Trade journaling software captures detailed records of trading activity, enabling performance analysis and strategy refinement through metrics and annotations. Order management systems (OMS) streamline trade execution by automating order placement, monitoring, and compliance across multiple asset classes and trading venues. Explore the differences and benefits of each solution to enhance your trading efficiency and decision-making.

Why it is important

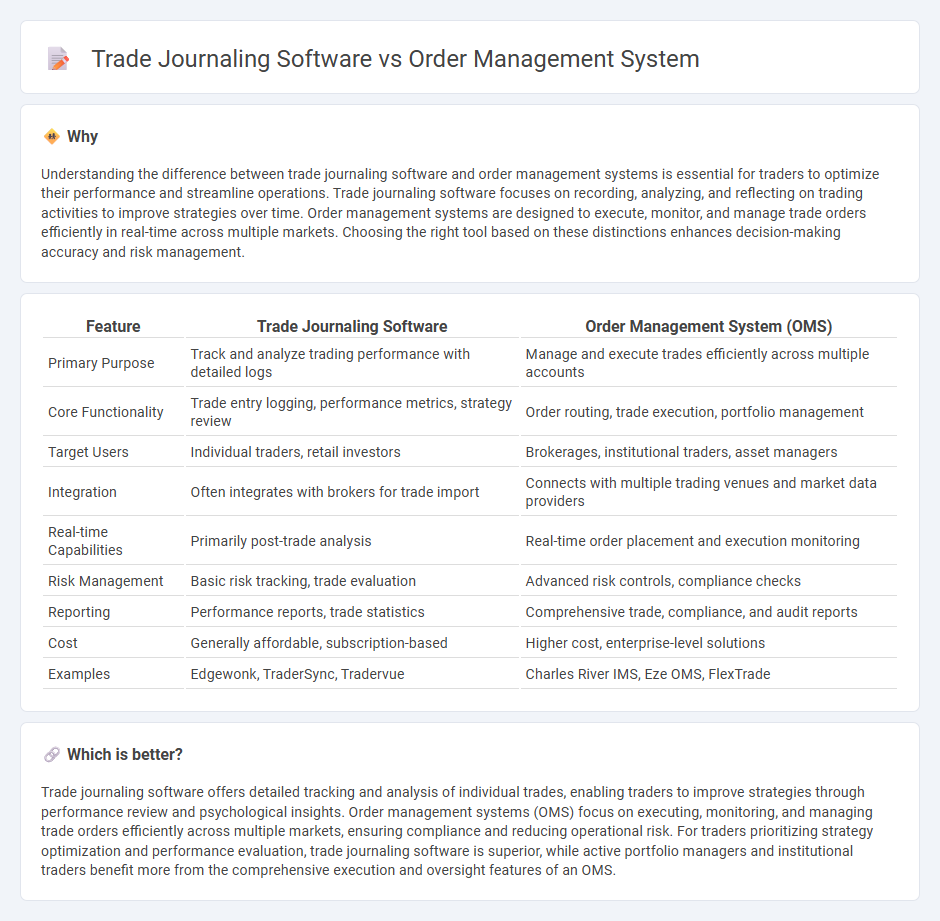

Understanding the difference between trade journaling software and order management systems is essential for traders to optimize their performance and streamline operations. Trade journaling software focuses on recording, analyzing, and reflecting on trading activities to improve strategies over time. Order management systems are designed to execute, monitor, and manage trade orders efficiently in real-time across multiple markets. Choosing the right tool based on these distinctions enhances decision-making accuracy and risk management.

Comparison Table

| Feature | Trade Journaling Software | Order Management System (OMS) |

|---|---|---|

| Primary Purpose | Track and analyze trading performance with detailed logs | Manage and execute trades efficiently across multiple accounts |

| Core Functionality | Trade entry logging, performance metrics, strategy review | Order routing, trade execution, portfolio management |

| Target Users | Individual traders, retail investors | Brokerages, institutional traders, asset managers |

| Integration | Often integrates with brokers for trade import | Connects with multiple trading venues and market data providers |

| Real-time Capabilities | Primarily post-trade analysis | Real-time order placement and execution monitoring |

| Risk Management | Basic risk tracking, trade evaluation | Advanced risk controls, compliance checks |

| Reporting | Performance reports, trade statistics | Comprehensive trade, compliance, and audit reports |

| Cost | Generally affordable, subscription-based | Higher cost, enterprise-level solutions |

| Examples | Edgewonk, TraderSync, Tradervue | Charles River IMS, Eze OMS, FlexTrade |

Which is better?

Trade journaling software offers detailed tracking and analysis of individual trades, enabling traders to improve strategies through performance review and psychological insights. Order management systems (OMS) focus on executing, monitoring, and managing trade orders efficiently across multiple markets, ensuring compliance and reducing operational risk. For traders prioritizing strategy optimization and performance evaluation, trade journaling software is superior, while active portfolio managers and institutional traders benefit more from the comprehensive execution and oversight features of an OMS.

Connection

Trade journaling software and order management systems (OMS) are interconnected through the seamless integration of real-time trading data and execution tracking. By synchronizing trade entries, order statuses, and performance metrics, traders gain comprehensive insights into execution quality, compliance, and strategy effectiveness. This connectivity enhances decision-making accuracy by providing a consolidated platform for trade analysis and order lifecycle management.

Key Terms

**Order Management System:**

Order Management System (OMS) streamlines the entire trade lifecycle by automating order entry, execution, and settlement, enabling real-time tracking of inventory and transaction status for improved operational efficiency. It integrates with multiple markets and brokers, ensuring compliance and reducing manual errors through centralized data management. Discover how an advanced OMS can optimize your trading workflow and boost accuracy in transaction handling.

Order Routing

Order management systems (OMS) excel in order routing by efficiently directing trades to optimal execution venues based on pre-set algorithms and real-time market data, enhancing execution speed and cost-efficiency. Trade journaling software, on the other hand, focuses on recording and analyzing trade performance rather than optimizing the order routing process itself. Explore how integrating OMS with trade journaling tools can streamline your trading strategy and improve execution outcomes.

Execution Management

Order management systems streamline trade execution by automating order routing, tracking, and real-time status updates to enhance efficiency and reduce errors. Trade journaling software primarily focuses on recording and analyzing trade performance rather than managing the execution process itself. Explore how integrating both solutions can optimize your trading strategy and execution accuracy.

Source and External Links

What is Order Management? | IBM - An Order Management System (OMS) is a digital platform that manages the entire lifecycle of an order, from entry through inventory management to fulfillment and after-sales service, providing real-time visibility to both businesses and customers and automating processes to reduce errors and costs.

What is an Order Management System? | Salesforce US - An OMS is software that enables sellers to track sales, process orders, manage inventory, and coordinate fulfillment to ensure timely delivery, transparency, and a seamless, customer-friendly order experience.

Order management system - Wikipedia - An OMS is computer software used across industries to manage order entry and processing, encompassing modules like product info, inventory, customer service, financial processing, and order fulfillment workflows.

dowidth.com

dowidth.com