Grid trading involves placing buy and sell orders at regular intervals within a predefined price range to capitalize on market fluctuations, while breakout trading focuses on entering positions when the price moves beyond established support or resistance levels, signaling a potential trend. Grid trading excels in sideways markets by capturing profits from oscillations, whereas breakout trading seeks to benefit from strong directional moves and volatility spikes. Explore the nuances and strategies of grid trading versus breakout trading to optimize your trading performance.

Why it is important

Understanding the difference between grid trading and breakout trading is crucial for optimizing risk management and profit potential in volatile markets. Grid trading involves placing buy and sell orders at preset intervals to capitalize on market fluctuations regardless of direction, while breakout trading focuses on entering positions when price moves beyond established support or resistance levels to catch strong trends. Traders skilled in distinguishing these strategies can tailor their approach to market conditions, enhancing strategic decision-making and portfolio performance. Mastering their differences allows for better alignment with individual risk tolerance and trading goals.

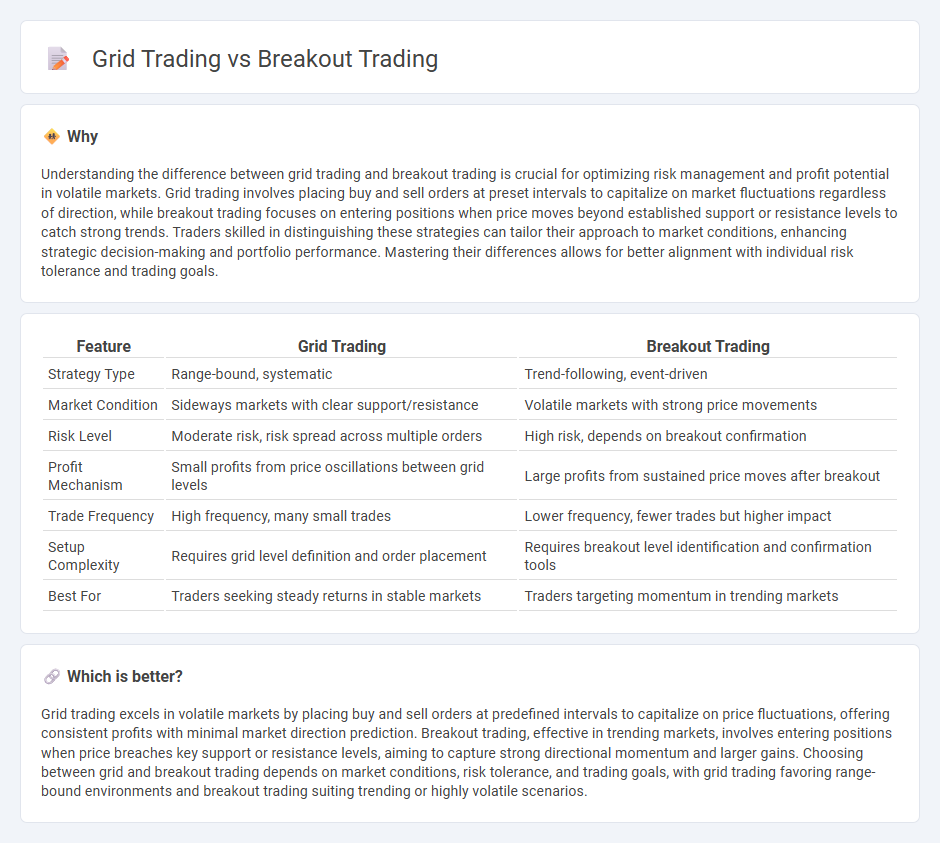

Comparison Table

| Feature | Grid Trading | Breakout Trading |

|---|---|---|

| Strategy Type | Range-bound, systematic | Trend-following, event-driven |

| Market Condition | Sideways markets with clear support/resistance | Volatile markets with strong price movements |

| Risk Level | Moderate risk, risk spread across multiple orders | High risk, depends on breakout confirmation |

| Profit Mechanism | Small profits from price oscillations between grid levels | Large profits from sustained price moves after breakout |

| Trade Frequency | High frequency, many small trades | Lower frequency, fewer trades but higher impact |

| Setup Complexity | Requires grid level definition and order placement | Requires breakout level identification and confirmation tools |

| Best For | Traders seeking steady returns in stable markets | Traders targeting momentum in trending markets |

Which is better?

Grid trading excels in volatile markets by placing buy and sell orders at predefined intervals to capitalize on price fluctuations, offering consistent profits with minimal market direction prediction. Breakout trading, effective in trending markets, involves entering positions when price breaches key support or resistance levels, aiming to capture strong directional momentum and larger gains. Choosing between grid and breakout trading depends on market conditions, risk tolerance, and trading goals, with grid trading favoring range-bound environments and breakout trading suiting trending or highly volatile scenarios.

Connection

Grid trading and breakout trading are connected through their reliance on market volatility and price levels to generate profits. Grid trading systematically places buy and sell orders at predefined intervals, capitalizing on price fluctuations within a range, while breakout trading focuses on entering positions when price moves decisively beyond support or resistance levels. Both strategies leverage market momentum, using predetermined entry and exit points to maximize gains during trending or volatile market conditions.

Key Terms

**Breakout Trading:**

Breakout trading capitalizes on price movements that surpass established support or resistance levels, signaling potential strong trends and increased volatility essential for profitable trades. This strategy relies heavily on identifying key breakout points using technical indicators like volume spikes and moving averages to confirm momentum. Explore our detailed guide to master breakout trading techniques and optimize your market entries.

Support/Resistance

Breakout trading targets price movements beyond established support and resistance levels, capitalizing on strong momentum and potential trend formation, while grid trading operates by placing buy and sell orders at predefined intervals around these levels to profit from price fluctuations within a range. Breakout strategies rely heavily on accurate identification of critical support and resistance points to enter positions during volatility expansions, whereas grid trading seeks to benefit from market retracements and consolidations without predicting trend directions. Explore deeper insights into how support and resistance influence these trading methods to optimize your strategy accuracy.

Volatility

Breakout trading capitalizes on significant volatility spikes to enter positions as prices move beyond established support or resistance levels, aiming to capture large market moves. Grid trading capitalizes on market volatility by placing buy and sell orders at set intervals, profiting from price fluctuations within a defined range without predicting directional movement. Explore detailed strategies and risk management techniques to enhance your understanding of both volatility-focused trading styles.

Source and External Links

What is Breakout Trading? Meaning, Types, Strategies & More - Breakout trading is a strategy where traders enter the market when the price of a security moves beyond a predefined support or resistance level, aiming to profit from emerging trends and directional price movements.

Breakout Trading | IG AU - Breakout trading focuses on entering trades once a security breaches a key support or resistance level, capitalizing on significant price movements that often signal shifts in market sentiment and increased volatility.

Breakout Strategy - Definition, Types, Advantages & Limitations - In breakout trading, traders buy or sell assets after they break important support or resistance levels, often using technical indicators and volume analysis to confirm the strength and direction of the breakout.

dowidth.com

dowidth.com