Statistical arbitrage exploits price inefficiencies by analyzing historical data and executing mean-reversion or momentum strategies across related securities. High-frequency trading leverages ultra-fast algorithms and low-latency systems to capitalize on fleeting market opportunities within microseconds. Explore the distinctive mechanisms and advantages of these cutting-edge trading strategies to enhance your market understanding.

Why it is important

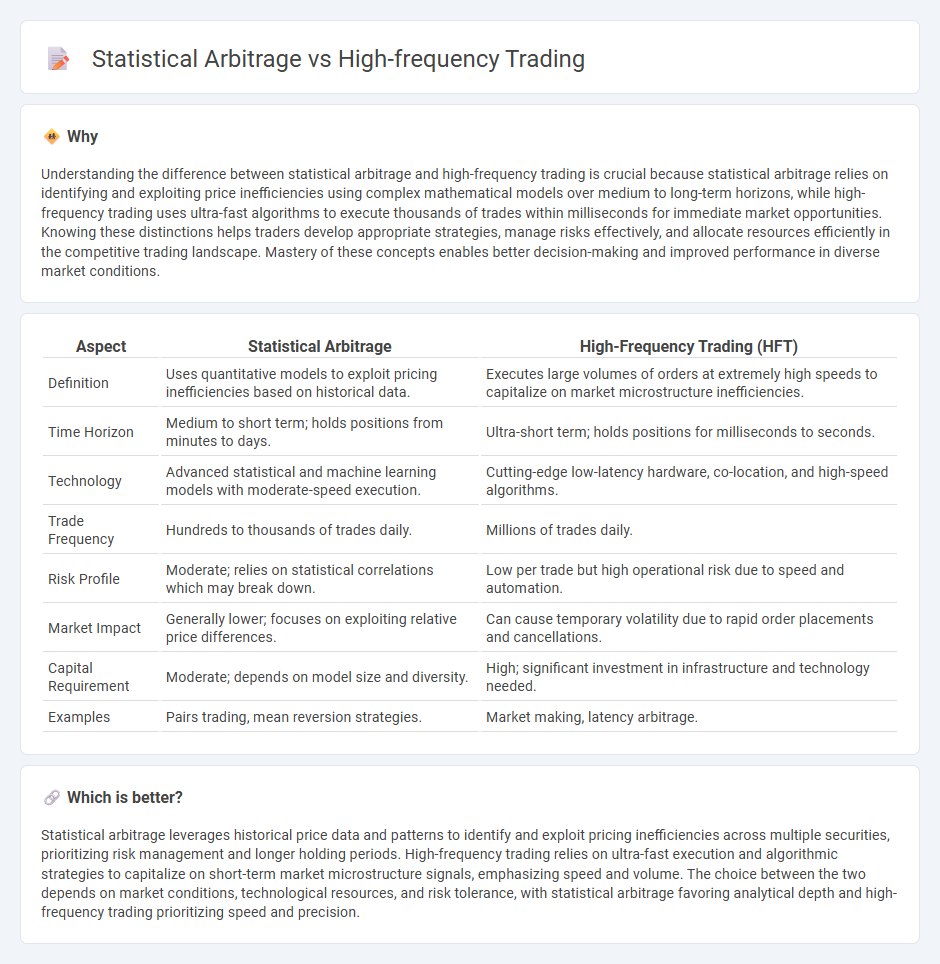

Understanding the difference between statistical arbitrage and high-frequency trading is crucial because statistical arbitrage relies on identifying and exploiting price inefficiencies using complex mathematical models over medium to long-term horizons, while high-frequency trading uses ultra-fast algorithms to execute thousands of trades within milliseconds for immediate market opportunities. Knowing these distinctions helps traders develop appropriate strategies, manage risks effectively, and allocate resources efficiently in the competitive trading landscape. Mastery of these concepts enables better decision-making and improved performance in diverse market conditions.

Comparison Table

| Aspect | Statistical Arbitrage | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Uses quantitative models to exploit pricing inefficiencies based on historical data. | Executes large volumes of orders at extremely high speeds to capitalize on market microstructure inefficiencies. |

| Time Horizon | Medium to short term; holds positions from minutes to days. | Ultra-short term; holds positions for milliseconds to seconds. |

| Technology | Advanced statistical and machine learning models with moderate-speed execution. | Cutting-edge low-latency hardware, co-location, and high-speed algorithms. |

| Trade Frequency | Hundreds to thousands of trades daily. | Millions of trades daily. |

| Risk Profile | Moderate; relies on statistical correlations which may break down. | Low per trade but high operational risk due to speed and automation. |

| Market Impact | Generally lower; focuses on exploiting relative price differences. | Can cause temporary volatility due to rapid order placements and cancellations. |

| Capital Requirement | Moderate; depends on model size and diversity. | High; significant investment in infrastructure and technology needed. |

| Examples | Pairs trading, mean reversion strategies. | Market making, latency arbitrage. |

Which is better?

Statistical arbitrage leverages historical price data and patterns to identify and exploit pricing inefficiencies across multiple securities, prioritizing risk management and longer holding periods. High-frequency trading relies on ultra-fast execution and algorithmic strategies to capitalize on short-term market microstructure signals, emphasizing speed and volume. The choice between the two depends on market conditions, technological resources, and risk tolerance, with statistical arbitrage favoring analytical depth and high-frequency trading prioritizing speed and precision.

Connection

Statistical arbitrage and high-frequency trading (HFT) are interconnected through their reliance on quantitative models and rapid execution to exploit market inefficiencies. Statistical arbitrage uses statistical methods to identify price discrepancies across related securities, while HFT leverages ultra-fast algorithms and low-latency infrastructure to capitalize on these opportunities within milliseconds. The synergy of statistical analysis and high-speed trading systems enhances profitability by enabling swift, data-driven decision-making in dynamic markets.

Key Terms

Latency

High-frequency trading (HFT) relies on ultra-low latency systems to execute a vast number of orders within microseconds, capitalizing on fleeting market inefficiencies. Statistical arbitrage employs quantitative models to identify price discrepancies but operates on slightly longer time frames, making latency less critical than in HFT. Explore the nuanced latency demands and technological infrastructure behind these strategies to understand their distinct market impacts.

Market Microstructure

High-frequency trading (HFT) leverages ultra-low latency infrastructure to execute numerous orders within milliseconds, exploiting order book imbalances and bid-ask spreads shaped by Market Microstructure dynamics. Statistical arbitrage relies on quantitative models to identify pricing inefficiencies, focusing on historical price patterns and correlations rather than immediate order flow or liquidity. Explore deeper insights into how Market Microstructure impacts these trading strategies and their execution.

Mean Reversion

High-frequency trading leverages ultra-fast execution speeds and sophisticated algorithms to capitalize on minimal price discrepancies across markets, while statistical arbitrage uses quantitative models, often anchored in mean reversion strategies, to identify and exploit price inefficiencies over slightly longer time frames. Mean reversion techniques assume that asset prices will revert to their historical average, enabling traders to predict potential price corrections with statistical confidence. Explore the nuances of these strategies and their roles in modern market dynamics to deepen your understanding of quantitative trading.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is automated trading using powerful computers and algorithms to execute a vast number of trades in microseconds, capitalizing on tiny price differences across markets for profit.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT involves high-speed trade executions with complex algorithms to detect short-term market trends, enabling institutions to profit from small price fluctuations and improving market liquidity and efficiency.

High-frequency trading - Wikipedia - High-frequency trading uses quantitative, algorithm-driven strategies characterized by short holding periods and very fast execution, typically implementing arbitrage and market-making techniques to exploit minute market inefficiencies.

dowidth.com

dowidth.com