Volatility harvesting involves exploiting fluctuations in market volatility to generate consistent returns by rebalancing portfolios strategically. Calendar spreads, a popular options trading strategy, capitalize on differences in implied volatility and time decay between near-term and longer-term contracts. Explore further to understand how these approaches can enhance your trading performance.

Why it is important

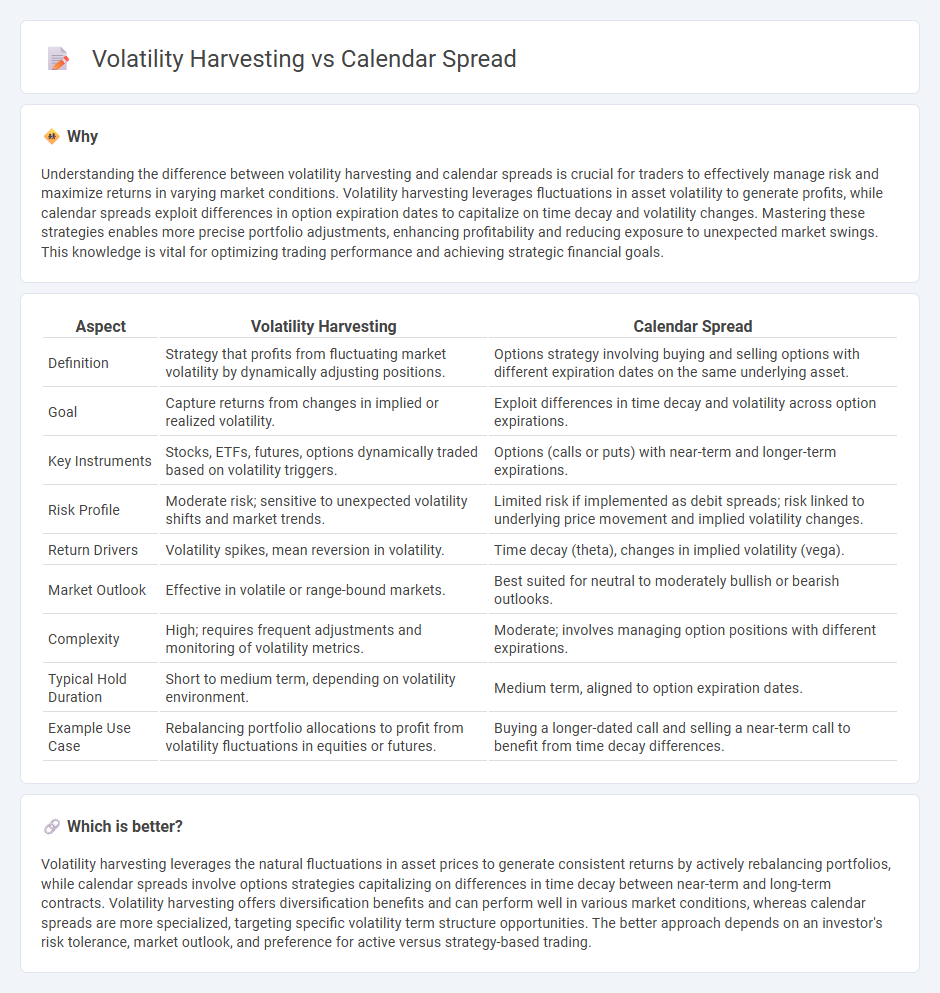

Understanding the difference between volatility harvesting and calendar spreads is crucial for traders to effectively manage risk and maximize returns in varying market conditions. Volatility harvesting leverages fluctuations in asset volatility to generate profits, while calendar spreads exploit differences in option expiration dates to capitalize on time decay and volatility changes. Mastering these strategies enables more precise portfolio adjustments, enhancing profitability and reducing exposure to unexpected market swings. This knowledge is vital for optimizing trading performance and achieving strategic financial goals.

Comparison Table

| Aspect | Volatility Harvesting | Calendar Spread |

|---|---|---|

| Definition | Strategy that profits from fluctuating market volatility by dynamically adjusting positions. | Options strategy involving buying and selling options with different expiration dates on the same underlying asset. |

| Goal | Capture returns from changes in implied or realized volatility. | Exploit differences in time decay and volatility across option expirations. |

| Key Instruments | Stocks, ETFs, futures, options dynamically traded based on volatility triggers. | Options (calls or puts) with near-term and longer-term expirations. |

| Risk Profile | Moderate risk; sensitive to unexpected volatility shifts and market trends. | Limited risk if implemented as debit spreads; risk linked to underlying price movement and implied volatility changes. |

| Return Drivers | Volatility spikes, mean reversion in volatility. | Time decay (theta), changes in implied volatility (vega). |

| Market Outlook | Effective in volatile or range-bound markets. | Best suited for neutral to moderately bullish or bearish outlooks. |

| Complexity | High; requires frequent adjustments and monitoring of volatility metrics. | Moderate; involves managing option positions with different expirations. |

| Typical Hold Duration | Short to medium term, depending on volatility environment. | Medium term, aligned to option expiration dates. |

| Example Use Case | Rebalancing portfolio allocations to profit from volatility fluctuations in equities or futures. | Buying a longer-dated call and selling a near-term call to benefit from time decay differences. |

Which is better?

Volatility harvesting leverages the natural fluctuations in asset prices to generate consistent returns by actively rebalancing portfolios, while calendar spreads involve options strategies capitalizing on differences in time decay between near-term and long-term contracts. Volatility harvesting offers diversification benefits and can perform well in various market conditions, whereas calendar spreads are more specialized, targeting specific volatility term structure opportunities. The better approach depends on an investor's risk tolerance, market outlook, and preference for active versus strategy-based trading.

Connection

Volatility harvesting leverages market fluctuations to generate returns, while calendar spreads exploit price differences between near-term and longer-term options contracts. Both strategies benefit from volatility changes but operate through distinct mechanisms: volatility harvesting captures gains from asset price swings, whereas calendar spreads profit from differences in implied volatility and time decay. Combining these approaches enables traders to optimize risk-adjusted returns by capitalizing on temporal and volatility arbitrage opportunities.

Key Terms

Time Decay (Theta)

Calendar spreads capitalize on time decay (Theta) by simultaneously buying longer-dated options and selling shorter-dated options, profiting as the near-term option's value erodes faster. Volatility harvesting leverages differences in implied volatility to generate returns, often minimizing exposure to Theta by actively managing option positions around volatility shifts. Explore in-depth strategies to optimize returns through precise time decay and volatility management techniques.

Implied Volatility

Calendar spreads capitalize on differences in implied volatility (IV) across option expiration dates by simultaneously buying longer-dated options and selling shorter-dated ones, profiting when near-term volatility decreases relative to long-term. Volatility harvesting involves strategically trading options to exploit oscillations in IV, aiming to capture profits from IV mean reversion while managing exposure to volatility skew and term structure. Explore deeper techniques to optimize implied volatility strategies and enhance returns.

Mean Reversion

Calendar spreads exploit mean reversion by capitalizing on the typically lower implied volatility of short-term options relative to long-term options, benefiting from the convergence of prices as expiration approaches. Volatility harvesting strategies aim to profit from fluctuations in actual volatility versus implied volatility, often by continuously adjusting positions to capture gains when prices revert to their mean levels. Explore detailed methodologies and performance insights to better understand how mean reversion drives these advanced trading techniques.

Source and External Links

Calendar spread - Wikipedia - A calendar spread is an options or futures strategy where you simultaneously buy and sell the same instrument with the same strike price but different expiration dates, aiming to profit from differences in time decay or implied volatility between the two legs.

What is a Calendar Spread Option? - tastylive - This low-risk, directionally neutral strategy profits mainly from the passage of time and/or an increase in implied volatility, often involving selling a near-term option and buying a longer-term option on the same underlying.

Option Calendar Spreads - CME Group - Traders use calendar spreads to reduce the cost of holding a longer-dated option by selling a nearer-term option, making the strategy attractive when expecting stable prices until the first expiration.

dowidth.com

dowidth.com