Execution algorithms focus on strategically breaking down large orders to minimize market impact and achieve optimal trade prices. High-frequency trading relies on advanced technology and speed to capitalize on minute price discrepancies within milliseconds. Discover how these trading approaches shape modern financial markets.

Why it is important

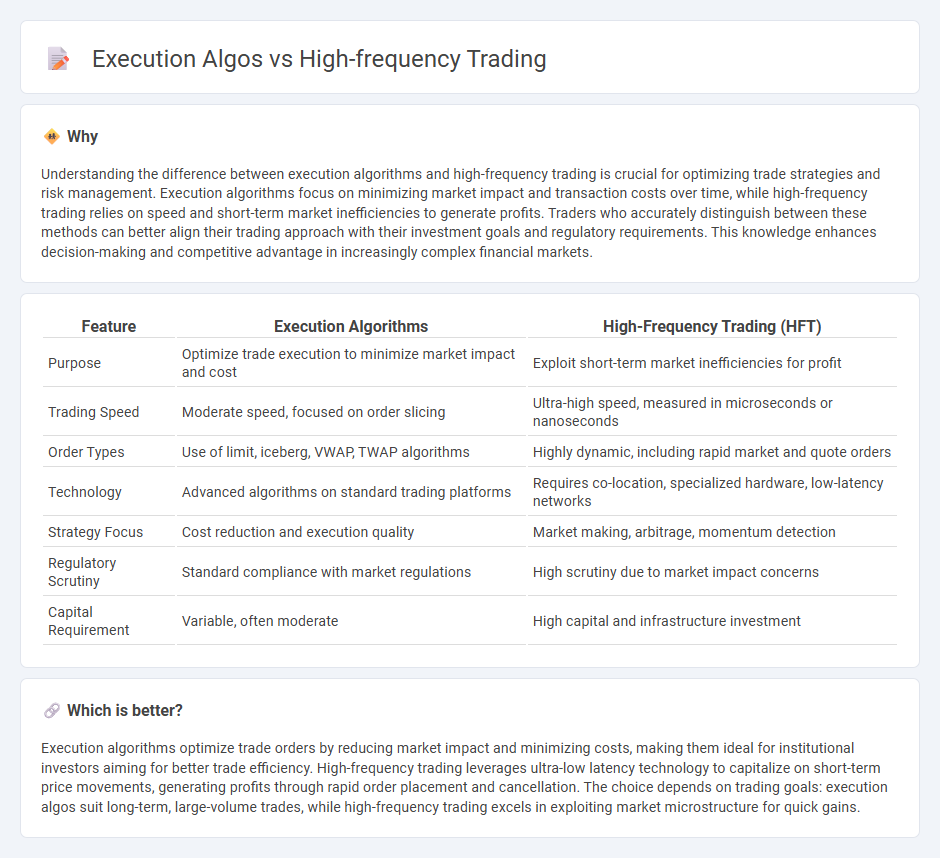

Understanding the difference between execution algorithms and high-frequency trading is crucial for optimizing trade strategies and risk management. Execution algorithms focus on minimizing market impact and transaction costs over time, while high-frequency trading relies on speed and short-term market inefficiencies to generate profits. Traders who accurately distinguish between these methods can better align their trading approach with their investment goals and regulatory requirements. This knowledge enhances decision-making and competitive advantage in increasingly complex financial markets.

Comparison Table

| Feature | Execution Algorithms | High-Frequency Trading (HFT) |

|---|---|---|

| Purpose | Optimize trade execution to minimize market impact and cost | Exploit short-term market inefficiencies for profit |

| Trading Speed | Moderate speed, focused on order slicing | Ultra-high speed, measured in microseconds or nanoseconds |

| Order Types | Use of limit, iceberg, VWAP, TWAP algorithms | Highly dynamic, including rapid market and quote orders |

| Technology | Advanced algorithms on standard trading platforms | Requires co-location, specialized hardware, low-latency networks |

| Strategy Focus | Cost reduction and execution quality | Market making, arbitrage, momentum detection |

| Regulatory Scrutiny | Standard compliance with market regulations | High scrutiny due to market impact concerns |

| Capital Requirement | Variable, often moderate | High capital and infrastructure investment |

Which is better?

Execution algorithms optimize trade orders by reducing market impact and minimizing costs, making them ideal for institutional investors aiming for better trade efficiency. High-frequency trading leverages ultra-low latency technology to capitalize on short-term price movements, generating profits through rapid order placement and cancellation. The choice depends on trading goals: execution algos suit long-term, large-volume trades, while high-frequency trading excels in exploiting market microstructure for quick gains.

Connection

Execution algorithms and high-frequency trading (HFT) are closely connected through their shared goal of optimizing trade execution speed and efficiency. Execution algos use complex mathematical models to split large orders into smaller, strategically timed trades to minimize market impact and transaction costs. HFT leverages these algorithms with ultra-low latency technology to capitalize on short-term market opportunities, enabling rapid execution across multiple venues.

Key Terms

Latency

High-frequency trading (HFT) relies on ultra-low latency environments to execute rapid trades based on market signals, whereas execution algorithms prioritize minimizing market impact and optimizing trade execution over longer time horizons. Latency in HFT systems is often measured in microseconds or nanoseconds, leveraging advanced co-location and direct market access technologies to gain competitive advantages. Explore detailed comparisons of latency effects and technology infrastructures behind HFT and execution algorithms to enhance trading strategies.

Order slicing

High-frequency trading (HFT) leverages ultra-fast algorithms to capitalize on market inefficiencies, whereas execution algorithms primarily focus on order slicing to minimize market impact and optimize trade execution. Order slicing involves breaking large orders into smaller, strategically timed trades to reduce price slippage and achieve better average fill prices. Discover how advanced order slicing strategies enhance execution quality and trading efficiency.

Market microstructure

High-frequency trading (HFT) exploits market microstructure by leveraging ultra-low latency and advanced algorithms to capitalize on short-term price inefficiencies and liquidity imbalances. Execution algorithms, in contrast, optimize trade execution by minimizing market impact and timing, often slicing large orders strategically to align with prevailing market conditions and microstructure elements like order book dynamics. Explore detailed insights on how market microstructure influences these trading strategies for enhanced understanding.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) uses powerful computers and advanced algorithms to execute an enormous number of trades in microseconds, capitalizing on tiny price differences across exchanges to generate profits through rapid, automated arbitrage.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading featuring extremely fast trade execution and high transaction volume, used mainly by large institutions to profit from very small price fluctuations and improve market liquidity by narrowing bid-ask spreads.

High-frequency trading - Wikipedia - HFT is a quantitative, high-speed, automated trading system that exploits minute market inefficiencies with strategies such as market-making, arbitrage, and latency arbitrage, based on processing large data volumes faster than human traders.

dowidth.com

dowidth.com