Options flow reveals real-time activity in the options market, highlighting large trades and unusual options contracts that can signal market sentiment and potential price movements. Order flow tracks the actual execution of buy and sell orders in the underlying securities, providing insights into market demand and supply dynamics. Explore the differences between options flow and order flow to enhance your trading strategies and market understanding.

Why it is important

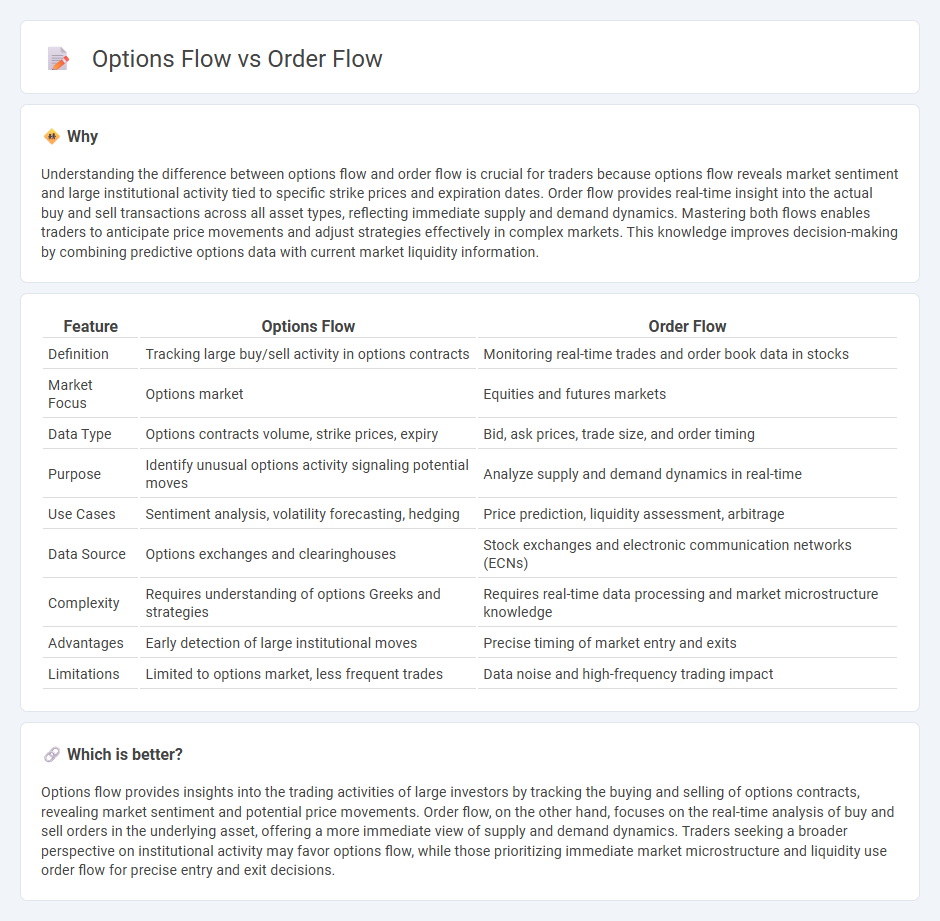

Understanding the difference between options flow and order flow is crucial for traders because options flow reveals market sentiment and large institutional activity tied to specific strike prices and expiration dates. Order flow provides real-time insight into the actual buy and sell transactions across all asset types, reflecting immediate supply and demand dynamics. Mastering both flows enables traders to anticipate price movements and adjust strategies effectively in complex markets. This knowledge improves decision-making by combining predictive options data with current market liquidity information.

Comparison Table

| Feature | Options Flow | Order Flow |

|---|---|---|

| Definition | Tracking large buy/sell activity in options contracts | Monitoring real-time trades and order book data in stocks |

| Market Focus | Options market | Equities and futures markets |

| Data Type | Options contracts volume, strike prices, expiry | Bid, ask prices, trade size, and order timing |

| Purpose | Identify unusual options activity signaling potential moves | Analyze supply and demand dynamics in real-time |

| Use Cases | Sentiment analysis, volatility forecasting, hedging | Price prediction, liquidity assessment, arbitrage |

| Data Source | Options exchanges and clearinghouses | Stock exchanges and electronic communication networks (ECNs) |

| Complexity | Requires understanding of options Greeks and strategies | Requires real-time data processing and market microstructure knowledge |

| Advantages | Early detection of large institutional moves | Precise timing of market entry and exits |

| Limitations | Limited to options market, less frequent trades | Data noise and high-frequency trading impact |

Which is better?

Options flow provides insights into the trading activities of large investors by tracking the buying and selling of options contracts, revealing market sentiment and potential price movements. Order flow, on the other hand, focuses on the real-time analysis of buy and sell orders in the underlying asset, offering a more immediate view of supply and demand dynamics. Traders seeking a broader perspective on institutional activity may favor options flow, while those prioritizing immediate market microstructure and liquidity use order flow for precise entry and exit decisions.

Connection

Options flow reveals real-time trading activity and investor sentiment by tracking large trades and unusual options volume, which directly impacts order flow by influencing the buying and selling decisions in the underlying asset. Order flow data captures the net buying or selling pressure in the market, providing insights into market liquidity and price movements that reflect the aggregated effect of options trades. The integration of options flow and order flow analysis enhances traders' ability to anticipate price trends and make informed decisions based on market dynamics and sentiment indicators.

Key Terms

Order Flow:

Order flow represents the real-time buying and selling data of stocks or assets, providing insight into market sentiment and liquidity by tracking actual trade transactions. This data is crucial for traders aiming to anticipate price movements based on supply and demand dynamics within the order book. Explore the nuances of order flow analysis to enhance your market timing and trading strategies.

Bid-Ask Spread

Order flow primarily reflects the actual transactions and the volume of buy and sell orders, directly impacting the Bid-Ask Spread by revealing market liquidity and trader sentiment. Options flow involves tracking the buying and selling of options contracts, which can signal expectations of future price volatility and indirectly influence the Bid-Ask Spread through changes in implied volatility and demand for hedging. Explore more about how these distinct flows provide valuable insights into market dynamics and trading strategies.

Market Depth

Order flow provides insights into the real-time buying and selling activities across various price levels, revealing the true market depth and liquidity available. Options flow focuses on the volume and nature of options trades, indicating market sentiment, potential price movements, and hedging activities but does not directly reflect the underlying market depth of the asset. Explore deeper analysis to understand how combining order flow and options flow can enhance trading strategies and market predictions.

Source and External Links

Order Flow Trading Strategy - What Is It? (Backtest Analysis Data) - Order flow trading strategy is a method based on analyzing the flow of trading orders and their impact on price, showing supply and demand imbalances to predict short-term price changes, often used by day traders and scalpers.

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing the real-time flow of buy and sell orders, including size and aggressiveness, to better predict price movements by reading order books and analyzing volume at price levels.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow trading is based on understanding how market and limit orders interact at bid and ask prices, with prices moving based on whether market orders consume bids or asks, which reflects buyer and seller aggressiveness in the market.

dowidth.com

dowidth.com