Degen trading involves high-risk, speculative trades often based on market momentum and social sentiment, aiming for quick, substantial gains through volatile assets. Arbitrage trading exploits price discrepancies across different markets or exchanges to secure risk-free profits by simultaneously buying low and selling high. Explore more to understand how these contrasting strategies impact trading outcomes and risk management.

Why it is important

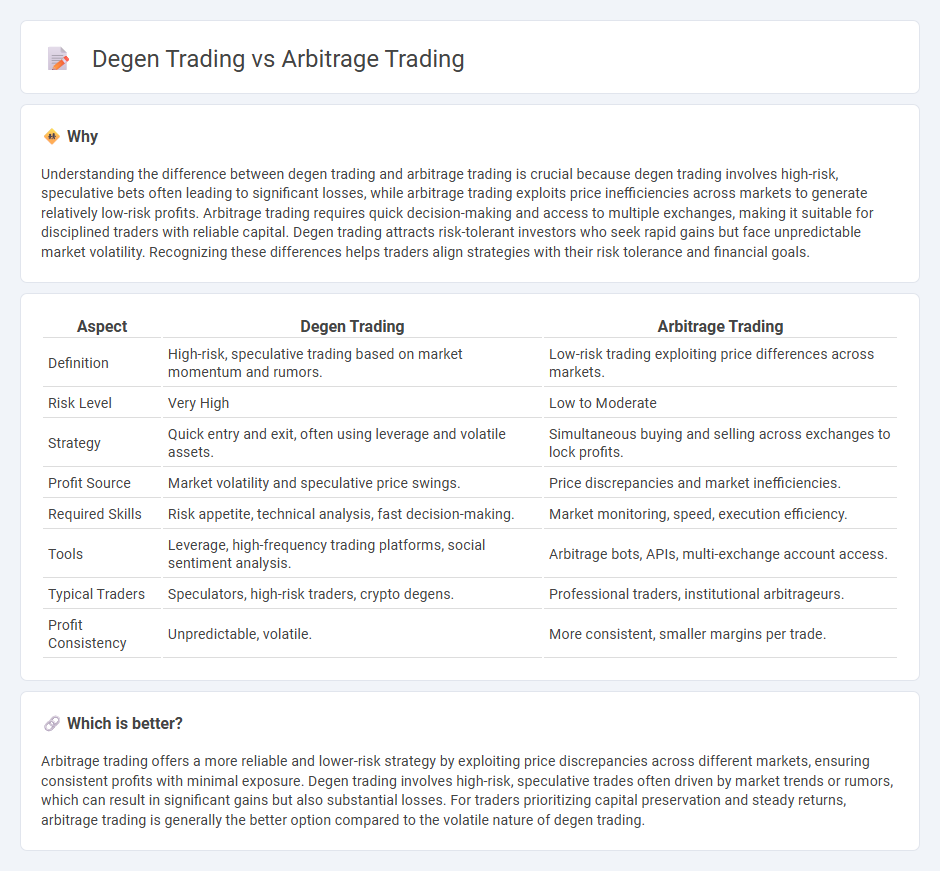

Understanding the difference between degen trading and arbitrage trading is crucial because degen trading involves high-risk, speculative bets often leading to significant losses, while arbitrage trading exploits price inefficiencies across markets to generate relatively low-risk profits. Arbitrage trading requires quick decision-making and access to multiple exchanges, making it suitable for disciplined traders with reliable capital. Degen trading attracts risk-tolerant investors who seek rapid gains but face unpredictable market volatility. Recognizing these differences helps traders align strategies with their risk tolerance and financial goals.

Comparison Table

| Aspect | Degen Trading | Arbitrage Trading |

|---|---|---|

| Definition | High-risk, speculative trading based on market momentum and rumors. | Low-risk trading exploiting price differences across markets. |

| Risk Level | Very High | Low to Moderate |

| Strategy | Quick entry and exit, often using leverage and volatile assets. | Simultaneous buying and selling across exchanges to lock profits. |

| Profit Source | Market volatility and speculative price swings. | Price discrepancies and market inefficiencies. |

| Required Skills | Risk appetite, technical analysis, fast decision-making. | Market monitoring, speed, execution efficiency. |

| Tools | Leverage, high-frequency trading platforms, social sentiment analysis. | Arbitrage bots, APIs, multi-exchange account access. |

| Typical Traders | Speculators, high-risk traders, crypto degens. | Professional traders, institutional arbitrageurs. |

| Profit Consistency | Unpredictable, volatile. | More consistent, smaller margins per trade. |

Which is better?

Arbitrage trading offers a more reliable and lower-risk strategy by exploiting price discrepancies across different markets, ensuring consistent profits with minimal exposure. Degen trading involves high-risk, speculative trades often driven by market trends or rumors, which can result in significant gains but also substantial losses. For traders prioritizing capital preservation and steady returns, arbitrage trading is generally the better option compared to the volatile nature of degen trading.

Connection

Degen trading and arbitrage trading are connected through their reliance on market inefficiencies and rapid decision-making to capitalize on profit opportunities. While degen trading involves high-risk, speculative bets often driven by short-term trends and sentiment, arbitrage trading exploits price discrepancies across different exchanges or assets to achieve low-risk, simultaneous gains. Both strategies demand advanced tools and algorithms for real-time data analysis to maximize returns in volatile markets.

Key Terms

**Arbitrage Trading:**

Arbitrage trading exploits price differences of the same asset across multiple markets to generate risk-free profits by simultaneously buying low and selling high. This strategy relies on sophisticated algorithms, real-time data, and quick execution to capitalize on fleeting price inefficiencies. Explore the nuances of arbitrage trading to enhance portfolio diversification and reduce exposure to market volatility.

Price Discrepancy

Arbitrage trading exploits price discrepancies across different markets to secure risk-free profits by simultaneously buying low and selling high. Degen trading involves high-risk speculative bets often based on short-term price momentum rather than fundamental price differences. Explore detailed strategies and risk profiles of both arbitrage and degen trading to enhance your market approach.

Market Efficiency

Arbitrage trading exploits price discrepancies across different markets to enhance market efficiency by aligning asset prices and eliminating arbitrage opportunities quickly. Degen trading, characterized by high-risk, speculative trades without significant fundamental analysis, often increases market volatility and can contribute to inefficiencies. Explore these contrasting strategies further to understand their impact on market dynamics and efficiency.

Source and External Links

What Is Arbitrage in Investing? (Risks, Types and Examples) - Indeed - Arbitrage is the practice of simultaneously buying an asset in one market at a lower price and selling it in another market at a higher price to profit from the price difference, often done within seconds using algorithms or specialized software.

Arbitrage - Wikipedia - Arbitrage involves taking advantage of price differences for the same asset across multiple markets with simultaneous transactions to avoid market risk, ensuring no exposure to price changes before both legs of the trade complete.

What is Arbitrage? - 2023 - Robinhood - Arbitrage trading is a short-term investment strategy where investors simultaneously buy and sell assets across different markets with price discrepancies, helping maintain market efficiency by correcting these price differences.

dowidth.com

dowidth.com