Prop firm challenges demand traders demonstrate consistent profitability under strict time constraints and risk parameters, often requiring a significant initial deposit or fee. Investor pitch contests prioritize persuasive presentation skills and innovative strategy proposals to secure funding, focusing more on potential than proven results. Explore how mastering both arenas can maximize your trading career opportunities.

Why it is important

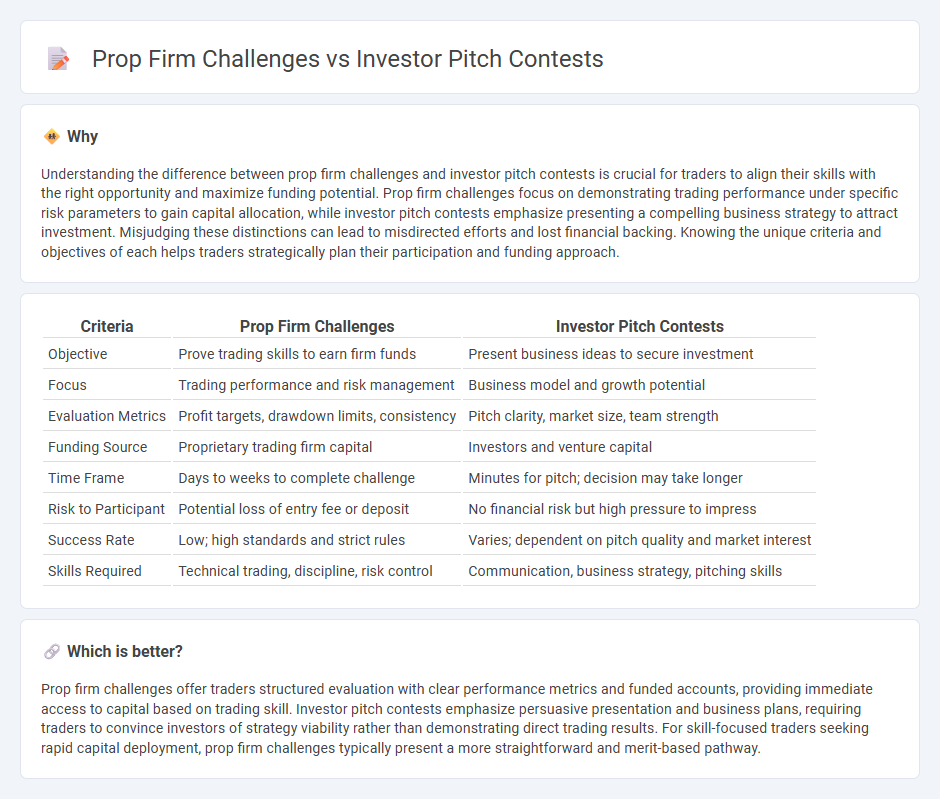

Understanding the difference between prop firm challenges and investor pitch contests is crucial for traders to align their skills with the right opportunity and maximize funding potential. Prop firm challenges focus on demonstrating trading performance under specific risk parameters to gain capital allocation, while investor pitch contests emphasize presenting a compelling business strategy to attract investment. Misjudging these distinctions can lead to misdirected efforts and lost financial backing. Knowing the unique criteria and objectives of each helps traders strategically plan their participation and funding approach.

Comparison Table

| Criteria | Prop Firm Challenges | Investor Pitch Contests |

|---|---|---|

| Objective | Prove trading skills to earn firm funds | Present business ideas to secure investment |

| Focus | Trading performance and risk management | Business model and growth potential |

| Evaluation Metrics | Profit targets, drawdown limits, consistency | Pitch clarity, market size, team strength |

| Funding Source | Proprietary trading firm capital | Investors and venture capital |

| Time Frame | Days to weeks to complete challenge | Minutes for pitch; decision may take longer |

| Risk to Participant | Potential loss of entry fee or deposit | No financial risk but high pressure to impress |

| Success Rate | Low; high standards and strict rules | Varies; dependent on pitch quality and market interest |

| Skills Required | Technical trading, discipline, risk control | Communication, business strategy, pitching skills |

Which is better?

Prop firm challenges offer traders structured evaluation with clear performance metrics and funded accounts, providing immediate access to capital based on trading skill. Investor pitch contests emphasize persuasive presentation and business plans, requiring traders to convince investors of strategy viability rather than demonstrating direct trading results. For skill-focused traders seeking rapid capital deployment, prop firm challenges typically present a more straightforward and merit-based pathway.

Connection

Prop firm challenges serve as intensive assessments of a trader's skill and discipline, often requiring participants to meet strict profit targets within set timeframes. Investor pitch contests provide traders an opportunity to present their strategies and track records to potential backers, leveraging the success demonstrated in prop challenges as credibility. Both platforms focus on identifying profitable traders and facilitating capital access by showcasing proven performance and trading consistency.

Key Terms

**Investor Pitch Contests:**

Investor pitch contests serve as pivotal platforms for startups and entrepreneurs to showcase innovative business ideas directly to potential investors, accelerating funding opportunities and market exposure. These contests emphasize clear, persuasive communication of value propositions, financial projections, and scalability, often resulting in increased investor confidence and networking prospects. Discover how investor pitch contests can transform your fundraising strategy and enhance business growth.

Business Model

Investor pitch contests emphasize presenting scalable business models with clear revenue streams, market potential, and competitive advantages to attract venture capital. Prop firm challenges focus on showcasing proprietary trading strategies, risk management frameworks, and profitability metrics that demonstrate consistent returns within financial markets. Explore detailed insights to understand which model aligns best with your strategic goals.

Return on Investment (ROI)

Investor pitch contests often provide startups with valuable visibility and potential funding, but the ROI can be uncertain and long-term due to competitive dynamics and market readiness. Proprietary trading firm (prop firm) challenges typically offer traders a more immediate and measurable ROI through performance-based capital allocation and profit sharing, aligning incentives closely with trading success. Explore detailed comparisons to understand which opportunity delivers optimal ROI for your individual goals.

Source and External Links

Invest Fest 2025 Announces Open Pitch, A Startup ... - PR Newswire - Invest Fest 2025 features Open Pitch, a high-energy startup competition offering a $125,000 investment prize and a national platform for early-stage tech founders, with finalists pitching live to investors and business leaders in Atlanta.

Pitch Competition | investfest.com - Open Pitch is a tech startup competition at Invest Fest that selects five finalists from hundreds of applicants, culminating in a live pitch event with a chance to win $125,000 and receive real-time feedback and investor connections.

Startup Pitch Competitions for Founders & Entrepreneurs - Morgan Stanley's Inclusive Ventures Lab hosts global pitch competitions designed to broaden access to capital by connecting startup founders outside major hubs to seasoned investors and expand entrepreneurial ecosystems.

dowidth.com

dowidth.com