Dark pool activity involves private, non-public trading venues where large institutional investors execute sizable trades discreetly, minimizing market impact and price fluctuations. High-frequency trading (HFT) uses sophisticated algorithms to execute a large number of trades at ultra-fast speeds, exploiting small price discrepancies for profit across various markets. Explore the nuances of dark pools and HFT to understand their distinct roles in modern financial trading.

Why it is important

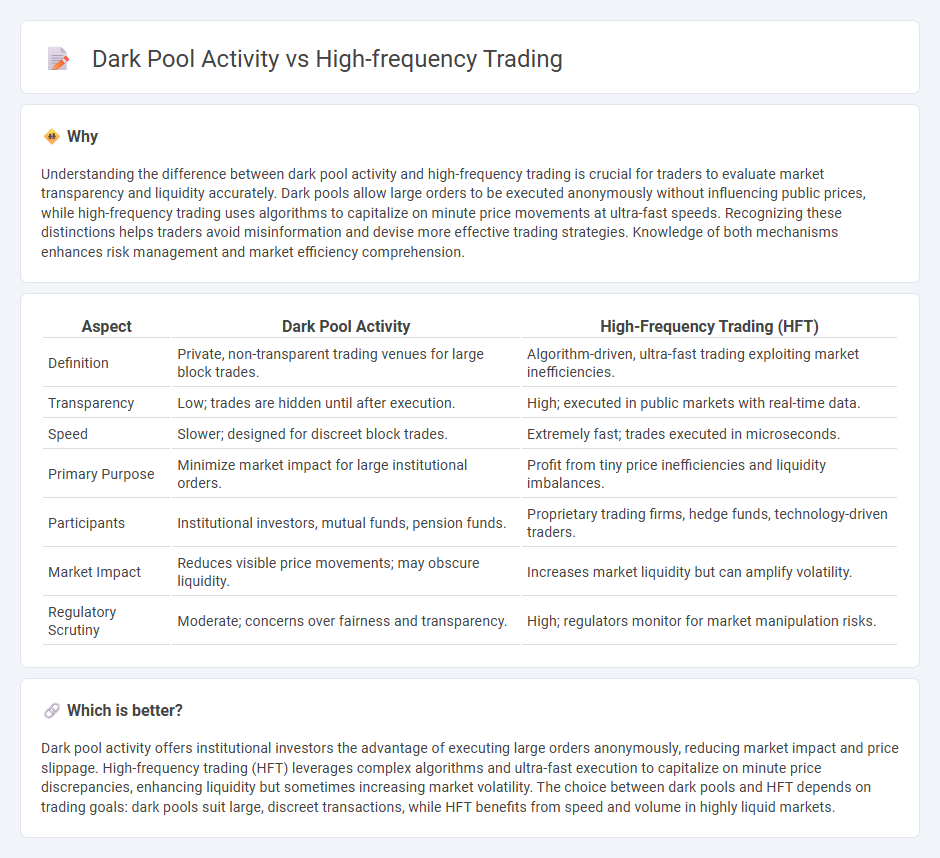

Understanding the difference between dark pool activity and high-frequency trading is crucial for traders to evaluate market transparency and liquidity accurately. Dark pools allow large orders to be executed anonymously without influencing public prices, while high-frequency trading uses algorithms to capitalize on minute price movements at ultra-fast speeds. Recognizing these distinctions helps traders avoid misinformation and devise more effective trading strategies. Knowledge of both mechanisms enhances risk management and market efficiency comprehension.

Comparison Table

| Aspect | Dark Pool Activity | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Private, non-transparent trading venues for large block trades. | Algorithm-driven, ultra-fast trading exploiting market inefficiencies. |

| Transparency | Low; trades are hidden until after execution. | High; executed in public markets with real-time data. |

| Speed | Slower; designed for discreet block trades. | Extremely fast; trades executed in microseconds. |

| Primary Purpose | Minimize market impact for large institutional orders. | Profit from tiny price inefficiencies and liquidity imbalances. |

| Participants | Institutional investors, mutual funds, pension funds. | Proprietary trading firms, hedge funds, technology-driven traders. |

| Market Impact | Reduces visible price movements; may obscure liquidity. | Increases market liquidity but can amplify volatility. |

| Regulatory Scrutiny | Moderate; concerns over fairness and transparency. | High; regulators monitor for market manipulation risks. |

Which is better?

Dark pool activity offers institutional investors the advantage of executing large orders anonymously, reducing market impact and price slippage. High-frequency trading (HFT) leverages complex algorithms and ultra-fast execution to capitalize on minute price discrepancies, enhancing liquidity but sometimes increasing market volatility. The choice between dark pools and HFT depends on trading goals: dark pools suit large, discreet transactions, while HFT benefits from speed and volume in highly liquid markets.

Connection

Dark pool activity and high-frequency trading (HFT) are closely connected through their shared reliance on advanced algorithms and real-time data processing to execute large-volume trades discreetly. Dark pools provide a private venue for HFT firms to access substantial liquidity without impacting public market prices, enhancing execution efficiency and minimizing market impact. This synergy allows high-frequency traders to capitalize on price discrepancies while maintaining confidentiality in their trading strategies.

Key Terms

Latency

High-frequency trading (HFT) capitalizes on ultra-low latency to execute rapid trades, often in milliseconds or microseconds, maximizing market opportunities. Dark pool activity benefits from reduced market impact and latency advantages by conducting large block trades privately, away from public exchanges. Explore the intricate dynamics between latency, HFT strategies, and dark pool executions for deeper insights.

Order Types

High-frequency trading (HFT) leverages advanced algorithms to execute a vast number of orders at extremely high speeds, primarily using market and limit orders to capitalize on minimal price discrepancies. Dark pool activity involves trading large blocks of securities privately, employing hidden order types such as iceberg orders to minimize market impact and maintain anonymity. Explore the nuances of order types in HFT and dark pools to enhance your understanding of market microstructure.

Liquidity

High-frequency trading (HFT) significantly enhances market liquidity by rapidly executing large volumes of orders, tightening bid-ask spreads in public exchanges. Dark pools, in contrast, offer private trading venues where large orders are executed anonymously, mitigating market impact but with less transparent liquidity signals. Explore the nuanced effects of HFT and dark pool activities on liquidity dynamics to better understand their influence on modern financial markets.

Source and External Links

High Frequency Trading (HFT) - Definition, Pros and Cons - High-frequency trading is an algorithmic trading approach that uses extremely fast trade execution and high transaction volumes to exploit small price fluctuations, primarily used by institutional investors such as banks and hedge funds to enhance liquidity and market efficiency.

High Frequency Trading | EBSCO Research Starters - High-frequency trading employs advanced computer algorithms to execute trades in microseconds, automating decision-making and significantly increasing transaction volumes while raising concerns about market stability and fairness.

High-frequency trading - Wikipedia - High-frequency trading involves quantitative, algorithm-driven trading strategies with very short holding periods, focusing on speed to execute strategies such as market-making, arbitrage, and exploiting small price deviations in milliseconds.

dowidth.com

dowidth.com