Trade journaling software captures detailed records of trading activities, performance metrics, and strategic insights for continuous improvement. Execution management systems (EMS) focus on the real-time execution of orders across multiple markets with advanced routing and order management capabilities. Explore how choosing between trade journaling software and an EMS can optimize your trading strategy and operational efficiency.

Why it is important

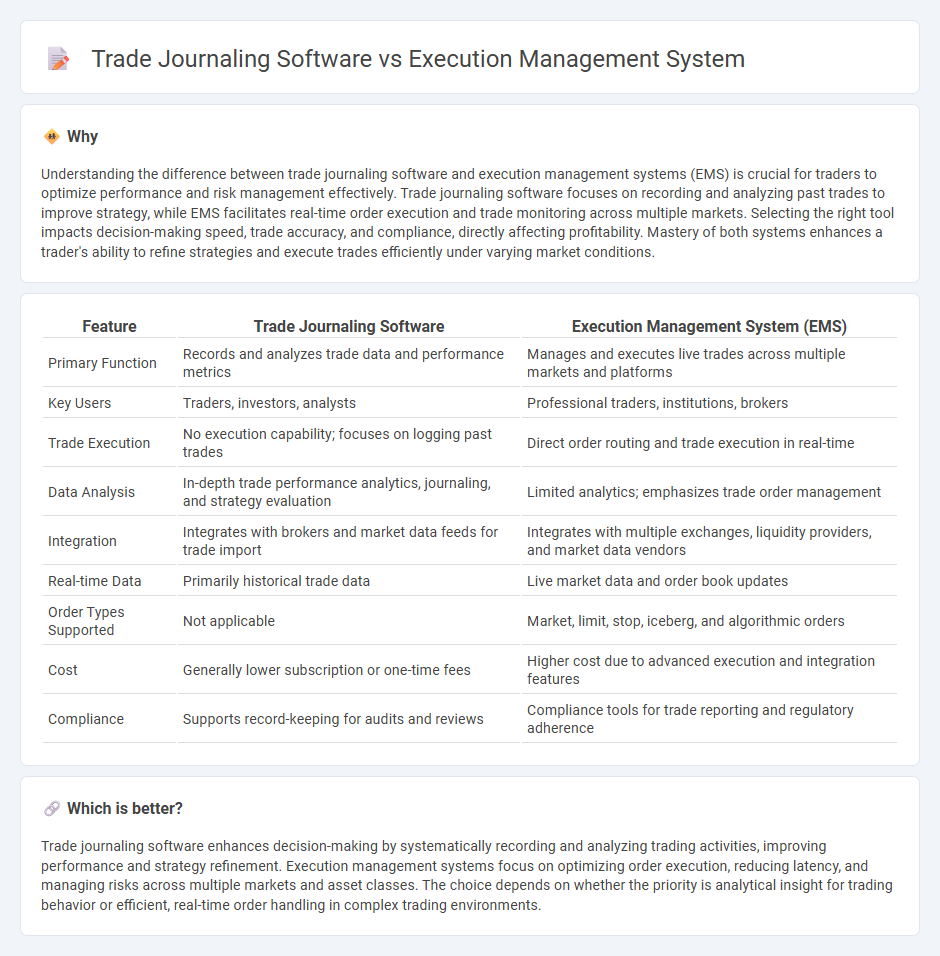

Understanding the difference between trade journaling software and execution management systems (EMS) is crucial for traders to optimize performance and risk management effectively. Trade journaling software focuses on recording and analyzing past trades to improve strategy, while EMS facilitates real-time order execution and trade monitoring across multiple markets. Selecting the right tool impacts decision-making speed, trade accuracy, and compliance, directly affecting profitability. Mastery of both systems enhances a trader's ability to refine strategies and execute trades efficiently under varying market conditions.

Comparison Table

| Feature | Trade Journaling Software | Execution Management System (EMS) |

|---|---|---|

| Primary Function | Records and analyzes trade data and performance metrics | Manages and executes live trades across multiple markets and platforms |

| Key Users | Traders, investors, analysts | Professional traders, institutions, brokers |

| Trade Execution | No execution capability; focuses on logging past trades | Direct order routing and trade execution in real-time |

| Data Analysis | In-depth trade performance analytics, journaling, and strategy evaluation | Limited analytics; emphasizes trade order management |

| Integration | Integrates with brokers and market data feeds for trade import | Integrates with multiple exchanges, liquidity providers, and market data vendors |

| Real-time Data | Primarily historical trade data | Live market data and order book updates |

| Order Types Supported | Not applicable | Market, limit, stop, iceberg, and algorithmic orders |

| Cost | Generally lower subscription or one-time fees | Higher cost due to advanced execution and integration features |

| Compliance | Supports record-keeping for audits and reviews | Compliance tools for trade reporting and regulatory adherence |

Which is better?

Trade journaling software enhances decision-making by systematically recording and analyzing trading activities, improving performance and strategy refinement. Execution management systems focus on optimizing order execution, reducing latency, and managing risks across multiple markets and asset classes. The choice depends on whether the priority is analytical insight for trading behavior or efficient, real-time order handling in complex trading environments.

Connection

Trade journaling software captures detailed records of trading activities, including entry and exit points, trade rationale, and performance metrics, enabling traders to analyze historical data effectively. Execution management systems (EMS) facilitate the real-time execution of trades across multiple markets and asset classes, optimizing order routing and minimizing latency. Integration between trade journaling software and EMS allows for seamless synchronization of trade execution data, enhancing accuracy in performance tracking and enabling data-driven strategy improvements.

Key Terms

**Execution Management System:**

An Execution Management System (EMS) streamlines the order execution process by integrating order routing, real-time market data, and risk controls to optimize trading strategies and reduce latency. It provides traders with advanced algorithms, customizable dashboards, and direct market access to enhance trade efficiency and compliance. Explore how top EMS platforms improve decision-making and execution precision in fast-paced trading environments.

Order Routing

Execution management systems (EMS) specialize in advanced order routing, enabling traders to send orders directly to multiple liquidity venues for faster execution and better price discovery. Trade journaling software primarily focuses on recording and analyzing past trades rather than optimizing the real-time order routing process. Explore how robust order routing capabilities can enhance trading efficiency by learning more about EMS functionalities.

Trade Execution

Execution management systems (EMS) enable traders to efficiently route and execute orders across multiple trading venues with real-time market data integration, ensuring optimal trade performance and reduced latency. Trade journaling software primarily focuses on recording and analyzing past trades to improve strategies, lacking direct order execution capabilities. Explore the key differences to determine which tool best enhances your trade execution workflow.

Source and External Links

Guide to Execution Management System (EMS) - An EMS is a software platform for traders to execute trades rapidly, featuring real-time market data, advanced execution options, liquidity management, and transaction cost analysis, often integrated with order management systems for seamless trading workflows.

What is Execution Management? - Execution Management refers to enterprise software like Celonis EMS that drives intelligent orchestration by integrating data, automation, and real-time action to improve business or trading performance.

Execution management system - An EMS is a trader application providing access to market data and multiple trading venues with broker and independent algorithms, enabling management of orders across diverse exchanges and networks for efficient order execution.

dowidth.com

dowidth.com