Microstructure trading focuses on exploiting short-term price inefficiencies by analyzing order flow, bid-ask spreads, and market depth to execute rapid trades. Trend following relies on identifying and capitalizing on sustained price movements over longer periods using technical indicators like moving averages and momentum oscillators. Explore key strategies, tools, and market conditions that differentiate microstructure trading from trend following for a deeper understanding.

Why it is important

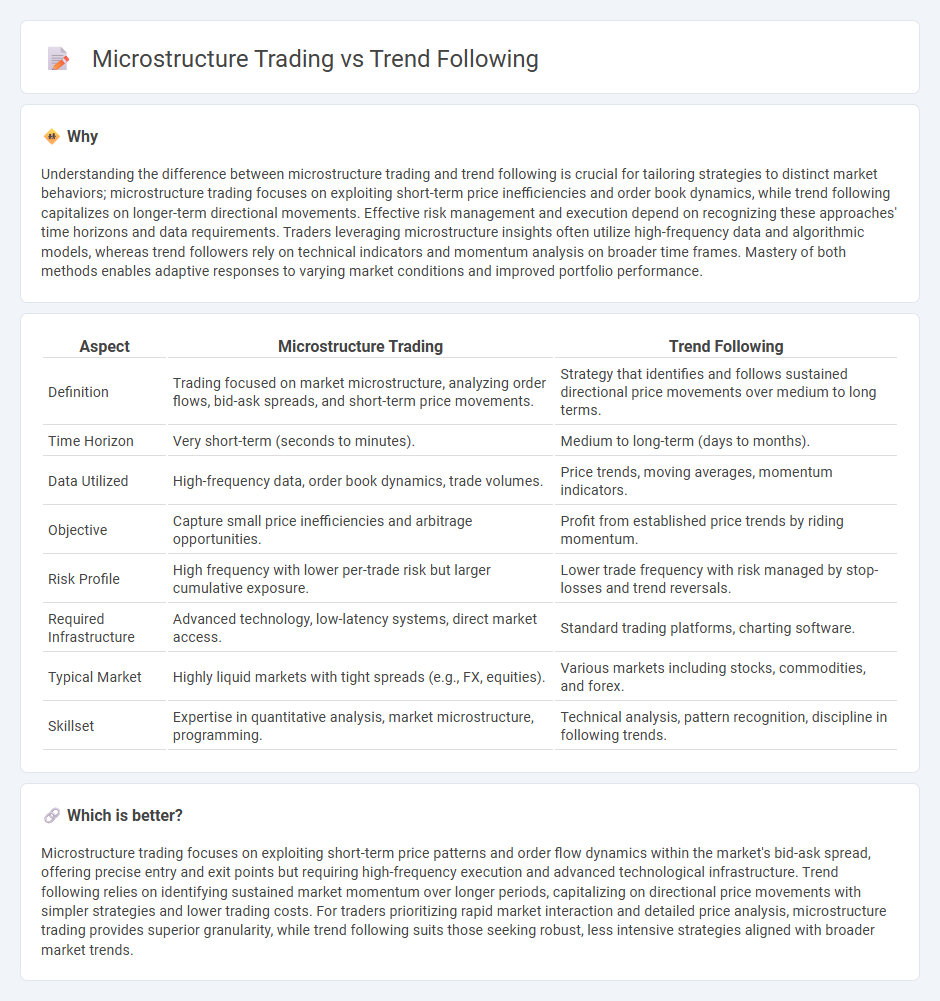

Understanding the difference between microstructure trading and trend following is crucial for tailoring strategies to distinct market behaviors; microstructure trading focuses on exploiting short-term price inefficiencies and order book dynamics, while trend following capitalizes on longer-term directional movements. Effective risk management and execution depend on recognizing these approaches' time horizons and data requirements. Traders leveraging microstructure insights often utilize high-frequency data and algorithmic models, whereas trend followers rely on technical indicators and momentum analysis on broader time frames. Mastery of both methods enables adaptive responses to varying market conditions and improved portfolio performance.

Comparison Table

| Aspect | Microstructure Trading | Trend Following |

|---|---|---|

| Definition | Trading focused on market microstructure, analyzing order flows, bid-ask spreads, and short-term price movements. | Strategy that identifies and follows sustained directional price movements over medium to long terms. |

| Time Horizon | Very short-term (seconds to minutes). | Medium to long-term (days to months). |

| Data Utilized | High-frequency data, order book dynamics, trade volumes. | Price trends, moving averages, momentum indicators. |

| Objective | Capture small price inefficiencies and arbitrage opportunities. | Profit from established price trends by riding momentum. |

| Risk Profile | High frequency with lower per-trade risk but larger cumulative exposure. | Lower trade frequency with risk managed by stop-losses and trend reversals. |

| Required Infrastructure | Advanced technology, low-latency systems, direct market access. | Standard trading platforms, charting software. |

| Typical Market | Highly liquid markets with tight spreads (e.g., FX, equities). | Various markets including stocks, commodities, and forex. |

| Skillset | Expertise in quantitative analysis, market microstructure, programming. | Technical analysis, pattern recognition, discipline in following trends. |

Which is better?

Microstructure trading focuses on exploiting short-term price patterns and order flow dynamics within the market's bid-ask spread, offering precise entry and exit points but requiring high-frequency execution and advanced technological infrastructure. Trend following relies on identifying sustained market momentum over longer periods, capitalizing on directional price movements with simpler strategies and lower trading costs. For traders prioritizing rapid market interaction and detailed price analysis, microstructure trading provides superior granularity, while trend following suits those seeking robust, less intensive strategies aligned with broader market trends.

Connection

Microstructure trading focuses on the analysis of market mechanisms and order flow to exploit short-term price inefficiencies, providing critical insights into liquidity and price dynamics. Trend following strategies, which rely on identifying and capitalizing on sustained directional price movements, benefit from microstructure trading by using detailed market data to confirm trend strength and entry points. This integration enhances trading performance by combining micro-level market signals with broader trend patterns for more informed decision-making.

Key Terms

Momentum

Trend following strategies capitalize on sustained price movements by identifying and riding market momentum over longer time frames, typically days to months. Microstructure trading zeroes in on the granular details of order flow, bid-ask spread, and immediate price changes to exploit short-term momentum at the tick or intraday level. Explore how these distinct momentum-based approaches can optimize trading performance and risk management.

Order Book

Trend following strategies capitalize on identifying and trading along sustained price movements, primarily using price action and momentum indicators, while microstructure trading deeply analyzes the order book to understand supply, demand, and liquidity at different price levels. Order book dynamics reveal real-time intentions of market participants through bid-ask imbalances, order flow, and hidden liquidity, which microstructure traders exploit for short-term execution advantages and market impact reduction. Explore further to uncover how integrating order book insights can enhance trend following techniques and optimize trading performance.

Liquidity

Trend following strategies capitalize on macro-level price movements and extended market trends, relying less on immediate market liquidity and more on sustained directional changes. Microstructure trading examines order book dynamics, bid-ask spreads, and liquidity supply-demand imbalances to make high-frequency, short-term decisions, heavily depending on deep liquidity pools. Explore how liquidity impacts both approaches and enhances trading efficiency by understanding their distinctive market interactions.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where traders buy assets when prices trend upwards and sell when prices trend downwards, using tools like moving averages and channel breakouts without trying to predict exact price points.

Trend-Following Primer - Graham Capital Management - Trend-following is a systematic investment strategy that uses algorithmic models to identify market trends, taking long positions during uptrends and short positions during downtrends, often across diverse liquid futures and currency markets.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies profit from sustained market momentum by entering trades with the trend and exiting on reversals, employing risk management and systematic rules, with examples like ATR channel breakout and moving average strategies.

dowidth.com

dowidth.com