Penny jump involves rapid, small price increments to gain execution priority, often impacting market liquidity and order book dynamics. Quote stuffing is a manipulative tactic where high-frequency traders flood the market with excessive orders and cancellations, creating confusion and slowing down competitors. Explore further to understand how these practices shape trading strategies and market behavior.

Why it is important

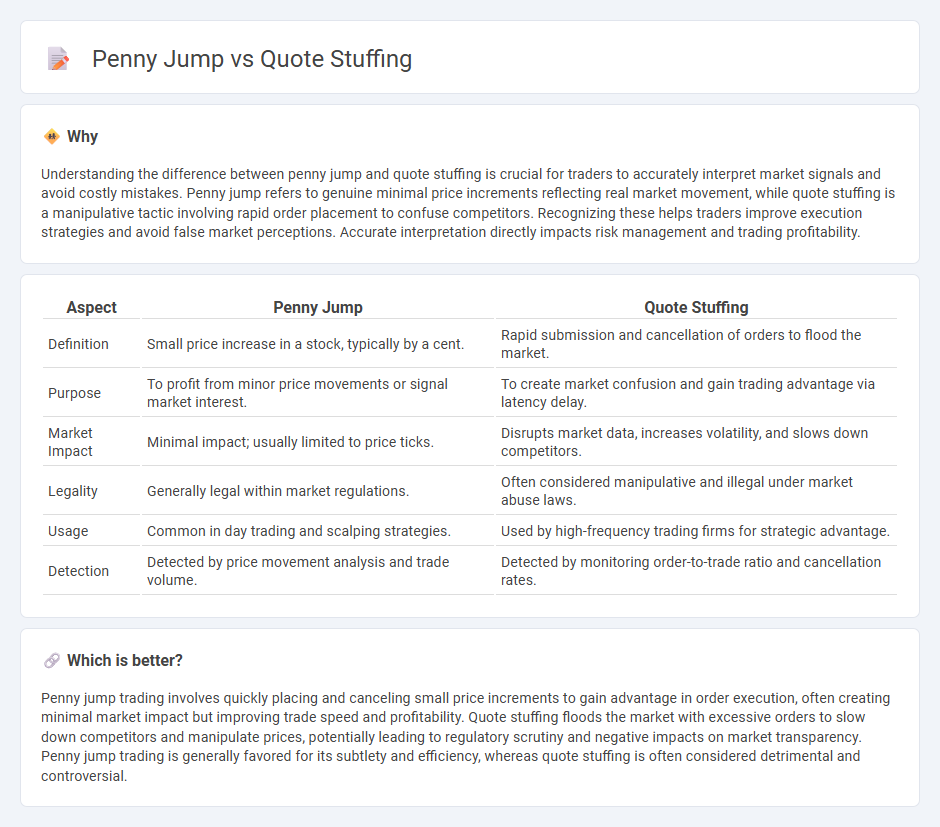

Understanding the difference between penny jump and quote stuffing is crucial for traders to accurately interpret market signals and avoid costly mistakes. Penny jump refers to genuine minimal price increments reflecting real market movement, while quote stuffing is a manipulative tactic involving rapid order placement to confuse competitors. Recognizing these helps traders improve execution strategies and avoid false market perceptions. Accurate interpretation directly impacts risk management and trading profitability.

Comparison Table

| Aspect | Penny Jump | Quote Stuffing |

|---|---|---|

| Definition | Small price increase in a stock, typically by a cent. | Rapid submission and cancellation of orders to flood the market. |

| Purpose | To profit from minor price movements or signal market interest. | To create market confusion and gain trading advantage via latency delay. |

| Market Impact | Minimal impact; usually limited to price ticks. | Disrupts market data, increases volatility, and slows down competitors. |

| Legality | Generally legal within market regulations. | Often considered manipulative and illegal under market abuse laws. |

| Usage | Common in day trading and scalping strategies. | Used by high-frequency trading firms for strategic advantage. |

| Detection | Detected by price movement analysis and trade volume. | Detected by monitoring order-to-trade ratio and cancellation rates. |

Which is better?

Penny jump trading involves quickly placing and canceling small price increments to gain advantage in order execution, often creating minimal market impact but improving trade speed and profitability. Quote stuffing floods the market with excessive orders to slow down competitors and manipulate prices, potentially leading to regulatory scrutiny and negative impacts on market transparency. Penny jump trading is generally favored for its subtlety and efficiency, whereas quote stuffing is often considered detrimental and controversial.

Connection

Penny jumping exploits rapid price movements in low-priced stocks, while quote stuffing overwhelms market systems with excessive orders to create confusion. Both tactics manipulate market liquidity and price discovery, often leading to increased volatility and distorted trading signals. High-frequency traders leverage these strategies to gain unfair advantages in crowded order books and fragmented markets.

Key Terms

High-Frequency Trading (HFT)

Quote stuffing involves rapidly placing and canceling large volumes of orders to create market confusion and slow down competitors, often used by high-frequency trading (HFT) firms to exploit microsecond advantages. Penny jumping in HFT refers to placing orders just a fraction of a cent better than the current best bid or ask, aiming to capture priority in the order book and profit from minimal price improvements. Explore more about how these tactics influence market liquidity and fairness in HFT environments.

Order Book

Quote stuffing overwhelms the order book with rapid, large volumes of orders that create false market signals, disrupting price discovery and execution. Penny jumping exploits small bid-ask price increments by quickly placing orders just ahead in the queue to gain priority, taking advantage of order book dynamics without inflating order volume. Explore deeper insights into how these tactics influence market behavior and order book integrity.

Market Manipulation

Quote stuffing is a market manipulation tactic where traders flood the order book with a large number of fake orders to create confusion and slow down competitors, distorting price discovery. Penny jump involves placing orders just one cent above the current best bid or ask to gain priority in the order queue and manipulate market prices subtly. Explore these strategies further to understand their impact on market integrity and trading fairness.

Source and External Links

Quote Stuffing - Overview, How It Works, Example - Quote stuffing is a market manipulation technique where a trader places and quickly cancels a large number of orders to create artificial demand or supply, influencing the stock price for profit.

How Larger Players Use Quote Stuffing to Gain an Edge in Trading - Quote stuffing involves flooding the market with excessive orders that are rapidly canceled to create confusion, disrupt trading, and manipulate prices, often using high-speed algorithms and technology.

Quote Stuffing - What Is It, Vs Spoofing Vs Layering - WallStreetMojo - Quote stuffing, mostly executed by high-frequency traders, is a tactic where multiple buy and sell orders are placed then withdrawn suddenly to create a false market trend and gain a price advantage over competitors.

dowidth.com

dowidth.com