Funded account programs provide traders with capital from proprietary firms to trade using professional strategies while retaining a share of profits, offering a risk-mitigated pathway to scale trading skills. Investment clubs pool resources from members to collectively invest in markets, emphasizing shared decision-making and collaborative returns over individual trading prowess. Explore the distinctions and benefits of each to determine the best fit for your trading ambitions.

Why it is important

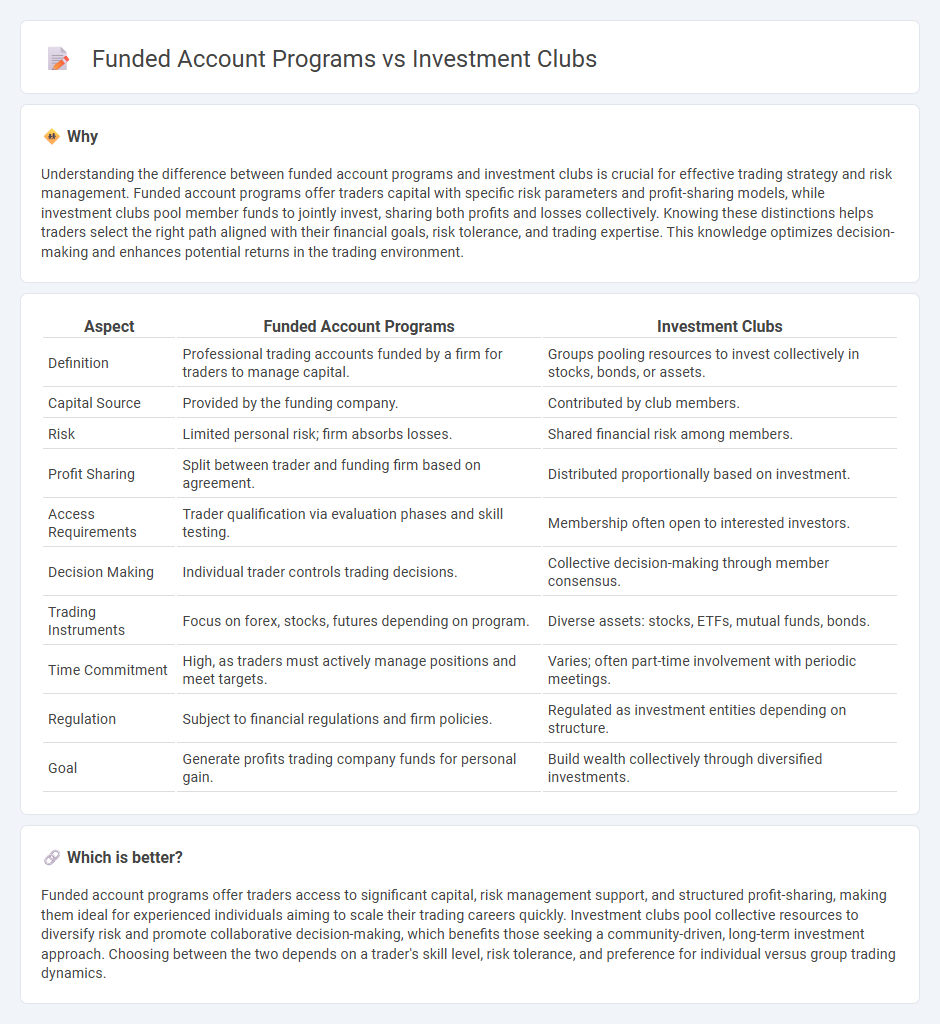

Understanding the difference between funded account programs and investment clubs is crucial for effective trading strategy and risk management. Funded account programs offer traders capital with specific risk parameters and profit-sharing models, while investment clubs pool member funds to jointly invest, sharing both profits and losses collectively. Knowing these distinctions helps traders select the right path aligned with their financial goals, risk tolerance, and trading expertise. This knowledge optimizes decision-making and enhances potential returns in the trading environment.

Comparison Table

| Aspect | Funded Account Programs | Investment Clubs |

|---|---|---|

| Definition | Professional trading accounts funded by a firm for traders to manage capital. | Groups pooling resources to invest collectively in stocks, bonds, or assets. |

| Capital Source | Provided by the funding company. | Contributed by club members. |

| Risk | Limited personal risk; firm absorbs losses. | Shared financial risk among members. |

| Profit Sharing | Split between trader and funding firm based on agreement. | Distributed proportionally based on investment. |

| Access Requirements | Trader qualification via evaluation phases and skill testing. | Membership often open to interested investors. |

| Decision Making | Individual trader controls trading decisions. | Collective decision-making through member consensus. |

| Trading Instruments | Focus on forex, stocks, futures depending on program. | Diverse assets: stocks, ETFs, mutual funds, bonds. |

| Time Commitment | High, as traders must actively manage positions and meet targets. | Varies; often part-time involvement with periodic meetings. |

| Regulation | Subject to financial regulations and firm policies. | Regulated as investment entities depending on structure. |

| Goal | Generate profits trading company funds for personal gain. | Build wealth collectively through diversified investments. |

Which is better?

Funded account programs offer traders access to significant capital, risk management support, and structured profit-sharing, making them ideal for experienced individuals aiming to scale their trading careers quickly. Investment clubs pool collective resources to diversify risk and promote collaborative decision-making, which benefits those seeking a community-driven, long-term investment approach. Choosing between the two depends on a trader's skill level, risk tolerance, and preference for individual versus group trading dynamics.

Connection

Funded account programs provide traders with capital to execute trades without risking personal funds, aligning closely with investment clubs that pool resources to increase market exposure. Both models emphasize collective financial management and risk sharing, enhancing capital efficiency and scaling trading opportunities. By leveraging shared expertise and funds, these structures optimize portfolio growth and risk mitigation in diverse market conditions.

Key Terms

**Investment Clubs:**

Investment clubs pool resources from individual members to collectively invest in stocks, bonds, or other assets, fostering shared decision-making and financial education. Members benefit from diversified portfolios and lower entry costs, leveraging combined capital for greater market influence. Discover how joining an investment club can enhance your investment strategy and community involvement.

Pooling capital

Investment clubs pool capital from multiple members who contribute funds and collectively make decisions on investments, promoting shared responsibility and diversified portfolios. Funded account programs provide individual traders with capital from a sponsoring firm, allowing them to trade using pooled company resources while receiving a share of the profits without risking personal funds. Explore the advantages and structures of these capital pooling methods to determine which aligns best with your investment goals.

Group decision-making

Investment clubs emphasize collaborative group decision-making, where members pool resources and share responsibility for investment choices, fostering diverse perspectives and collective learning. Funded account programs, however, typically assign trading decisions to individual traders backed by the firm's capital, limiting group input but providing structured risk management and professional oversight. Explore the advantages and challenges of these models to determine which suits your investment strategy and goals.

Source and External Links

Investment club - Wikipedia - An investment club is a group of individuals who meet periodically to pool money and invest collectively, often combining education with joint investment decisions.

Investment Clubs: How To Join One Or Start Your Own | Bankrate - Investment clubs bring together like-minded people to discuss strategies, pool funds for joint investments, and educate members on investing, meeting regularly with elected roles and sometimes pooling money into shared portfolios.

Investment Clubs and the SEC - The SEC generally does not regulate investment clubs, which may either pool money to invest jointly or research investments together while investing individually, and each club determines if any registration is necessary.

dowidth.com

dowidth.com