Smart Money Concepts focus on the behavior and strategies of institutional traders who influence market movements through large volume trades and order flow analysis. Supply and Demand Zones identify price areas where buying or selling pressure has previously caused reversals, signaling potential entry or exit points for traders. Explore this comparison to enhance your trading strategy with deeper market insights.

Why it is important

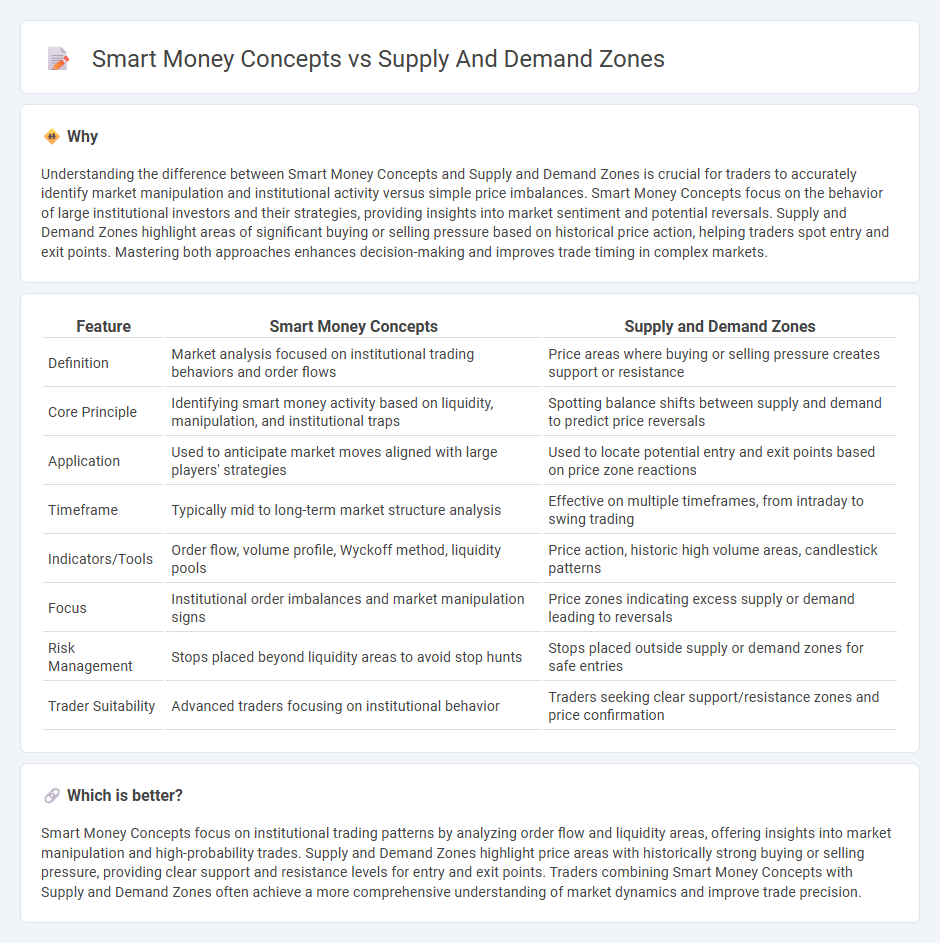

Understanding the difference between Smart Money Concepts and Supply and Demand Zones is crucial for traders to accurately identify market manipulation and institutional activity versus simple price imbalances. Smart Money Concepts focus on the behavior of large institutional investors and their strategies, providing insights into market sentiment and potential reversals. Supply and Demand Zones highlight areas of significant buying or selling pressure based on historical price action, helping traders spot entry and exit points. Mastering both approaches enhances decision-making and improves trade timing in complex markets.

Comparison Table

| Feature | Smart Money Concepts | Supply and Demand Zones |

|---|---|---|

| Definition | Market analysis focused on institutional trading behaviors and order flows | Price areas where buying or selling pressure creates support or resistance |

| Core Principle | Identifying smart money activity based on liquidity, manipulation, and institutional traps | Spotting balance shifts between supply and demand to predict price reversals |

| Application | Used to anticipate market moves aligned with large players' strategies | Used to locate potential entry and exit points based on price zone reactions |

| Timeframe | Typically mid to long-term market structure analysis | Effective on multiple timeframes, from intraday to swing trading |

| Indicators/Tools | Order flow, volume profile, Wyckoff method, liquidity pools | Price action, historic high volume areas, candlestick patterns |

| Focus | Institutional order imbalances and market manipulation signs | Price zones indicating excess supply or demand leading to reversals |

| Risk Management | Stops placed beyond liquidity areas to avoid stop hunts | Stops placed outside supply or demand zones for safe entries |

| Trader Suitability | Advanced traders focusing on institutional behavior | Traders seeking clear support/resistance zones and price confirmation |

Which is better?

Smart Money Concepts focus on institutional trading patterns by analyzing order flow and liquidity areas, offering insights into market manipulation and high-probability trades. Supply and Demand Zones highlight price areas with historically strong buying or selling pressure, providing clear support and resistance levels for entry and exit points. Traders combining Smart Money Concepts with Supply and Demand Zones often achieve a more comprehensive understanding of market dynamics and improve trade precision.

Connection

Smart money concepts revolve around understanding the behavior of institutional investors who drive market trends, often revealing critical price levels. Supply and Demand Zones represent areas where these institutional participants accumulate or distribute assets, marking potential reversal or breakout points in trading. Identifying these zones enhances the ability to anticipate market moves influenced by smart money activity, increasing the accuracy of trade entries and exits.

Key Terms

Liquidity

Supply and demand zones represent price areas where buying or selling interest is strong, often leading to market reversals, while smart money concepts focus on understanding institutional investors' behavior and identifying liquidity pockets where these entities accumulate or distribute positions. Liquidity zones, crucial in smart money theory, are areas where stop-loss orders cluster, providing opportunities for market makers to execute large trades by triggering these orders. Discover how mastering liquidity dynamics and supply-demand interplay can enhance your trading strategy.

Order Blocks

Order Blocks are specific price areas where smart money institutions place large buy or sell orders, causing significant market shifts. Unlike general supply and demand zones, Order Blocks reflect more precise institutional trading activity, offering higher accuracy in predicting price reversals. Explore detailed strategies on identifying and leveraging Order Blocks to enhance your trading edge.

Imbalances

Supply and Demand Zones highlight areas where price historically reverses due to excess buy or sell orders, reflecting market participants' aggregated intentions. Smart Money Concepts, particularly the focus on Imbalances, emphasize price inefficiencies caused by aggressive institutional trading that leaves gaps or unfilled orders, often acting as catalysts for strong price movements. Explore the dynamics of Imbalances within Smart Money strategies to enhance your market analysis and trading precision.

Source and External Links

What Are Supply And Demand Zones? | TrendSpider Learning Center - Supply and demand zones are areas on a price chart where buying or selling pressure is concentrated, causing the price to stall or reverse; supply zones have excess sellers pushing price down, while demand zones have excess buyers pushing price up, and these zones are typically marked with horizontal lines and color for easy identification.

Mastering supply and demand zones - how to use it in trading? - Supply zones form when selling pressure exceeds buying pressure, often leading to price drops, while demand zones form when buying pressure exceeds selling, causing prices to rise, reflecting market imbalances that traders use to anticipate reversals or stalls in price.

Demand and Liquidity Zones Guide: How Smart Money Moves and ... - Demand zones are areas where buyers aggressively enter, causing rapid price increases, while supply zones reflect where sellers dominate; these zones create imbalances and can be identified by finding the origin of sharp price moves, confirming liquidity sweeps, and marking these key areas for trading insights.

dowidth.com

dowidth.com