for high-frequency trading. Mastery of these concepts optimizes portfolio performance and risk management in dynamic markets.

Comparison Table

| Feature | Copy Trading | Automated Trading |

|---|---|---|

| Definition | Replicates trades of expert traders in real-time | Uses algorithms and bots to execute trades automatically |

| User Control | Limited control; follows chosen expert's strategy | Full control over strategy parameters and execution |

| Skill Requirement | Minimal; suitable for beginners | Requires knowledge of programming and trading |

| Speed of Execution | Dependent on copied trader's actions and platform latency | Instant trade execution based on algorithm triggers |

| Customization | Low; predefined by the copied trader's style | High; customizable strategies and risk management |

| Risk Management | Depends on the expert trader's risk profile | User-defined risk controls and stop-loss orders |

| Cost | May include performance fees or platform commissions | Initial setup cost and possibly subscription fees for software |

| Best For | Novice traders looking to leverage expert experience | Traders with technical skills seeking full automation |

Which is better?

Copy trading enables investors to replicate the strategies of experienced traders, offering a hands-off approach with real-time adjustments based on market behavior. Automated trading relies on pre-set algorithms and high-speed execution, minimizing emotional bias but requiring thorough backtesting and strategy validation. Choosing between copy trading and automated trading depends on the trader's expertise, risk tolerance, and desire for control versus convenience.

Connection

Copy trading and automated trading are interconnected by their reliance on technology to replicate successful trade strategies. Copy trading allows investors to mimic the trades of experienced traders in real-time, while automated trading uses algorithms to execute trades based on pre-set criteria without human intervention. Both methods enhance accessibility and efficiency in financial markets by leveraging automation and strategic replication.

Key Terms

Algorithm

Automated trading utilizes algorithmic strategies to execute trades based on pre-set rules and market data, minimizing emotional bias and enabling high-frequency operations. Copy trading, while also algorithm-driven in some cases, primarily involves replicating another trader's moves rather than relying solely on complex algorithms. Explore the nuances of algorithmic impact on trading efficiency and risk management to understand which method aligns with your investment goals.

Signal Provider

Automated trading uses algorithms to execute trades based on pre-set criteria, minimizing human intervention and allowing rapid market reactions. Copy trading relies on Signal Providers who share their trading decisions, enabling followers to replicate successful strategies without deep market expertise. Explore the advantages and nuances of Signal Providers in both methods to optimize your trading performance.

Execution

Automated trading executes pre-programmed strategies through algorithms, ensuring rapid order placement with minimal human intervention, while copy trading replicates the trades of experienced investors in real-time, relying on the trader's decisions. Execution speed in automated trading is typically faster and more consistent, ideal for high-frequency trading, whereas copy trading execution depends on the trader's platform and market conditions. Explore our detailed analysis to understand which execution method aligns with your trading goals.

Source and External Links

Automated trading system - Wikipedia - Automated trading systems use computer programs to create and submit buy and sell orders automatically based on predefined rules and trading strategies, executing trades much faster than humans and dominating up to 80% of market transactions, although they require special risk controls to prevent issues like market crashes.

Automated Trading Platforms | Autotrading Software - AvaTrade - Automated trading can be done via bots that execute trades based on coded strategies or through social/copy trading platforms where users replicate the trades of others, offering advantages like discipline preservation and time savings but also risks such as over-optimization and system failures.

What is Automated Trading and How Do You Get Started? - IG - Automated trading involves using programmed rules to enter and exit trades with high efficiency and speed, enabling traders to apply thorough technical analysis combined with automated execution to optimize their trading strategies.

dowidth.com

dowidth.com