Tokenized assets represent ownership in real-world items digitized on a blockchain, offering direct exposure and enhanced liquidity, while futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a future date, primarily used for hedging or speculation. Tokenized assets provide fractional ownership and transparency, whereas futures enable leverage and price discovery in regulated markets. Explore the nuances of tokenized assets versus futures to optimize your trading strategy.

Why it is important

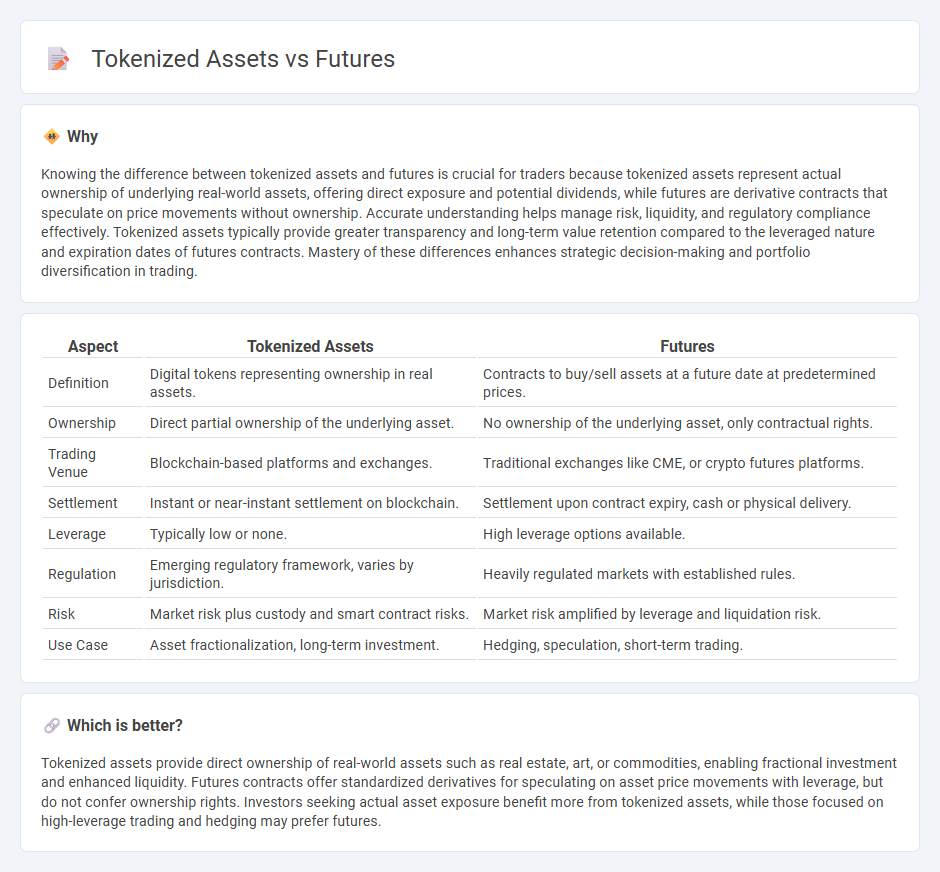

Knowing the difference between tokenized assets and futures is crucial for traders because tokenized assets represent actual ownership of underlying real-world assets, offering direct exposure and potential dividends, while futures are derivative contracts that speculate on price movements without ownership. Accurate understanding helps manage risk, liquidity, and regulatory compliance effectively. Tokenized assets typically provide greater transparency and long-term value retention compared to the leveraged nature and expiration dates of futures contracts. Mastery of these differences enhances strategic decision-making and portfolio diversification in trading.

Comparison Table

| Aspect | Tokenized Assets | Futures |

|---|---|---|

| Definition | Digital tokens representing ownership in real assets. | Contracts to buy/sell assets at a future date at predetermined prices. |

| Ownership | Direct partial ownership of the underlying asset. | No ownership of the underlying asset, only contractual rights. |

| Trading Venue | Blockchain-based platforms and exchanges. | Traditional exchanges like CME, or crypto futures platforms. |

| Settlement | Instant or near-instant settlement on blockchain. | Settlement upon contract expiry, cash or physical delivery. |

| Leverage | Typically low or none. | High leverage options available. |

| Regulation | Emerging regulatory framework, varies by jurisdiction. | Heavily regulated markets with established rules. |

| Risk | Market risk plus custody and smart contract risks. | Market risk amplified by leverage and liquidation risk. |

| Use Case | Asset fractionalization, long-term investment. | Hedging, speculation, short-term trading. |

Which is better?

Tokenized assets provide direct ownership of real-world assets such as real estate, art, or commodities, enabling fractional investment and enhanced liquidity. Futures contracts offer standardized derivatives for speculating on asset price movements with leverage, but do not confer ownership rights. Investors seeking actual asset exposure benefit more from tokenized assets, while those focused on high-leverage trading and hedging may prefer futures.

Connection

Tokenized assets enable fractional ownership and liquidity of real-world assets on blockchain platforms, while futures contracts provide standardized agreements to buy or sell these assets at predetermined prices in the future. The integration of tokenized assets with futures markets enhances price discovery, hedging opportunities, and market accessibility by allowing traders to speculate and manage risks based on tokenized representations of underlying assets. This synergy facilitates seamless trading of traditionally illiquid assets through digital derivatives, expanding participation and efficiency across global financial markets.

Key Terms

Leverage

Futures contracts allow traders to use high leverage, sometimes up to 100x, enabling significant exposure to asset price movements with relatively small capital. Tokenized assets typically offer lower leverage, often around 2x to 5x, balancing risk and regulatory compliance while maintaining liquidity and transparency on blockchain platforms. Explore the differences in leverage strategies between futures and tokenized assets to optimize your trading approach.

Ownership

Futures contracts grant investors exposure to the price movements of underlying assets without conferring direct ownership rights, making them primarily speculative instruments. Tokenized assets represent real-world assets on a blockchain, offering fractional ownership and transparent proof of possession through smart contracts. Explore how the distinction between futures and tokenized assets reshapes investment strategies and asset management.

Settlement

Futures contracts settle based on predetermined dates either through cash settlement or physical delivery, ensuring standardized and regulated transactions on established exchanges. Tokenized assets settle via blockchain technology, enabling near-instant, transparent, and immutable ownership transfers recorded on distributed ledgers. Explore deeper insights into settlement mechanisms by understanding how these approaches impact liquidity and security.

Source and External Links

Futures contract - Wikipedia - Futures are standardized legal agreements to buy or sell assets at predetermined prices and dates, initially developed for commodities and now including financial instruments like stock and currency futures, used for hedging and speculation in markets.

What Are Futures? | Charles Schwab Futures and Forex - Futures are derivative contracts to buy or sell specific assets on a future date at a set price, offering capital efficiency through leverage but also carrying high risk, widely used for speculation and hedging.

Commodity Futures Trading Commission | CFTC - The CFTC regulates futures trading in the US, providing oversight to protect against fraud, ensuring market transparency and compliance through reporting, enforcement, and guidance for market participants.

dowidth.com

dowidth.com