Delta hedging involves managing the directional risk of an options portfolio by offsetting changes in the underlying asset's price through strategic buying or selling. Vega hedging focuses on minimizing exposure to volatility fluctuations by adjusting positions sensitive to implied volatility shifts. Explore the differences between delta hedging and vega hedging to optimize your options trading strategy effectively.

Why it is important

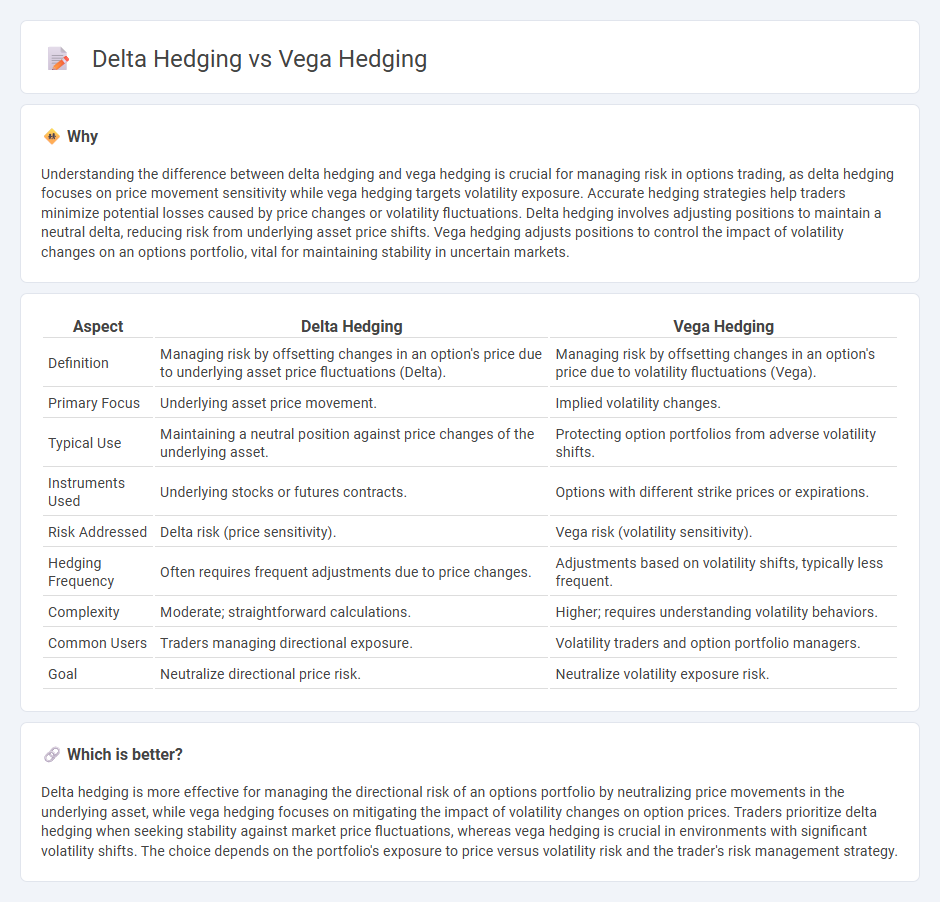

Understanding the difference between delta hedging and vega hedging is crucial for managing risk in options trading, as delta hedging focuses on price movement sensitivity while vega hedging targets volatility exposure. Accurate hedging strategies help traders minimize potential losses caused by price changes or volatility fluctuations. Delta hedging involves adjusting positions to maintain a neutral delta, reducing risk from underlying asset price shifts. Vega hedging adjusts positions to control the impact of volatility changes on an options portfolio, vital for maintaining stability in uncertain markets.

Comparison Table

| Aspect | Delta Hedging | Vega Hedging |

|---|---|---|

| Definition | Managing risk by offsetting changes in an option's price due to underlying asset price fluctuations (Delta). | Managing risk by offsetting changes in an option's price due to volatility fluctuations (Vega). |

| Primary Focus | Underlying asset price movement. | Implied volatility changes. |

| Typical Use | Maintaining a neutral position against price changes of the underlying asset. | Protecting option portfolios from adverse volatility shifts. |

| Instruments Used | Underlying stocks or futures contracts. | Options with different strike prices or expirations. |

| Risk Addressed | Delta risk (price sensitivity). | Vega risk (volatility sensitivity). |

| Hedging Frequency | Often requires frequent adjustments due to price changes. | Adjustments based on volatility shifts, typically less frequent. |

| Complexity | Moderate; straightforward calculations. | Higher; requires understanding volatility behaviors. |

| Common Users | Traders managing directional exposure. | Volatility traders and option portfolio managers. |

| Goal | Neutralize directional price risk. | Neutralize volatility exposure risk. |

Which is better?

Delta hedging is more effective for managing the directional risk of an options portfolio by neutralizing price movements in the underlying asset, while vega hedging focuses on mitigating the impact of volatility changes on option prices. Traders prioritize delta hedging when seeking stability against market price fluctuations, whereas vega hedging is crucial in environments with significant volatility shifts. The choice depends on the portfolio's exposure to price versus volatility risk and the trader's risk management strategy.

Connection

Delta hedging and vega hedging are connected through their role in options trading risk management by targeting different Greeks: delta hedging minimizes price risk from underlying asset movements, while vega hedging addresses volatility risk fluctuations. Both strategies are essential for maintaining a neutral position to protect portfolios from adverse market changes. Effective implementation requires continuous adjustments to option positions based on underlying price and implied volatility shifts.

Key Terms

Vega

Vega hedging manages the risk associated with changes in an option's implied volatility by adjusting positions in options with different vega exposures, whereas delta hedging focuses on neutralizing price risk from underlying asset movements. Vega represents sensitivity to volatility fluctuations, crucial for traders in volatile markets or with options sensitive to volatility shifts. Explore detailed strategies and applications of vega hedging to optimize portfolio risk management.

Delta

Delta hedging focuses on neutralizing the directional risk of an option position by adjusting the underlying asset quantity to maintain a delta-neutral portfolio, effectively managing price movements. Vega hedging, in contrast, targets volatility risk by using options to offset changes in implied volatility rather than price. Explore deeper insights on advanced hedging techniques and portfolio risk management strategies.

Options

Vega hedging involves managing an option's sensitivity to volatility changes, crucial for traders anticipating market swings, while delta hedging focuses on neutralizing price movements of the underlying asset to maintain a balanced position. Options traders use vega hedging to protect portfolios from implied volatility shifts, whereas delta hedging ensures minimal risk from directional price changes. Explore advanced strategies to optimize both vega and delta hedging for effective options risk management.

Source and External Links

Mastering Vega Hedging Strategies - Number Analytics - Vega hedging involves taking positions to offset the vega risk of an options portfolio, aiming to minimize the impact of volatility changes by assessing vega exposure, selecting appropriate hedging instruments, calculating hedge ratios, executing the hedge, and continuously monitoring and adjusting the position.

Vega hedge: The Vega Hedge: Mitigating Risk in Options Trading - Vega hedging is a risk management strategy that uses options (long or short) to offset the impact of implied volatility changes on portfolio value, including strategies like long vega, short vega, and vega-neutral positions such as long straddles to manage volatility risk effectively.

Vega Neutral - Overview, How It Works, How To Create - Vega neutral is a strategy to create a portfolio with a total vega of zero by balancing positive and negative vega positions, so that changes in implied volatility do not affect the portfolio's value, often achieved by calculating and adjusting the number of options held to offset total vega exposure.

dowidth.com

dowidth.com