Zero knowledge proof trading leverages cryptographic protocols to enable transaction validation without revealing sensitive information, enhancing privacy and security in digital asset exchanges. Over-the-counter (OTC) trading involves direct, private negotiations between parties, often for large volumes of securities, bypassing traditional public exchanges to reduce market impact and maintain confidentiality. Explore in-depth comparisons and implications for traders seeking optimized privacy and efficiency.

Why it is important

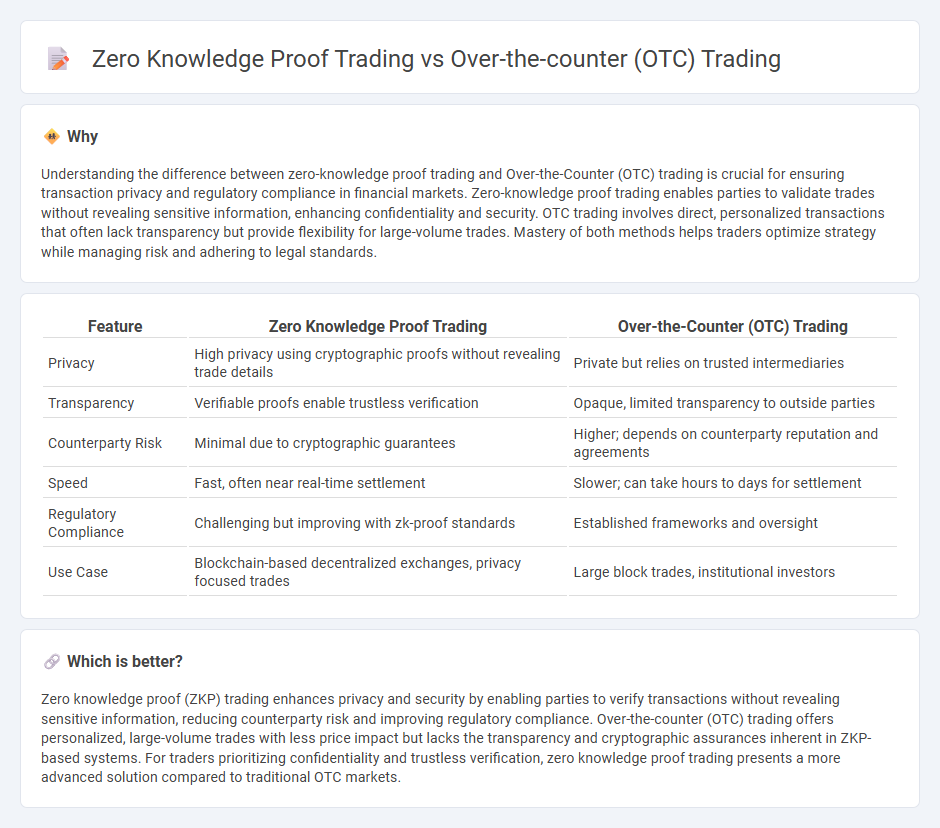

Understanding the difference between zero-knowledge proof trading and Over-the-Counter (OTC) trading is crucial for ensuring transaction privacy and regulatory compliance in financial markets. Zero-knowledge proof trading enables parties to validate trades without revealing sensitive information, enhancing confidentiality and security. OTC trading involves direct, personalized transactions that often lack transparency but provide flexibility for large-volume trades. Mastery of both methods helps traders optimize strategy while managing risk and adhering to legal standards.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Over-the-Counter (OTC) Trading |

|---|---|---|

| Privacy | High privacy using cryptographic proofs without revealing trade details | Private but relies on trusted intermediaries |

| Transparency | Verifiable proofs enable trustless verification | Opaque, limited transparency to outside parties |

| Counterparty Risk | Minimal due to cryptographic guarantees | Higher; depends on counterparty reputation and agreements |

| Speed | Fast, often near real-time settlement | Slower; can take hours to days for settlement |

| Regulatory Compliance | Challenging but improving with zk-proof standards | Established frameworks and oversight |

| Use Case | Blockchain-based decentralized exchanges, privacy focused trades | Large block trades, institutional investors |

Which is better?

Zero knowledge proof (ZKP) trading enhances privacy and security by enabling parties to verify transactions without revealing sensitive information, reducing counterparty risk and improving regulatory compliance. Over-the-counter (OTC) trading offers personalized, large-volume trades with less price impact but lacks the transparency and cryptographic assurances inherent in ZKP-based systems. For traders prioritizing confidentiality and trustless verification, zero knowledge proof trading presents a more advanced solution compared to traditional OTC markets.

Connection

Zero knowledge proof trading enhances Over-the-counter (OTC) trading by enabling private and secure transaction verification without revealing sensitive trade details. This cryptographic method ensures confidentiality and trust between OTC parties, reducing the risk of information leakage and fraud. Integrating zero knowledge proofs in OTC trading streamlines compliance while maintaining the decentralized and discreet nature of large-volume, off-exchange transactions.

Key Terms

Counterparty Risk

Over-the-counter (OTC) trading exposes participants to significant counterparty risk due to the lack of centralized clearing and reliance on bilateral agreements, increasing potential default scenarios. Zero-knowledge proof (ZKP) trading enhances security by enabling private transactions with cryptographic assurances, reducing counterparty risk through verifiable, trustless protocols. Discover how zero-knowledge proofs transform risk management in OTC markets by exploring their innovative applications and benefits.

Anonymity

Over-the-counter (OTC) trading offers increased privacy by enabling direct transactions between parties without public order books, reducing exposure of trade details. Zero knowledge proof (ZKP) trading enhances anonymity through cryptographic methods that verify transaction validity without revealing sensitive information. Explore how these approaches safeguard privacy in financial markets and their evolving impact on secure trading.

Settlement

Over-the-counter (OTC) trading involves direct negotiation and settlement between parties, often resulting in longer settlement times and increased counterparty risk. Zero knowledge proof trading utilizes cryptographic techniques to enable secure, private, and near-instant settlement without revealing sensitive transaction details, enhancing trust and efficiency. Explore how zero knowledge proofs revolutionize settlement processes and reduce risks in modern trading environments.

Source and External Links

What is the Over The Counter (OTC) market? - The OTC market is a decentralized trading system where financial instruments are traded through dealer networks or electronic platforms rather than centralized exchanges, offering flexibility and access to securities not listed on major exchanges but with less transparency and higher risk.

Over-the-Counter (OTC) - OTC trading involves securities exchanged directly between counterparties outside formal exchanges, through dealer networks, allowing customized contracts and benefiting companies unable to list on major exchanges while bearing credit risk concerns.

What is OTC trading? How to trade securities over-the-counter - OTC trading is the purchase and sale of financial instruments via decentralized networks and brokers outside traditional exchanges, facilitating transactions through electronic platforms or phone rather than a centralized order book.

dowidth.com

dowidth.com