Social sentiment analysis trading leverages real-time data from social media platforms, forums, and news to gauge market sentiment and predict short-term price movements. Day trading relies on technical analysis, charts, and price patterns to execute multiple trades within a single day for quick profits. Explore how integrating social sentiment can enhance your day trading strategy for more informed decisions.

Why it is important

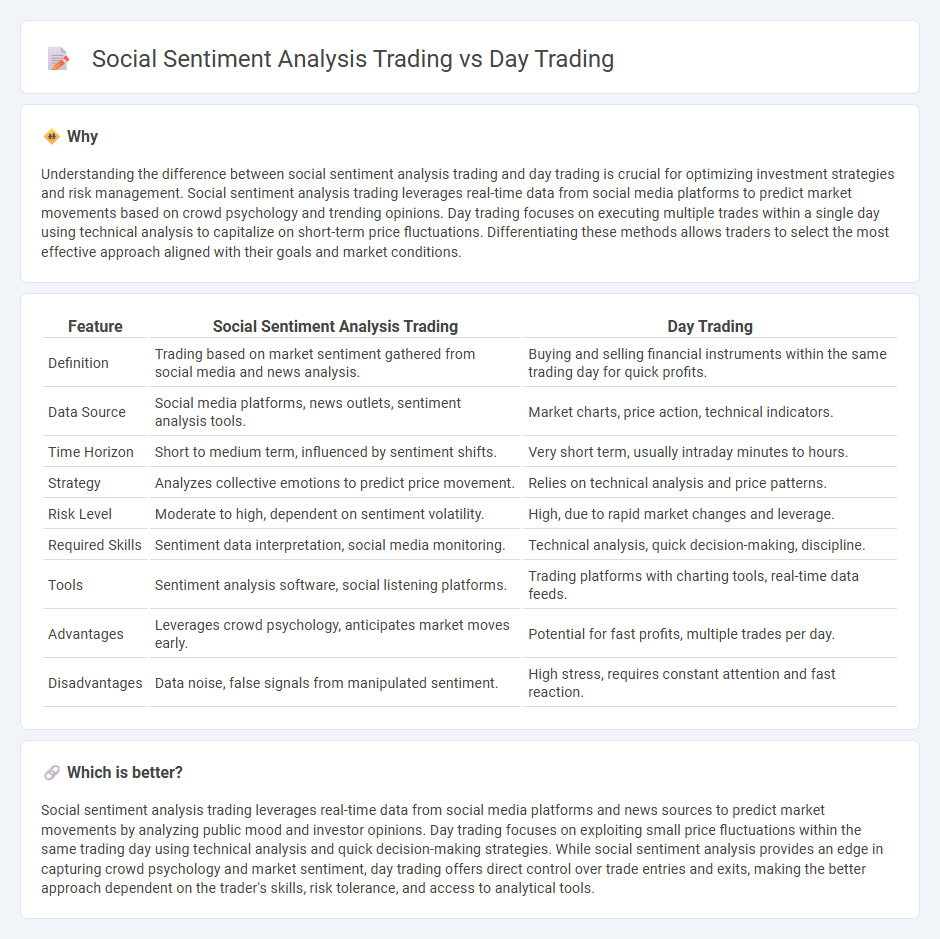

Understanding the difference between social sentiment analysis trading and day trading is crucial for optimizing investment strategies and risk management. Social sentiment analysis trading leverages real-time data from social media platforms to predict market movements based on crowd psychology and trending opinions. Day trading focuses on executing multiple trades within a single day using technical analysis to capitalize on short-term price fluctuations. Differentiating these methods allows traders to select the most effective approach aligned with their goals and market conditions.

Comparison Table

| Feature | Social Sentiment Analysis Trading | Day Trading |

|---|---|---|

| Definition | Trading based on market sentiment gathered from social media and news analysis. | Buying and selling financial instruments within the same trading day for quick profits. |

| Data Source | Social media platforms, news outlets, sentiment analysis tools. | Market charts, price action, technical indicators. |

| Time Horizon | Short to medium term, influenced by sentiment shifts. | Very short term, usually intraday minutes to hours. |

| Strategy | Analyzes collective emotions to predict price movement. | Relies on technical analysis and price patterns. |

| Risk Level | Moderate to high, dependent on sentiment volatility. | High, due to rapid market changes and leverage. |

| Required Skills | Sentiment data interpretation, social media monitoring. | Technical analysis, quick decision-making, discipline. |

| Tools | Sentiment analysis software, social listening platforms. | Trading platforms with charting tools, real-time data feeds. |

| Advantages | Leverages crowd psychology, anticipates market moves early. | Potential for fast profits, multiple trades per day. |

| Disadvantages | Data noise, false signals from manipulated sentiment. | High stress, requires constant attention and fast reaction. |

Which is better?

Social sentiment analysis trading leverages real-time data from social media platforms and news sources to predict market movements by analyzing public mood and investor opinions. Day trading focuses on exploiting small price fluctuations within the same trading day using technical analysis and quick decision-making strategies. While social sentiment analysis provides an edge in capturing crowd psychology and market sentiment, day trading offers direct control over trade entries and exits, making the better approach dependent on the trader's skills, risk tolerance, and access to analytical tools.

Connection

Social sentiment analysis trading leverages real-time data from social media platforms to gauge market sentiment and predict price movements, enhancing decision-making for day traders. Day trading relies on rapid market fluctuations, where insights from sentiment analysis can identify trending assets and potential volatility within short time frames. Integrating sentiment analysis tools with day trading strategies helps traders capitalize on crowd psychology and market momentum to improve trade timing and profitability.

Key Terms

Intraday Volatility

Day trading capitalizes on rapid price fluctuations within a single trading day by exploiting intraday volatility patterns using technical indicators like moving averages and volume spikes. Social sentiment analysis trading leverages real-time data from social media platforms and news feeds to gauge market sentiment shifts that often precede price movements, enhancing intraday decision-making. Explore how integrating social sentiment data can refine your intraday volatility strategies for more informed trades.

Crowd Psychology

Day trading leverages short-term price movements and technical indicators to capitalize on market volatility within the same trading day. Social sentiment analysis trading relies on real-time data from social media platforms, news, and crowd behavior to predict market trends driven by collective psychology. Discover how integrating crowd psychology into your trading strategy can enhance decision-making and market timing.

Real-time Data

Day trading hinges on rapid decision-making using real-time price movements, volume, and technical indicators to capitalize on short-term market fluctuations. Social sentiment analysis trading leverages real-time data from social media platforms, news sources, and online forums to gauge market sentiment and predict stock momentum. Explore the latest tools and strategies to integrate real-time data effectively in your trading approach.

Source and External Links

Day trading - Wikipedia - Day trading is the act of buying and selling financial instruments within the same trading day to avoid overnight risk, with pattern day traders required to maintain a minimum equity of $25,000 in their trading account to continue day trading activities.

Day Trading Guide | Warrior Trading - Day trading involves actively buying and selling securities on the same day to profit from short-term price fluctuations using strategies like momentum or contrarian trading.

What are the rules for day trading? - Merrill Edge - Day trading includes opening and closing positions within one day, with pattern day traders subject to FINRA rules requiring a minimum equity of $25,000 and brokerage monitoring of these accounts.

dowidth.com

dowidth.com