Algorithmic arbitrage leverages automated systems to exploit price discrepancies across multiple markets, ensuring rapid and precise execution of trades. Order flow analysis focuses on interpreting the real-time buying and selling pressure to predict price movements and optimize trade timing. Discover how combining these advanced trading strategies can enhance market efficiency and profitability.

Why it is important

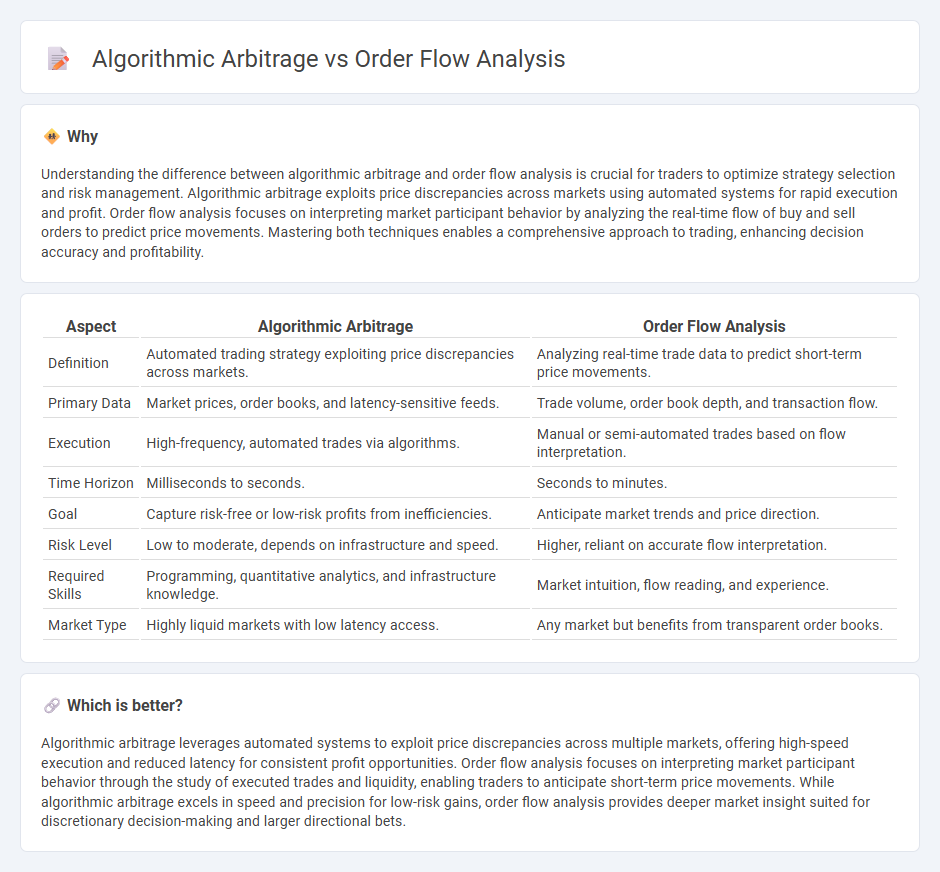

Understanding the difference between algorithmic arbitrage and order flow analysis is crucial for traders to optimize strategy selection and risk management. Algorithmic arbitrage exploits price discrepancies across markets using automated systems for rapid execution and profit. Order flow analysis focuses on interpreting market participant behavior by analyzing the real-time flow of buy and sell orders to predict price movements. Mastering both techniques enables a comprehensive approach to trading, enhancing decision accuracy and profitability.

Comparison Table

| Aspect | Algorithmic Arbitrage | Order Flow Analysis |

|---|---|---|

| Definition | Automated trading strategy exploiting price discrepancies across markets. | Analyzing real-time trade data to predict short-term price movements. |

| Primary Data | Market prices, order books, and latency-sensitive feeds. | Trade volume, order book depth, and transaction flow. |

| Execution | High-frequency, automated trades via algorithms. | Manual or semi-automated trades based on flow interpretation. |

| Time Horizon | Milliseconds to seconds. | Seconds to minutes. |

| Goal | Capture risk-free or low-risk profits from inefficiencies. | Anticipate market trends and price direction. |

| Risk Level | Low to moderate, depends on infrastructure and speed. | Higher, reliant on accurate flow interpretation. |

| Required Skills | Programming, quantitative analytics, and infrastructure knowledge. | Market intuition, flow reading, and experience. |

| Market Type | Highly liquid markets with low latency access. | Any market but benefits from transparent order books. |

Which is better?

Algorithmic arbitrage leverages automated systems to exploit price discrepancies across multiple markets, offering high-speed execution and reduced latency for consistent profit opportunities. Order flow analysis focuses on interpreting market participant behavior through the study of executed trades and liquidity, enabling traders to anticipate short-term price movements. While algorithmic arbitrage excels in speed and precision for low-risk gains, order flow analysis provides deeper market insight suited for discretionary decision-making and larger directional bets.

Connection

Algorithmic arbitrage leverages real-time order flow analysis to identify and exploit price discrepancies across markets, enabling automated execution of trades with minimal latency. By analyzing the sequence and volume of buy and sell orders, algorithms detect imbalances and liquidity shifts that signal arbitrage opportunities. This integration enhances market efficiency and profitability by capitalizing on transient price differentials before they dissipate.

Key Terms

**Order Flow Analysis:**

Order Flow Analysis examines real-time market data to track buy and sell orders, providing insight into market sentiment and liquidity. This method helps traders anticipate price movements by identifying the actual supply and demand behind trades rather than relying solely on price charts. Explore how understanding order flow can enhance your trading strategy and decision-making.

Market Depth

Order flow analysis leverages real-time transaction data to gauge market sentiment and predict short-term price movements by examining bid and ask volume changes within market depth. Algorithmic arbitrage exploits price inefficiencies across multiple markets, using automated systems that rapidly execute trades based on order book imbalances and liquidity disparities reflected in market depth. Explore the intricate relationship between order flow analysis and algorithmic arbitrage to enhance trading strategies grounded in market depth insights.

Order Book

Order flow analysis examines the real-time transactions and order placements within the order book to predict short-term price movements based on supply and demand imbalances. Algorithmic arbitrage uses automated strategies to exploit price discrepancies across markets by quickly analyzing and responding to order book data and market signals. Explore the detailed mechanics of order book dynamics to enhance trading strategies and gain a competitive edge.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, by reading the order book and analyzing volume clusters to predict price movements and identify support and resistance levels.

Order Flow Trading Strategy That Pros Are Using In 2024 - Order flow trading is a technical analysis method that tracks the actual executed buy and sell orders (market orders) to anticipate price changes, often using indicators like volume profile, order book imbalance, delta, and cumulative delta alongside price action analysis.

Order Flow Trading & Volumetric Bars | NinjaTrader - This method visualizes buying and selling pressure with tools such as volumetric bars, volume profile, VWAP, and cumulative delta to identify support/resistance zones, market strength, and potential reversals through detailed order flow data.

dowidth.com

dowidth.com