Order flow analysis focuses on interpreting real-time market data to understand supply and demand dynamics, providing traders with insights into price movements and potential reversals. Algorithmic trading relies on pre-programmed rules and complex mathematical models to execute trades at high speed, minimizing human emotion and optimizing execution efficiency. Explore deeper to discover which strategy aligns best with your trading goals and market conditions.

Why it is important

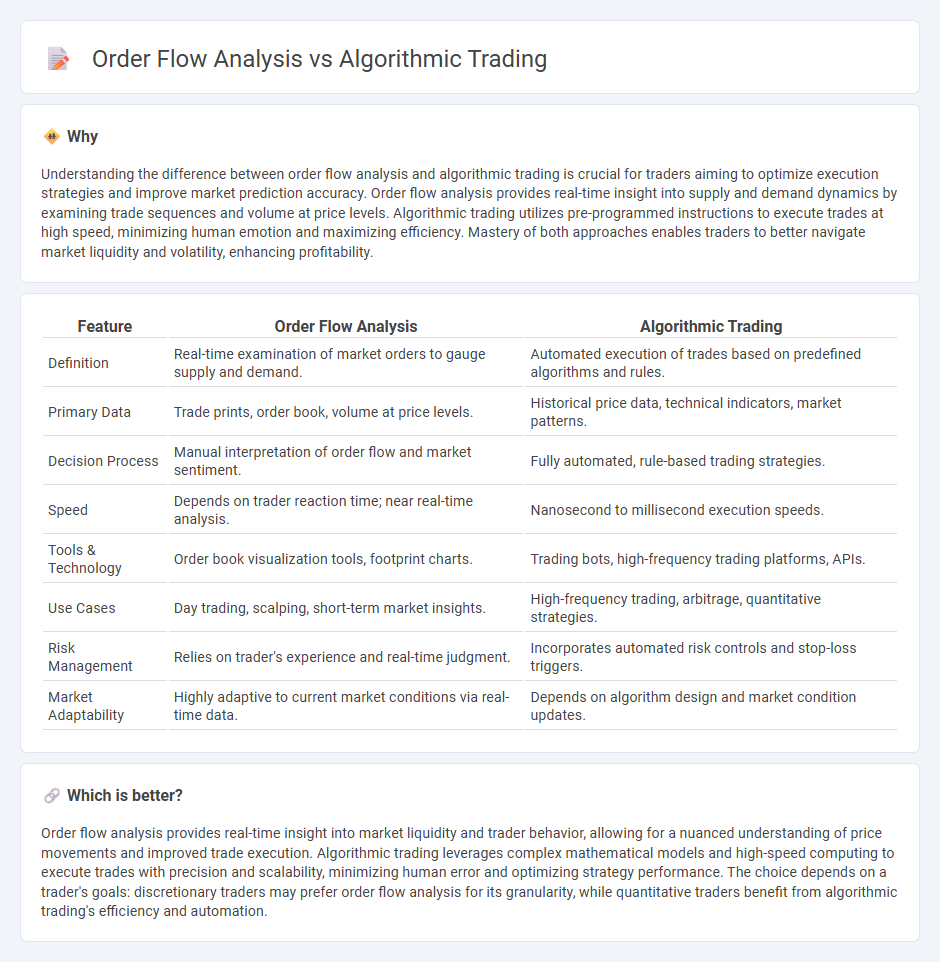

Understanding the difference between order flow analysis and algorithmic trading is crucial for traders aiming to optimize execution strategies and improve market prediction accuracy. Order flow analysis provides real-time insight into supply and demand dynamics by examining trade sequences and volume at price levels. Algorithmic trading utilizes pre-programmed instructions to execute trades at high speed, minimizing human emotion and maximizing efficiency. Mastery of both approaches enables traders to better navigate market liquidity and volatility, enhancing profitability.

Comparison Table

| Feature | Order Flow Analysis | Algorithmic Trading |

|---|---|---|

| Definition | Real-time examination of market orders to gauge supply and demand. | Automated execution of trades based on predefined algorithms and rules. |

| Primary Data | Trade prints, order book, volume at price levels. | Historical price data, technical indicators, market patterns. |

| Decision Process | Manual interpretation of order flow and market sentiment. | Fully automated, rule-based trading strategies. |

| Speed | Depends on trader reaction time; near real-time analysis. | Nanosecond to millisecond execution speeds. |

| Tools & Technology | Order book visualization tools, footprint charts. | Trading bots, high-frequency trading platforms, APIs. |

| Use Cases | Day trading, scalping, short-term market insights. | High-frequency trading, arbitrage, quantitative strategies. |

| Risk Management | Relies on trader's experience and real-time judgment. | Incorporates automated risk controls and stop-loss triggers. |

| Market Adaptability | Highly adaptive to current market conditions via real-time data. | Depends on algorithm design and market condition updates. |

Which is better?

Order flow analysis provides real-time insight into market liquidity and trader behavior, allowing for a nuanced understanding of price movements and improved trade execution. Algorithmic trading leverages complex mathematical models and high-speed computing to execute trades with precision and scalability, minimizing human error and optimizing strategy performance. The choice depends on a trader's goals: discretionary traders may prefer order flow analysis for its granularity, while quantitative traders benefit from algorithmic trading's efficiency and automation.

Connection

Order flow analysis provides real-time insights into market liquidity and trader behavior, which are critical for developing effective algorithmic trading strategies. Algorithmic trading systems utilize this flow of order data to identify patterns, predict short-term price movements, and execute trades with minimal latency. Integrating order flow analysis enhances the precision and profitability of algorithmic trading by enabling dynamic response to market supply and demand imbalances.

Key Terms

Execution Algorithms

Execution algorithms are specialized tools in algorithmic trading designed to optimize order placement and minimize market impact by breaking large trades into smaller executions. Order flow analysis focuses on interpreting the real-time supply and demand in the market to predict price movements and improve trade timing. Explore more to understand how integrating execution algorithms with order flow analysis can enhance trading performance.

Market Microstructure

Algorithmic trading leverages complex mathematical models and high-frequency data processing to execute trades with precision, reducing latency and exploiting market inefficiencies. Order flow analysis delves into the granular insight of buy and sell orders, revealing the intentions and liquidity dynamics that shape price movements in Market Microstructure. Explore our detailed comparison to understand how each strategy impacts trading decisions and market behavior.

Volume Delta

Algorithmic trading leverages predefined rules and quantitative models to execute trades at high speed, optimizing entries and exits based on statistical data. Order flow analysis, particularly through Volume Delta, examines the difference between buying and selling volume to gauge market sentiment and pinpoint potential price reversals. Explore further to understand how Volume Delta can enhance your trading strategy and decision-making.

Source and External Links

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves executing trades based on pre-set rules programmed into a computer, such as buying or selling securities when certain price conditions are met, helping traders avoid large market distortions by splitting large orders into smaller batches.

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses software to execute trades automatically based on rules involving price movements or technical indicators, with main strategies including price action, technical analysis, and hybrids useful for high-frequency trading and risk management.

Algorithmic trading - Wikipedia - Algorithmic trading systems typically involve receiving market data, analyzing it with trading strategies coded by users, and sending orders to exchanges, utilizing low-latency networks and standardized protocols such as FIX for efficient automated trading.

dowidth.com

dowidth.com