Quantitative sentiment analysis leverages large-scale data from social media, news outlets, and financial reports to gauge market emotions and predict trading opportunities, contrasting with price action analysis that focuses on interpreting historical price movements and chart patterns to make trading decisions. Both methods offer unique insights, with sentiment analysis providing forward-looking market sentiment and price action analysis emphasizing tangible market behavior. Explore deeper to understand their strengths and integration for smarter trading strategies.

Why it is important

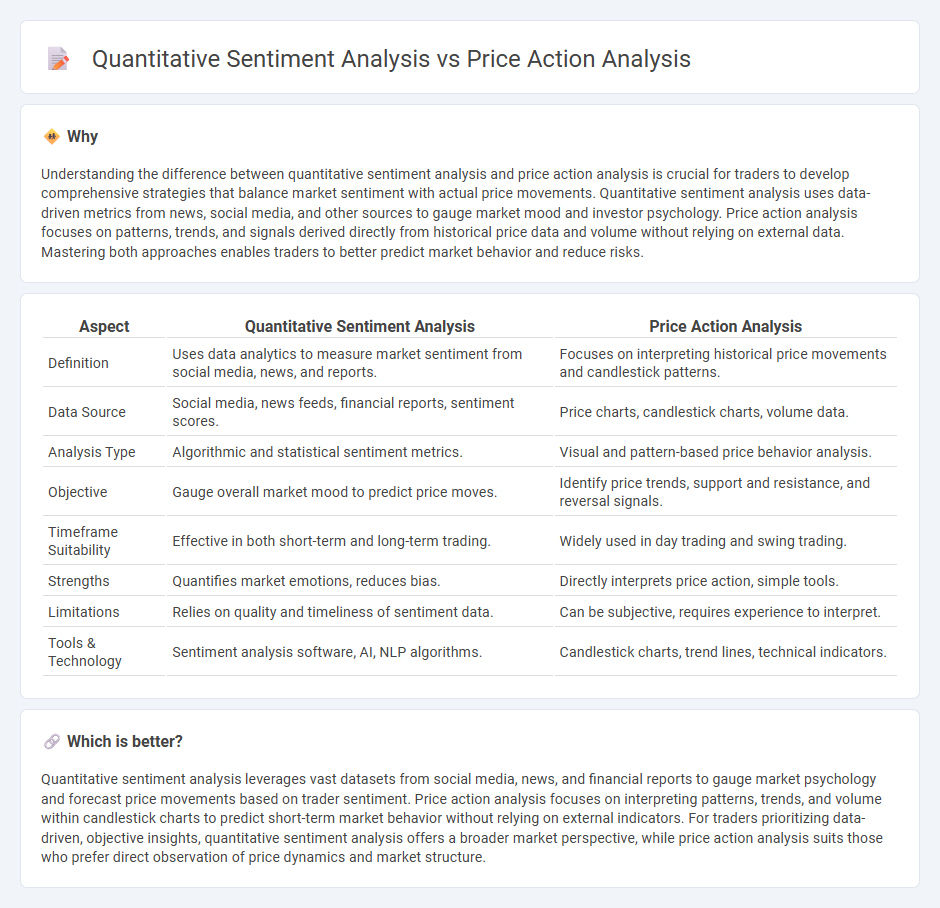

Understanding the difference between quantitative sentiment analysis and price action analysis is crucial for traders to develop comprehensive strategies that balance market sentiment with actual price movements. Quantitative sentiment analysis uses data-driven metrics from news, social media, and other sources to gauge market mood and investor psychology. Price action analysis focuses on patterns, trends, and signals derived directly from historical price data and volume without relying on external data. Mastering both approaches enables traders to better predict market behavior and reduce risks.

Comparison Table

| Aspect | Quantitative Sentiment Analysis | Price Action Analysis |

|---|---|---|

| Definition | Uses data analytics to measure market sentiment from social media, news, and reports. | Focuses on interpreting historical price movements and candlestick patterns. |

| Data Source | Social media, news feeds, financial reports, sentiment scores. | Price charts, candlestick charts, volume data. |

| Analysis Type | Algorithmic and statistical sentiment metrics. | Visual and pattern-based price behavior analysis. |

| Objective | Gauge overall market mood to predict price moves. | Identify price trends, support and resistance, and reversal signals. |

| Timeframe Suitability | Effective in both short-term and long-term trading. | Widely used in day trading and swing trading. |

| Strengths | Quantifies market emotions, reduces bias. | Directly interprets price action, simple tools. |

| Limitations | Relies on quality and timeliness of sentiment data. | Can be subjective, requires experience to interpret. |

| Tools & Technology | Sentiment analysis software, AI, NLP algorithms. | Candlestick charts, trend lines, technical indicators. |

Which is better?

Quantitative sentiment analysis leverages vast datasets from social media, news, and financial reports to gauge market psychology and forecast price movements based on trader sentiment. Price action analysis focuses on interpreting patterns, trends, and volume within candlestick charts to predict short-term market behavior without relying on external indicators. For traders prioritizing data-driven, objective insights, quantitative sentiment analysis offers a broader market perspective, while price action analysis suits those who prefer direct observation of price dynamics and market structure.

Connection

Quantitative sentiment analysis leverages data from news, social media, and market reports to gauge investor emotions, which influence market trends and price movements. Price action analysis interprets actual historical price data and candlestick patterns to predict future market behavior without relying on external indicators. Integrating sentiment scores with price action provides traders a comprehensive view, enhancing signal accuracy and improving trading decision-making.

Key Terms

**Price action analysis:**

Price action analysis relies on studying historical price movements and patterns to predict future market behavior, emphasizing support, resistance, candlestick formations, and trend lines without depending on indicators or external data. Traders use this technique to identify entry and exit points by interpreting market psychology reflected in price fluctuations. Discover more about how price action analysis can enhance your trading strategy and decision-making process.

Candlestick patterns

Candlestick patterns in price action analysis provide visual insights into market sentiment by identifying trends, reversals, and entry or exit points based on historical price movements. Quantitative sentiment analysis leverages large datasets, such as social media feeds and news articles, to measure investor mood and predict market behavior through sentiment scores and algorithms. Explore deeper to understand how combining these methods can enhance trading strategies.

Support and resistance

Support and resistance levels in price action analysis are identified through historical price patterns where buying or selling pressure repeatedly halts price movement, serving as critical decision points for traders. Quantitative sentiment analysis supplements this by measuring market mood through data sources like news, social media, and analyst reports to predict potential shifts around these key levels. Explore further to understand how combining these methods can enhance trading strategies by integrating technical signals with market psychology insights.

Source and External Links

What is Price Action? (2025) A Complete Trader's Guide - Price action analysis involves studying raw price movements over time to interpret market sentiment, predict future price trends, and gauge the strength of movements without relying on lagging indicators, giving traders direct insights into supply and demand dynamics in real time.

What Is Price Action? - Price Action Trading Introduction - Price action trading is a pure technical analysis method focusing solely on analyzing basic price movements over time, ignoring fundamental factors and derived indicators to predict future market directions based on recent price history.

Price action trading - Wikipedia - Price action trading relies on observing classic patterns like trend lines and breakouts plus bar-by-bar analysis, interpreting these price movements to anticipate market behavior, requiring in-depth market knowledge to understand the psychology of buyers and sellers behind the price moves.

dowidth.com

dowidth.com